An analyst suggests that the selling activity by Bitcoin miners may extend for four to six months post-halving, potentially reaching up to $5 billion in value.

A substantial Bitcoin outflow from miners is anticipated in the months post-halving, mirroring patterns from previous cycles, notes a market analyst.

According to Markus Thielen, Head of Research at 10x Research, calculations suggest Bitcoin miners could potentially liquidate up to $5 billion worth of BTC after the upcoming halving, as outlined in an April 13 analyst note. Thielen speculates that the resulting selling pressure may persist for four to six months, potentially leading to a sideways trend in Bitcoin prices, akin to past halving events.

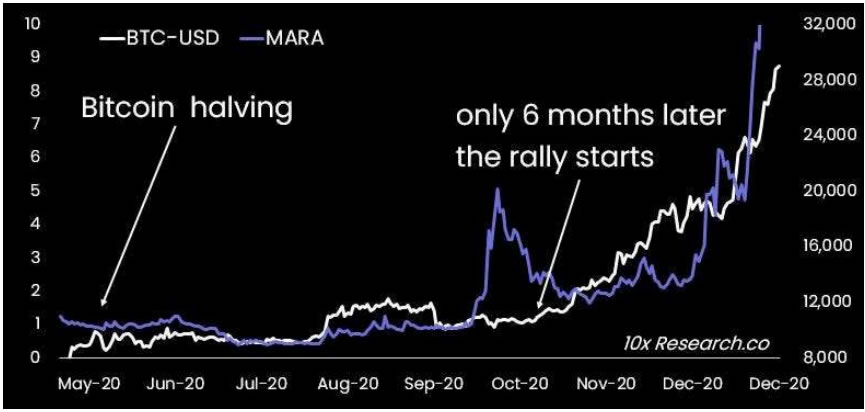

Thielen highlights the possibility of crypto markets encountering a significant challenge during a six-month ‘summer’ lull. Notably, following the 2020 halving, Bitcoin prices remained within the $9,000 to $11,500 range for five months.

With this year’s halving slated for around April 20, just six days away, historical trends suggest that significant upward movement may not materialize until around October.

BTC post-2020 halving prices. Source: 10x Research

BTC post-2020 halving prices. Source: 10x Research

Moreover, he noted that miners typically accumulate BTC, resulting in a supply/demand disparity and subsequent price surge in Bitcoin leading up to the halving event.

Already, this phenomenon has unfolded, witnessing a remarkable 74% surge in BTC prices throughout 2024, culminating in an unprecedented peak of $73,734 on March 14. However, prices subsequently corrected to below $63,000 by mid-April.

Thielen also anticipates that altcoins, in particular, may face the repercussions of this scenario. Over the past week, many altcoins have experienced significant declines, with numerous still distant from their 2021 peaks.

“Even if there is a correlation between the halving and an altcoin rally, as some predict, historical evidence shows that the rally typically begins almost six months later.”

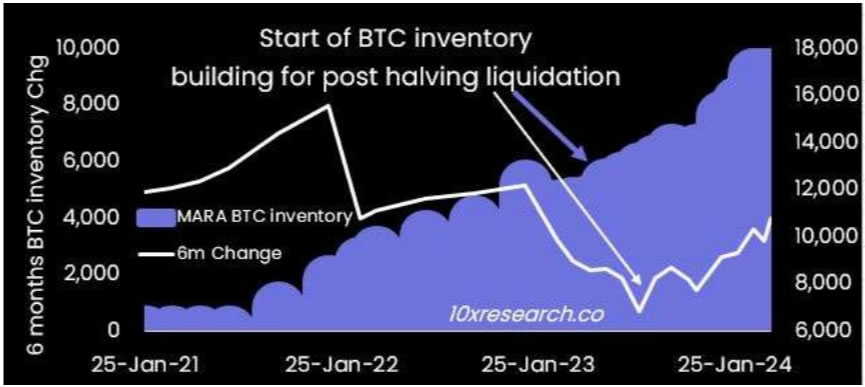

Thielen theorized that Marathon, recognized as the world’s largest Bitcoin miner, has amassed an inventory strategically, intending to gradually liquidate it post-halving to mitigate the risk of a sudden revenue decline.

Marathon pre-halving accumulation. Source: 10x Research

Marathon pre-halving accumulation. Source: 10x Research

Thielen pointed out that considering Marathon’s current production of 28–30 BTC daily, this could potentially introduce an additional 133 days’ worth of supply to the market, along with the BTC it continues to generate, estimated at 14–15 BTC per day post-halving.

“Other miners will likely follow a similar strategy to liquidate part of their inventory gradually.”

The analyst concluded that should all miners adopt a similar inventory-selling strategy post-halving, it could potentially lead to a daily BTC selling volume of up to $104 million, thereby reversing the supply/demand dynamics that drove BTC’s pre-halving rally.

In a statement last week, Marathon CEO Fred Thiel mentioned that the company’s break-even point would hover around $46,000 per BTC to sustain profitability post-halving. He also forecasted minimal price fluctuations in the six-month period following the event.