Factors such as mounting concerns about inflation and stagnant Bitcoin ETF inflows may have contributed to the $435 million outflow from cryptocurrency investment funds last week.

According to CoinShares’ report, there was a significant $435 million outflow from cryptocurrency investment products for the week ending April 26. This marks the third consecutive week of outflows for crypto exchange-traded products (ETPs), coinciding with Bitcoin’s relatively stable price in the low $60,000 range.

Source: CoinShares

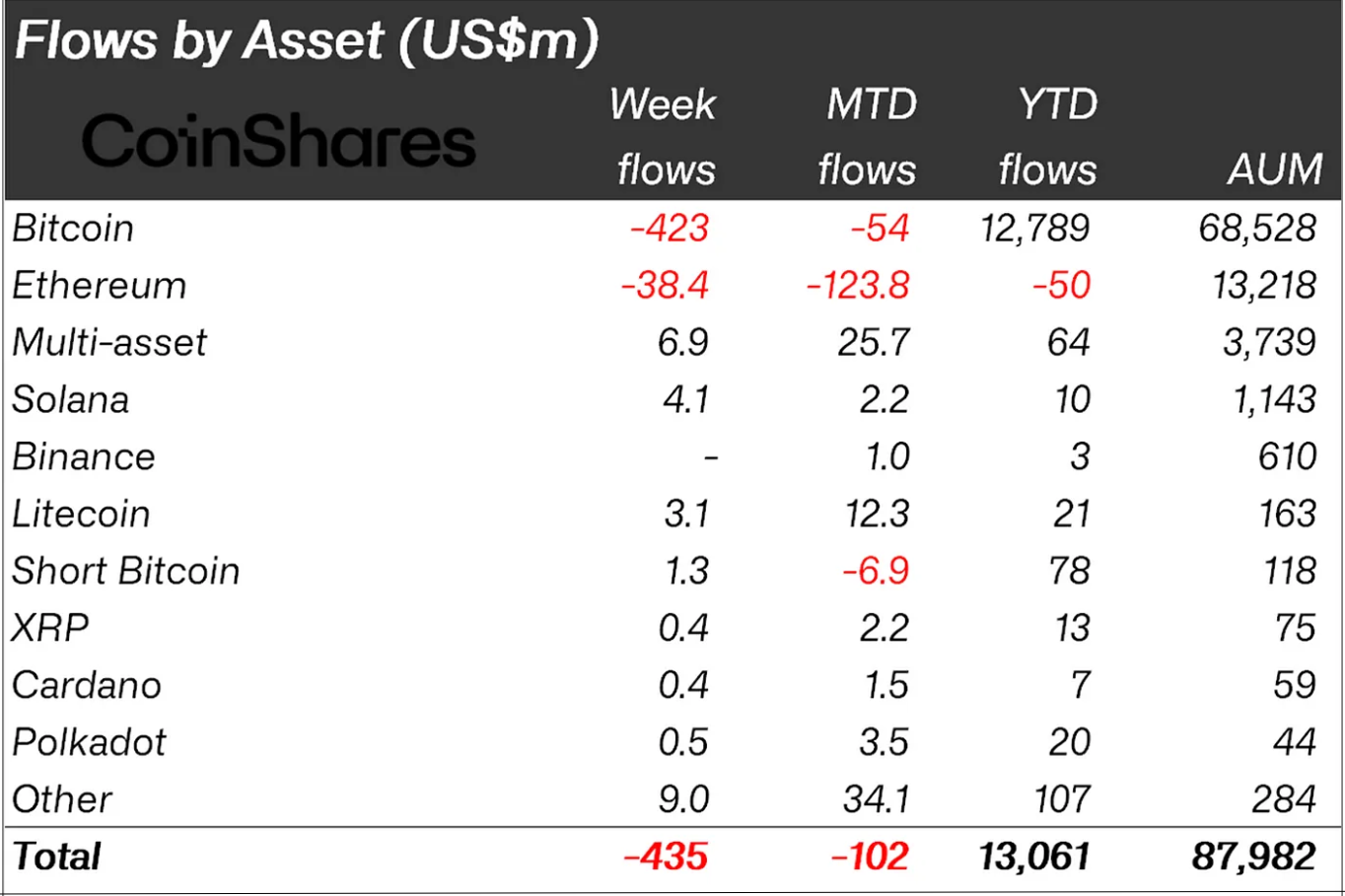

Source: CoinShares

Bitcoin (BTC) saw a dip, marking  $61,704 on the tickers, while funds led significant outflows, with $423 million exiting the market after the halving event. Meanwhile, Ether (ETH) ticked down to

$61,704 on the tickers, while funds led significant outflows, with $423 million exiting the market after the halving event. Meanwhile, Ether (ETH) ticked down to  $3,039, and faced withdrawals of $38 million, extending their streak to seven consecutive weeks of negative flow. Conversely, Solana (SOL) and Litecoin (LTC) ETPs saw deposits, with net inflows of $4.1 million and $3.1 million, respectively, as they ticked down to

$3,039, and faced withdrawals of $38 million, extending their streak to seven consecutive weeks of negative flow. Conversely, Solana (SOL) and Litecoin (LTC) ETPs saw deposits, with net inflows of $4.1 million and $3.1 million, respectively, as they ticked down to  $130

$130

and  $80.48.

$80.48.

Flows into crypto investment products. Source: CoinShares

Flows into crypto investment products. Source: CoinShares

As per CoinShares, the downturn in outflows is probably attributable to a “slowdown in inflows from new issuers,” which amounted to just $126 million last week, a decrease from the $254 million recorded the previous week.

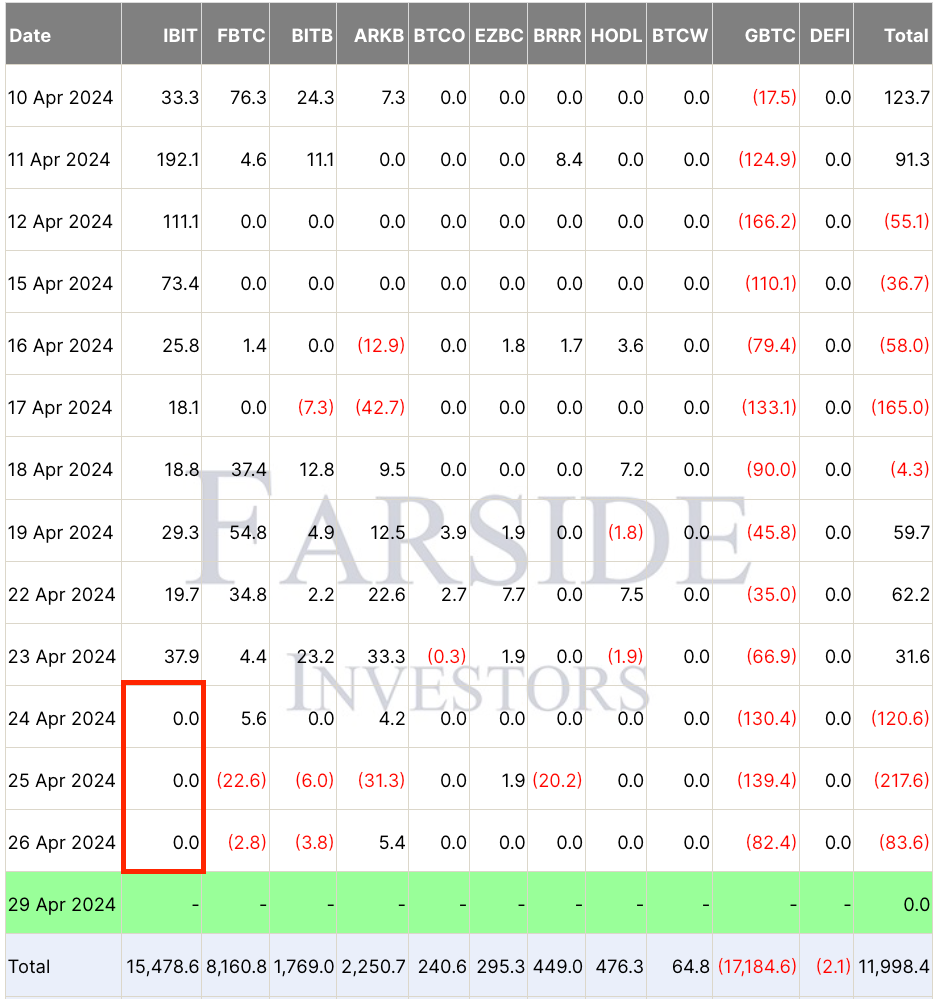

Information from Farside Investors indicates that BlackRock’s Bitcoin ETF, IBIT, registered “no flows” for the first time last week. Additionally, other issuers have encountered several days of zero inflows in recent weeks, coinciding with the slowdown in outflows from Grayscale’s GBTC.

Bitcoin ETF flows table. Source: Farside Investors

Bitcoin ETF flows table. Source: Farside Investors

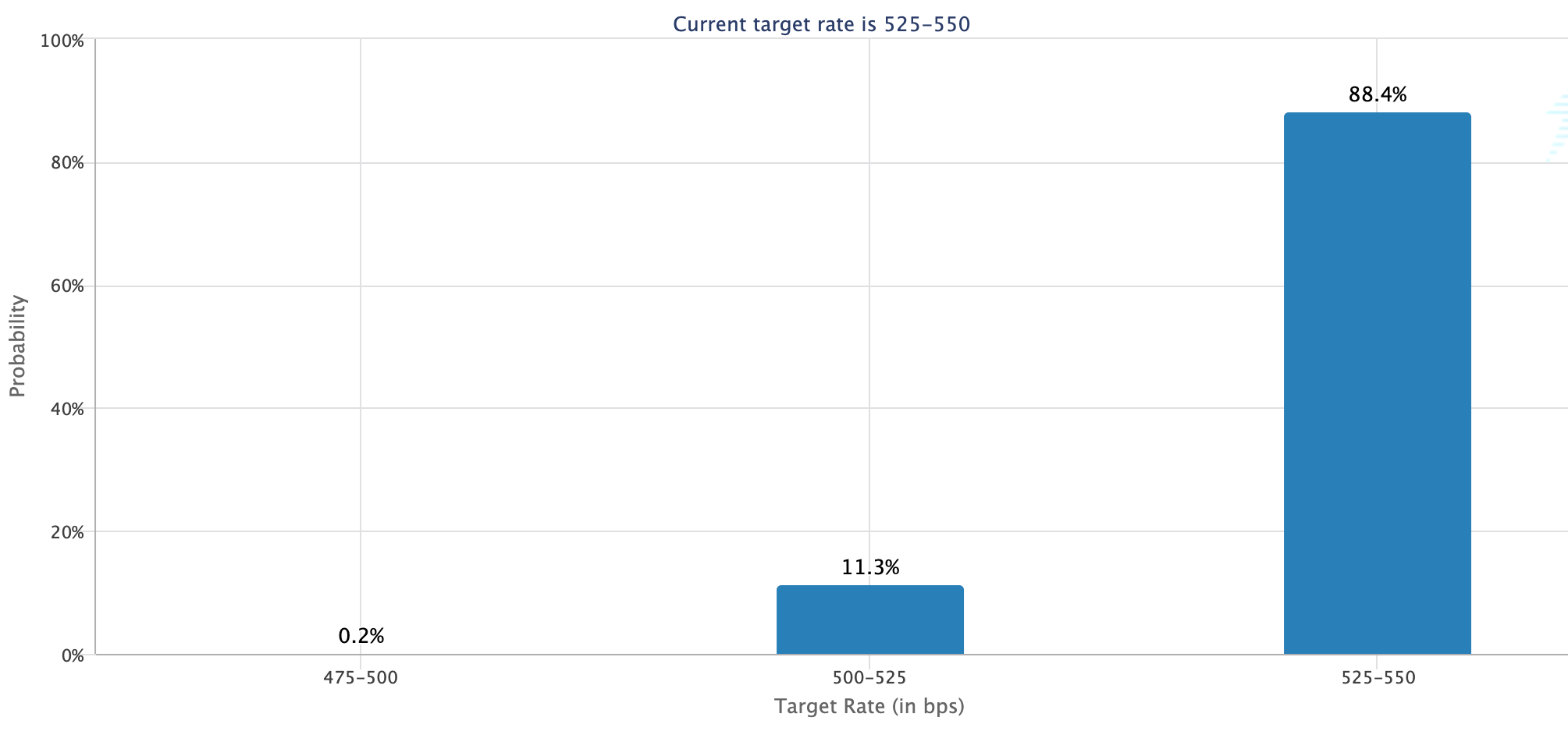

The outflows in a negative direction are likely driven by investor apprehensions regarding U.S. stagflation, characterized by a sluggish economic growth rate coupled with persistent inflation, thereby diminishing the likelihood of Federal Reserve rate cuts.

As indicated by the CME FedWatch tool, traders are currently assigning a mere 11.3% probability to a rate cut in June, compared to 44.8% for September and 43.8% for November. This suggests that market analysts anticipate the U.S. Federal Reserve to maintain interest rates unchanged in May and June, with the possibility of the first cut later in the year.

Target rate probabilities for June 12, 2024 Fed meeting. Source: CME

Target rate probabilities for June 12, 2024 Fed meeting. Source: CME

The Bitcoin bull market is currently undergoing a “temporary halt.”

Brokers at Bernstein brokerage firm suggest that the deceleration in spot Bitcoin ETF inflows does not signify the start of an adverse trend, but rather represents a “brief interruption” before BTC recommences its bullish trajectory.

In a communication to their clientele, Gautam Chhugani and Mahika Sapra, analysts at Bernstein, conveyed in a report,

“We don’t expect the Bitcoin ETF slowdown to be a worrying trend, but believe it is a short-term pause before ETFs become more integrated with private bank platforms, wealth advisers, and even more brokerage platforms.”

The analysts reiterated their forecast of a $150,000 price target for Bitcoin by the conclusion of 2025, attributing it to “remarkable ETF demand,” with $12 billion of net inflows into spot Bitcoin ETFs since their introduction to the market on January 11.

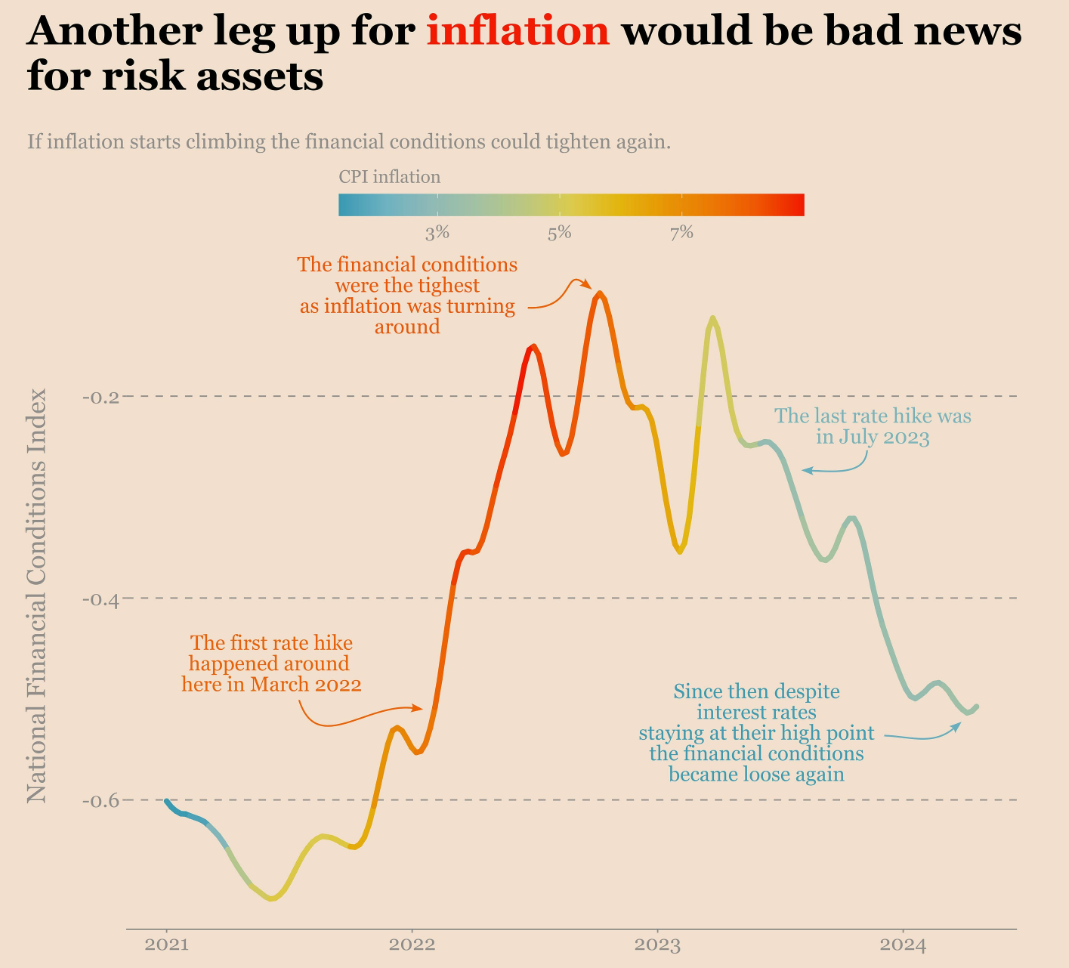

Ecoinometrics’ latest report advises readers to remain vigilant for a potential shift in financial conditions that could either “propel or hinder the Bitcoin bull market.”

The report elaborates that while spot Bitcoin ETFs have “unveiled a fresh demand stream,” shifts in macroeconomic conditions and the Federal Reserve’s struggle to rein in inflation could pose challenges to the ongoing bull market.

“That could cause a re-tightening of the financial conditions. And this would create a headwind for the bull market.”

Ecoinometrics states that the National Financial Conditions Index (NFCI) from the Federal Reserve Bank of Chicago, indicating the degree of stringency in the U.S. financial system, has plateaued and currently matches its level from 2022 when interest rates began to rise.

National Financial Conditions Index (NFCI). Source: Federal Reserve Bank of Chicago

National Financial Conditions Index (NFCI). Source: Federal Reserve Bank of Chicago

As depicted in the chart above, the NFCI shows signs of stagnation, which could account for the bearish sentiment observed in risk assets like Bitcoin, as explained by Ecoinometrics.

“If it just stays at that, then we are simply experiencing a pause in the bull market. But if this is a pivot in the financial conditions, the bull market would be in trouble.”

On a weekend note, QCP highlighted a potential positive catalyst for the upcoming week with the commencement of trading for HK BTC and ETH spot ETFs. There is increasing interest in this development, seen as a potential avenue for the influx of Asian institutional capital.