Bitcoin might still be consolidating below its new all-time highs, as the BTC price faces rejection above $70,000.

Bitcoin (BTC) remained close to key price levels near $68,749 as the market approached the weekly close on May 26, with weekend trading around $69,000.

BTC/USD 1-hour chart. Source: TradingView

BTC/USD 1-hour chart. Source: TradingView

Data from Cointelegraph Markets Pro and TradingView revealed a strong performance for BTC/USD, which briefly surpassed $69,500 before consolidating.

The anticipated weekend upside, forecasted by some market observers, remained constrained by familiar resistance zones.

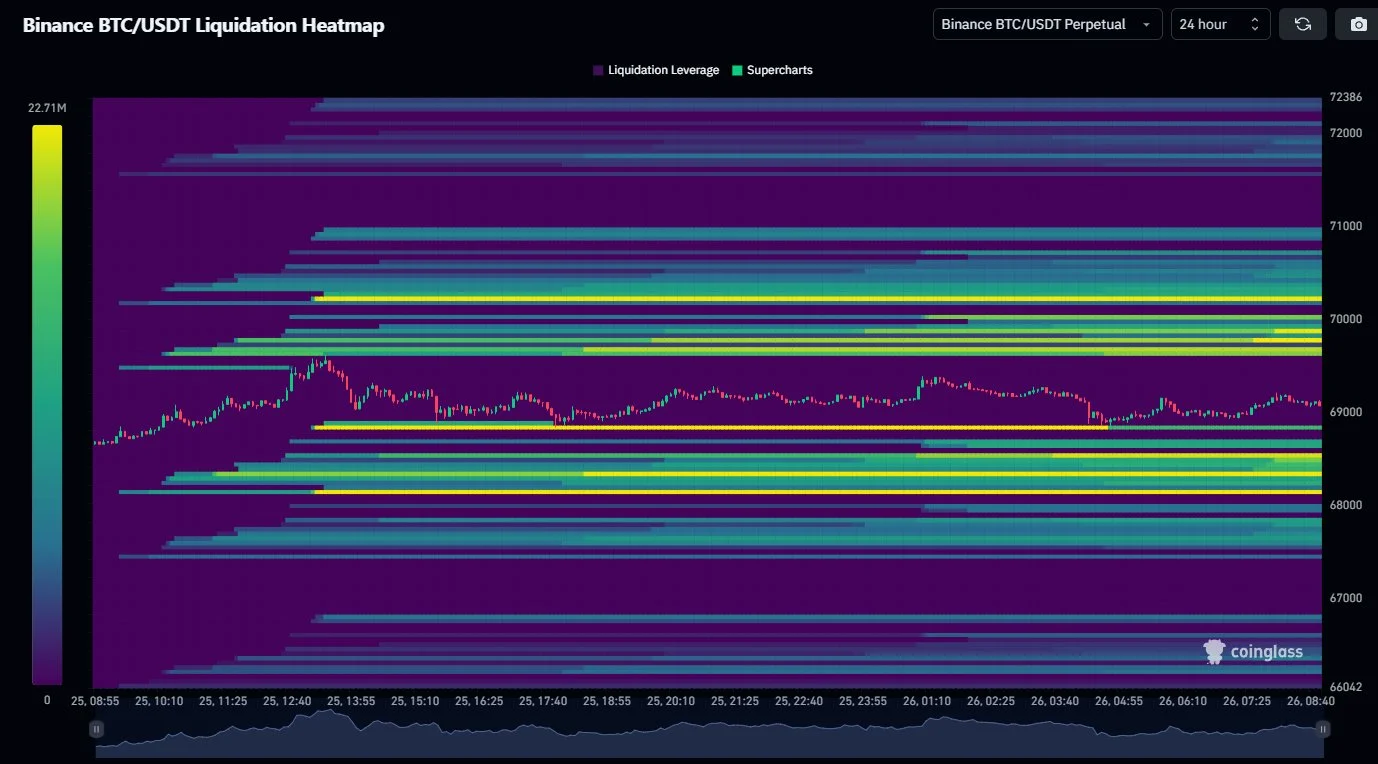

“As the price hovers around ~$69K, liquidity is accumulating on both sides,” noted popular trader Daan Crypto Trades in his latest analysis on X (formerly Twitter).

“Most notably: $68.3K & $69.8K. Good levels to watch in the short term going into next week.”

BTC/USDT liquidation heatmap. Source: Daan Crypto Trades/X

BTC/USDT liquidation heatmap. Source: Daan Crypto Trades/X

An accompanying chart displayed liquidity concentrations for the BTC/USDT perpetual swaps pair on the largest global exchange, Binance.

In BTC order books, liquidity was increasing around the spot price, resulting in lower volatility but raising the likelihood of a future liquidity raid.

Keith Alan, co-founder of trading resource Material Indicators, emphasized the importance of turning $69,000 into a support level.

“Bitcoin lost $69K again. It’s our strongest and most important resistance level on the chart,” he stated in his latest post on X.

“I’d like to see a weekly close above $69k to gain some confidence in a measured move to $73k.”

BTC/USD 1-week chart. Source: Keith Alan/X

BTC/USD 1-week chart. Source: Keith Alan/X

Alan noted that U.S. markets would be closed on May 27 for the Memorial Day holiday.

Bitcoin may continue consolidating for “several more weeks”

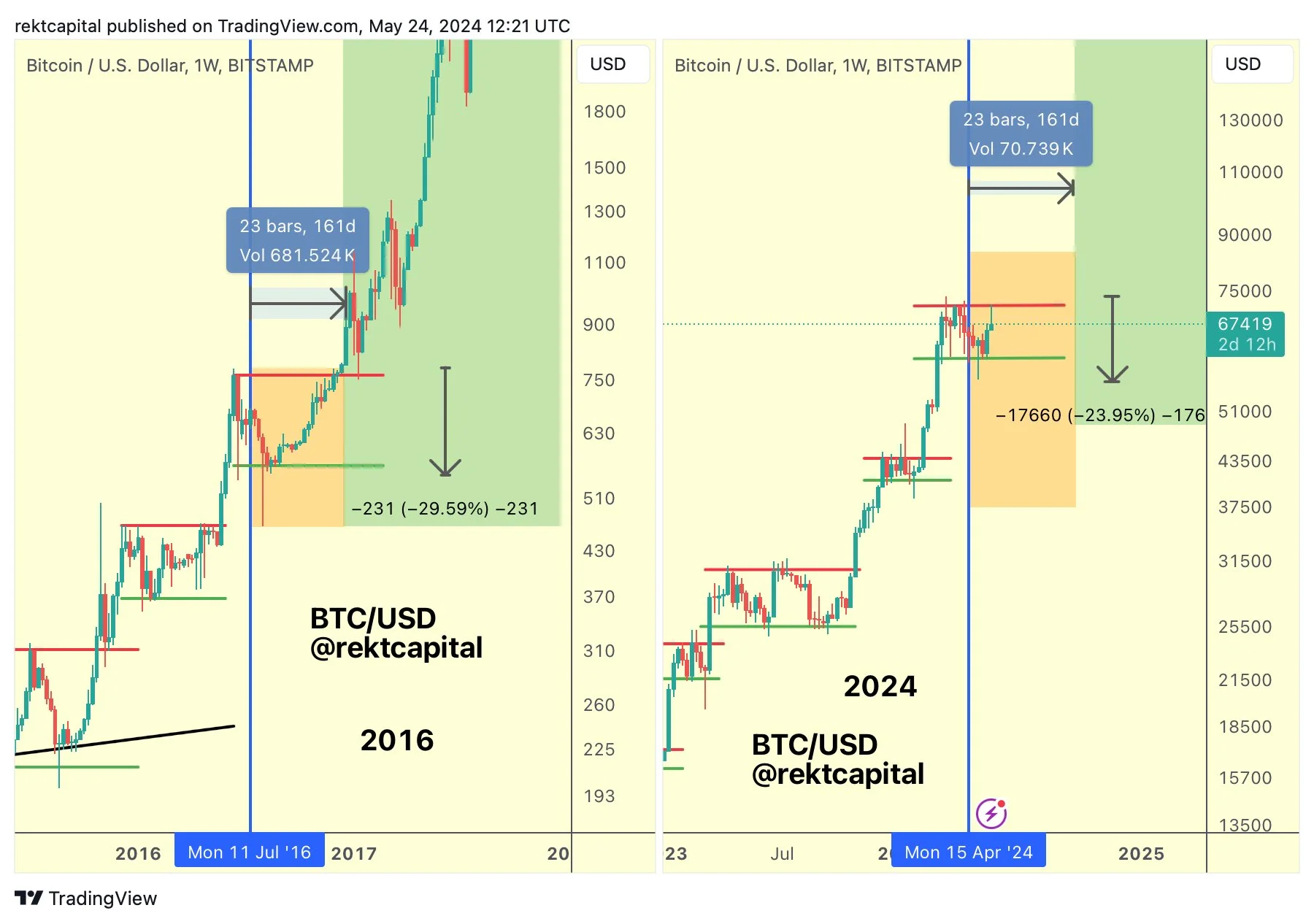

Regarding resistance, popular trader and analyst Rekt Capital they directed attention to levels above $71,000.

Providing updates to X subscribers regarding BTC price movement following the April block subsidy halving, he verified that the market had moved beyond the “danger zone” typically associated with such occurrences.

However, despite this development, bulls aren’t completely in the clear.

“Since the conclusion of the Bitcoin Post-Halving ‘Danger Zone,’ Bitcoin surged to $71,500. Nevertheless, approximately $71,500 aligns with the Range High resistance of the Macro Re-Accumulation Range, and this is where Bitcoin faced rejection,” Rekt Capital clarified.

“The consolidation continues and history suggests it will continue for several more weeks between $60000 and $70000.”

BTC/USD comparison. Source: Rekt Capital/X

BTC/USD comparison. Source: Rekt Capital/X

If that scenario were to unfold, the May monthly close might still end up in the red, consistent with the pattern observed over the past three years, according to data from monitoring resource CoinGlass.

BTC/USD monthly returns (screenshot). Source: CoinGlass

BTC/USD monthly returns (screenshot). Source: CoinGlass

This article does not offer investment advice or recommendations. All investment and trading actions carry risks, and readers should conduct their research before making any decisions.