Bitfinex suggests that pre-halving sales of Bitcoin miner reserves and the presence of U.S. spot ETFs have mitigated any adverse price movements following the halving of Bitcoin.

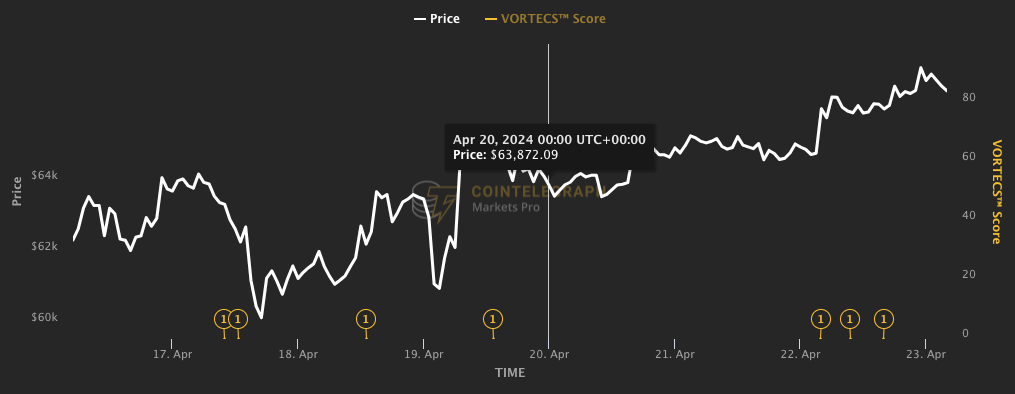

Bitfinex said Bitcoin miners preemptively sold their reserves leading up to the halving. At the same time, the introduction of spot exchange-traded funds (ETFs) in the United States might have helped disperse potential selling pressure, thereby averting a significant price decline during the event. In its weekly market report dated April 22, the crypto exchange noted that miners appeared to have timed their sales advantageously, providing short-term market stability. Bitfinex referenced CryptoQuant data indicating a substantial decrease in the daily average Bitcoin sent by miners to exchanges in March compared to February. The exchange speculated that miners were either liquidating their BTC holdings or using them as collateral for upgrading equipment and infrastructure. Meanwhile, Cointelegraph Markets Pro data indicates a 4.5% increase in Bitcoin’s price to $66,597 since the April 20 halving, extending a positive trend that began on April 17 following a more than 40-day low of under $60,000.

Bitcoin’s seven-day price — vertical line denotes the halving. Source: Cointelegraph Markets Pro

Bitcoin’s seven-day price — vertical line denotes the halving. Source: Cointelegraph Markets Pro

The report clarified that miners typically experience a decline in their revenues following halvings. This time, their rewards were reduced to 3.125 BTC per block mined, equivalent to approximately $208,000 at current market rates. Historically, during previous halving events, miners have applied significant selling pressure to maximize their earnings before their revenue is halved. This behavior has often resulted in short-term spikes in volatility and price drops, according to Bitfinex. However, it noted that after these declines, prices tend to rise, and mining operations expand to compensate for the reduced rewards. The report emphasized that the negative impacts on the market are usually transitory as market dynamics adapt over time.

Bitcoin Exchange-Traded Funds (ETFs) mitigate the effects of halving

Bitfinex suggests that institutional interest in the newly introduced United States spot Bitcoin ETFs might have contributed to mitigating any potential price volatility resulting from Bitcoin’s updated reward structure. According to Bitfinex, the substantial flows associated with these ETFs, totaling $192 million in Bitcoin investment product outflows last week, can significantly influence market sentiment and pricing. These flows are often independent of the conventional supply-demand dynamics. it added.

“The added dynamic of the halving-induced ‘supply shock,’ the combination of ETF demand and constrained supply could drive further price appreciation for BTC.”

The cryptocurrency exchange observed that ETF flows have decelerated since their introduction in January and have occasionally experienced net outflows. However, there continues to be significant interest in these ETFs.

The ETF issuers have been acquiring more Bitcoin for their funds than the amount newly created since their launch, a trend that Bitfinex predicts will lead to significant tightening in the market. Bitfinex’s analysis suggests that after the halving, as little as $30 million worth of Bitcoin could enter the market daily, whereas the average daily net inflows to ETFs exceed $150 million. According to Bitfinex, the total demand for ETFs has surpassed the available supply by over 150,000 BTC to date, and this trend is anticipated to persist in the foreseeable future.