On Friday evening, the Bitcoin network completed its fourth “halving,” reducing miner rewards from 6.25 bitcoins to 3.125 bitcoins.

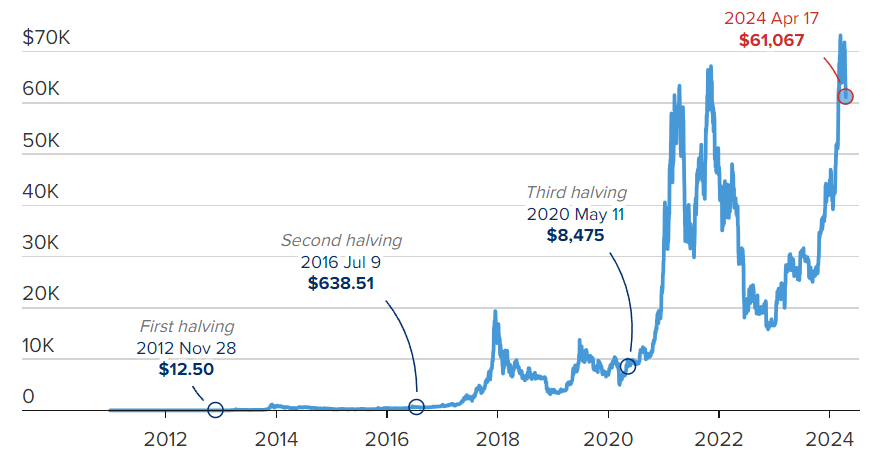

Bitcoin’s price has been volatile leading up to the event, dropping approximately 4% this week to hover around $64,100, as reported by Coin Metrics.

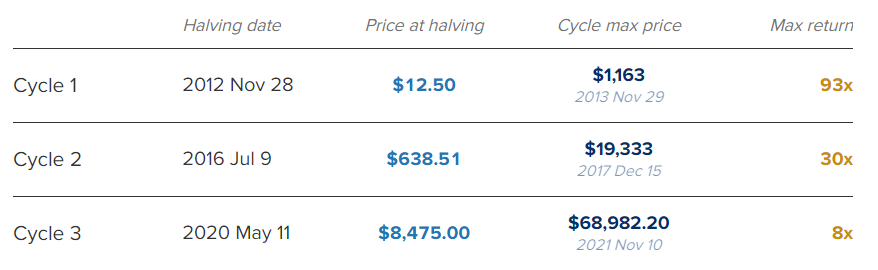

While the halving itself shouldn’t immediately impact Bitcoin’s price, many investors anticipate significant gains in the coming months based on the cryptocurrency’s historical performance post-halving. Previous halvings in 2012, 2016, and 2020 saw Bitcoin’s price surge approximately 93x, 30x, and 8x, respectively, from the day of the halving to its peak.

Nevertheless, the event presents a significant challenge for mining companies.

Bitcoin halving events and peak cycles

Source: Coin Metrics

Source: Coin Metrics

In a recent investor note, JPMorgan analyst Reginald Smith highlighted the potential impact of the Bitcoin halving event, stating, “All else equal, the halving will cut industry revenues in half, triggering a wave of consolidation and business closures, while (hopefully) rationalizing the network hash rate and industry capex, which is ultimately good for the remaining operators.”

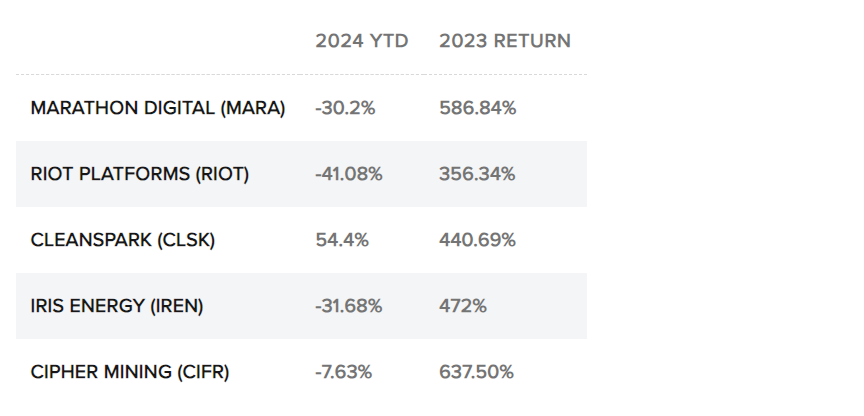

Hash rates, indicative of computational power on the Bitcoin network, are crucial for miners’ revenue potential. The upcoming halving has caused volatility in mining stocks, with many experiencing double-digit declines this year after significant rallies in 2023. For instance, Riot Platforms saw a 41% drop in 2024 after surging 356% the previous year.

Bernstein analyst Gautam Chhugani noted, “The market so far has seen bitcoin mining stocks as mere BTC proxies, in the absence of bitcoin ETFs. [The] halving would further differentiate the low cost, high-scale consolidating winners vs. rest of smaller miners which may be disadvantaged post-halving.”

MINING STOCKS IN 2023 AND 2024

However, traders may continue to speculate on the event. Nikolaos Panigirtzoglou, another analyst at JPMorgan, expressed his expectation on Thursday that the short-term price of Bitcoin might decline post-halving. He attributed this projection to overbought conditions, elevated prices compared to gold after adjusting for volatility, and subdued venture capital funding in crypto projects.

Deutsche Bank analysts share a similar perspective. Marion Laboure from the firm noted in a Thursday note that “[The] Bitcoin halving is already partially priced in by the market and we do not expect prices to increase significantly following the halving event.” She added that anticipation for the event had been widespread due to the nature of the Bitcoin algorithm.

Note: USD

Note: USD

Source: Coin Metrics

Closing price as of April 17, 2024

In the future, we anticipate prices to remain elevated,” she remarked, pointing to anticipated approvals for spot Ethereum ETFs, potential central bank rate cuts, and regulatory advancements.

Bitcoin is presently trading at slightly below $64,000, approximately 13% down from its all-time high of $73,797.68 recorded on March 14th.