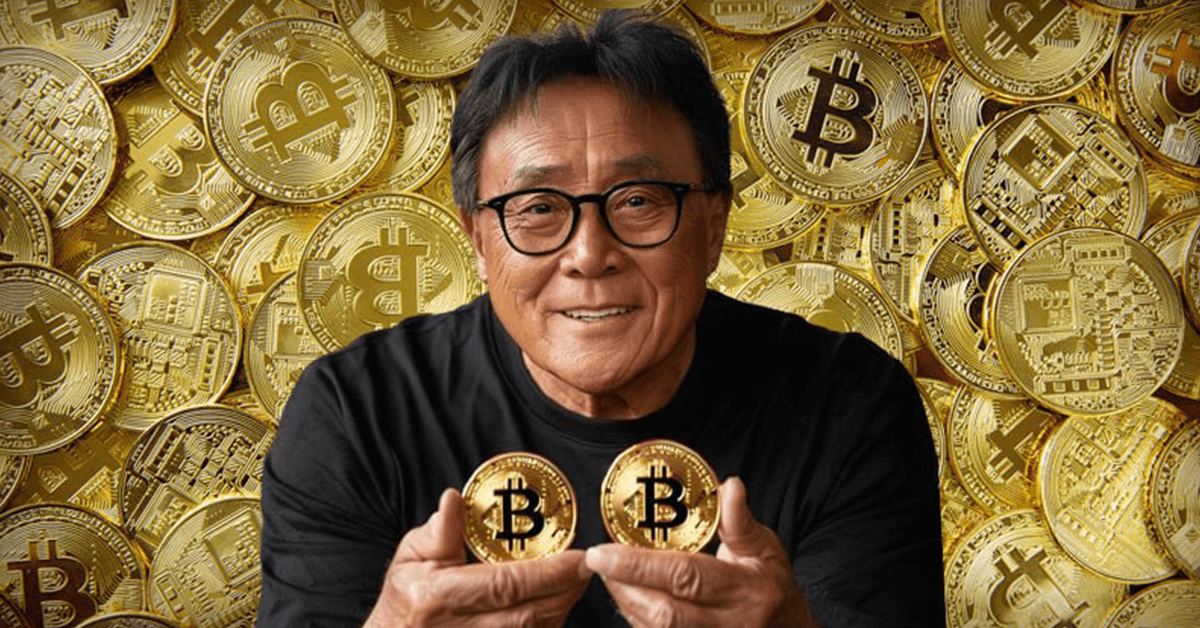

Renowned Author Robert Kiyosaki Urges Investors to Embrace Bitcoin Amidst Global Economic Uncertainty

In a recent statement, Rich Dad Poor Dad author Robert Kiyosaki has offered bold advice to investors, suggesting that now is the opportune moment to prioritize investments in Bitcoin over traditional stocks and bonds. Citing ongoing economic challenges in China, Kiyosaki emphasizes the importance of diversifying portfolios with tangible assets such as gold, silver, and, notably, Bitcoin. With his rallying cry to secure as much Bitcoin as financially feasible, Kiyosaki underscores the urgency of adapting to the evolving financial landscape.

Robert Kiyosaki’s Advice: Invest in Bitcoin to the Fullest Extent Possible

Renowned author Robert Kiyosaki, co-author of the bestselling book Rich Dad Poor Dad, recently took to social media to encourage investors to prioritize Bitcoin investments amidst global economic uncertainties. Pointing to challenges in China’s stock market and a wider trend of decreased global consumer spending, Kiyosaki suggests steering away from traditional investments like stocks and bonds. Instead, he advises acquiring tangible assets such as gold, and silver, and maximizing Bitcoin holdings. Kiyosaki’s perspective, informed by the enduring success of Rich Dad Poor Dad, underscores his expertise in financial matters.

The celebrated author has consistently advocated for the inclusion of gold, silver, and bitcoin in investment portfolios, categorizing them as ‘real assets’ compared to fiat currencies which he deems ‘fake money.’ However, recent insights from him shed light on a drawback of investing in gold and silver, highlighting the tendency for increased discovery and mining as prices rise. In contrast, he lauds Bitcoin’s capped supply of 21 million coins.

In his recent predictions, Kiyosaki anticipated a potential downturn for gold, potentially dipping below $1,200. Nevertheless, he maintains an optimistic outlook on silver and bitcoin, anticipating significant growth. Notably, he foresees BTC surging to $100K by June this year, alongside a bold projection of $300 for Bitcoin within the same timeframe, reflecting his continued confidence in the cryptocurrency market.