Weekly Crypto Market Insights

(9-15 September 2024)

From the chart, the price of BTC opened at US$53,686.99 on 9 September 2024 and closed at US$60,335.41. It marks an approximately 12.25% decrease in price. The price is below the EMA200 which marks a bullish trend for now, and the Fear & Greed Index is Fear.

From the chart, the price of ETH opened at US$2,245.74 on 9 September 2024 and US$2,408.71 on 15 September 2024. It marks an approximately 6.94% increase in price. The price is below the EMA200 which marks a bullish trend for now.

From the chart, the price of SOL opened at US$126.75 on 9 September 2024 and closed at US$135.76 on 15 September 2024. It marks an approximately 7.01% increase in price. The price is below the EMA200 which marks a bullish trend for now.

From the chart, the market capitalization of TOTAL3 opened at US$535.642B on 9 September 2024 and closed at US$578.206B on 15 September 2024. It marks an approximately 7.73% increase in price. The market cap is below the EMA200 which marks a bullish trend for now.

From the chart, the market capitalization of OTHERS opened at US$178.626B on 9 September 2024 and closed at US$199.108B on 15 September 2024. It marks an approximately 11.17% increase in price. The market cap is above the EMA200 which shows a bullish trend.

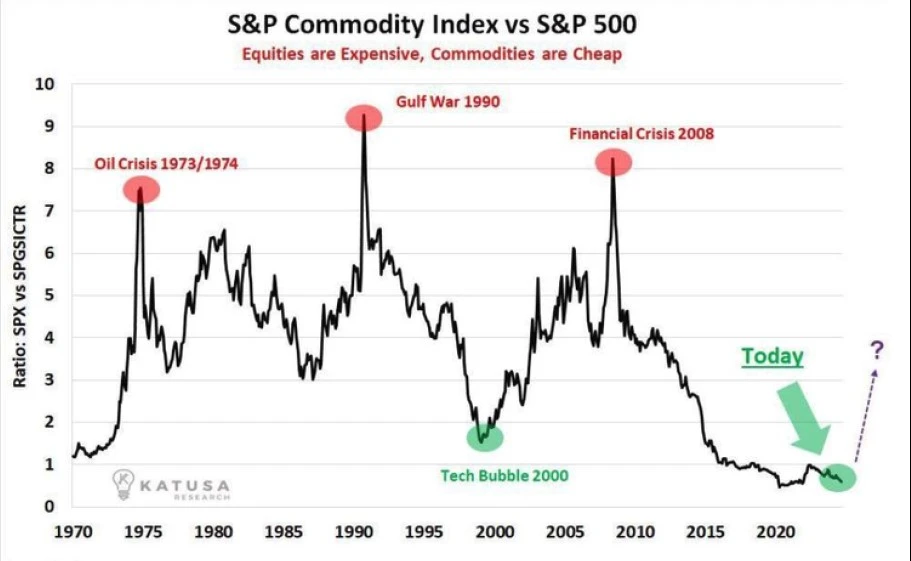

Crypto and commodities poised for massive rally, says market analyst

A notable market analyst believes the cryptocurrency and commodities markets could both be ahead of a parabolic rally.

“Commodities & crypto are extremely

undervalued and it’s likely that commodities go into a 10-year-long bull market. I’m expecting a lot of upside from these two asset classes.”

This is because both crypto assets and commodities remain “extremely undervalued,” according to analyst and entrepreneur Michaël van de Poppe.1.

The analyst noted in a September 15 post on X that commodities were last valued at similar levels in 2000 and 197

The index shows that commodities are valued at lower levels compared to the bubble of 2,000 before the markets rallied up into the 2008 financial crisis.

Increasingly, more analysts are calling for a Bitcoin BTCUSD breakout in October, which could be catalyzed by next week’s Federal Reserve meeting on Sept. 18, which could bring a widely expected interest rate cut

Global liquidity is about to break out:

Raoul Pal

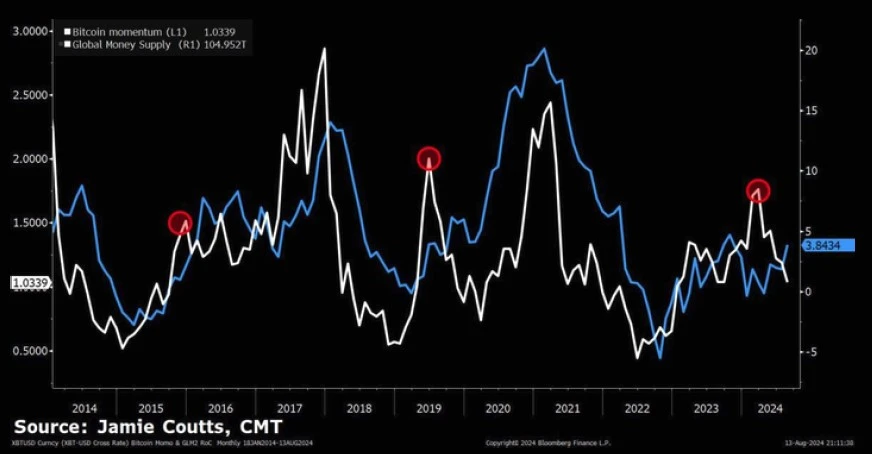

An incoming rise in global liquidity could catalyze the next Bitcoin bull rally.

According to Raoul Pal, the founder and CEO of Global Macro Investor, this is mainly because the leading economies will be forced to refinance their debts.

This will drive a global liquidity breakout in the US, Japan, China and Europe, Pal shared in a Sept. 15 X video:

“As global liquidity rises, cryptocurrencies will rise, as will other markets like the Nasdaq… Global M2 is also starting to rise.”

Part of this growing global liquidity could find its way into Bitcoin, leading to the next leg up in the 2024 cycle — since Bitcoin price is highly correlated with the M2 money supply.

Bitcoin heading for three-month historic rally as analysts eye $92,000 BTC

Based on historical chart patterns, Bitcoin appears poised for a three-month rally after a decline lasting more than three months.

Bitcoin recently retested a key support level on the weekly chart, which could set it up for a rally above $90,000, according to popular analyst Titan of Crypto.

The analyst wrote in a Sept. 13 X post:

“In previous cycles, when the price retested the 50-week simple moving average, it bounced at least 40%. On average, the bounce was 71%. If #BTC rallies 71% from here, it could reach $92,000.”

However, Bitcoin’s “anxiety stage” threatens more potential September downside, ahead of the next leg up, which could be catalyzed by the next Federal Reserve meeting on Sept. 18.

Magazine: Bitcoin will ‘start ripping’ as Trump’s polls improve: Felix Hartmann, X Hall of Flame

Source: https://www.tradingview.com/news/cointelegraph:d84b2e610094b:0-crypto-and-commodities-poised-for-massive-rally-says-market-analyst/ This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

BlackRock Calls

Bitcoin ‘Hedge Against

Global Disorder’,

Analyst Sets

$600,000 Target

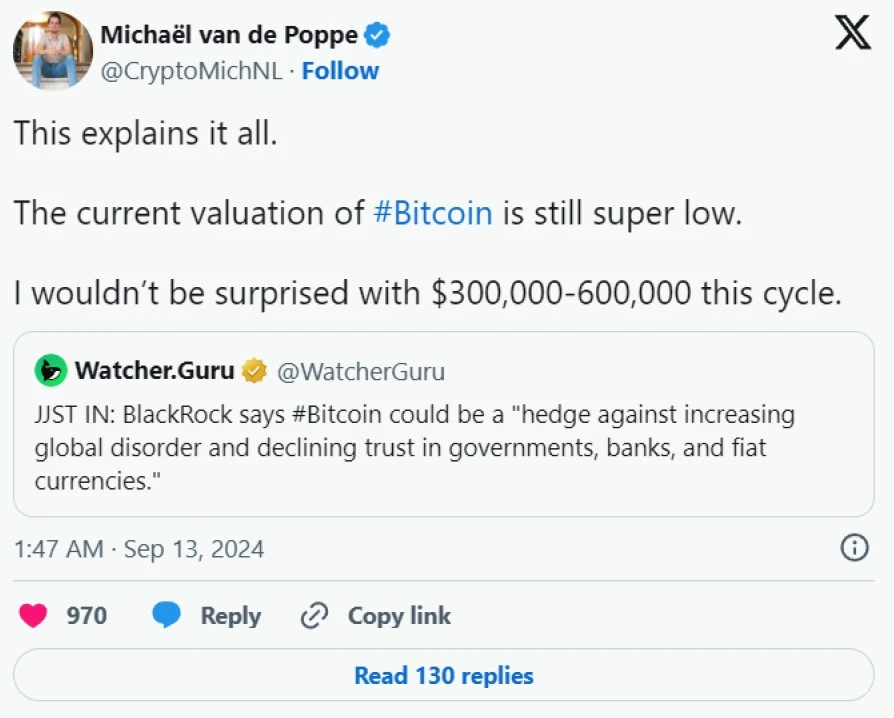

BlackRock, the prominent American multinational investment management corporation, has once again emphasized the enduring belief surrounding the Bitcoin potential as a strategic asset. In a recent statement, the firm reiterated a school of thought that has been gaining momentum within the financial world for years.

According to the investment company, BTC is a good tool for hedging against increasing global disorder, which might arise from growing distrust in governments, banks, and fiat currencies.

BlackRock’s Involvement With Bitcoin

There’s no denying the fact that BlackRock’s decision to foray into Bitcoin in 2023 through applications of Spot Bitcoin ETFs was a turning point for the cryptocurrency. As the biggest asset manager in the world, this move sent ripples throughout the investment community and affirmed Bitcoin’s growing role as a legitimate asset class.

CEO of BlackRock, Larry Fink, who was once a proud Bitcoin skeptic, changed his stance and became an advocate of investors adding Bitcoin to their portfolio in order to hedge against inflation. According to him, Bitcoin “is an asset class that protects you.”

Important week

In a similar statement, Blackrock noted that Bitcoin could be a “hedge against increasing global disorder and declining trust in governments, banks, and fiat currencies.” This comes amidst inflation concerns in economies all around the globe since the beginning of the year.

The company’s perspective echoes the sentiments of many investors who believe that as the cracks in conventional financial systems become more apparent, BTC will play a critical role in preserving wealth as its value continues to increase in the future. An example of such investors is Michaël van de Poppe, who is a staunch Bitcoin enthusiast.

In reply to a social media post mentioning BlackRock’s comments, van de Poppe noted that Bitcoin’s current valuation is still very low. In terms of a correct valuation, the analyst notes a target between $300,000 and $600,000. Bitcoin currently trades at $57,983, which represents price increases of 417% and 935%, respectively.

What’s Next For BTC?

Although BTC is up by 3.89% in seven days, it continues to hover beneath $58,000 in what seems like forever.

This is because Spot Bitcoin ETFs, which recently went on two days of inflows after weeks of consecutive outflows, recently registered another day of outflow. This could suggest a slowdown in a growing bullish sentiment among institutional investors.

From a technical perspective, Bitcoin faces critical resistance at several key price levels. The first significant hurdle for the cryptocurrency would be breaking through the $60,000 mark, and then $62,000 with strong upward momentum.

Source: https://www.tradingview.com/news/newsbtc:a4372e4e3094b:0-blackrock-calls-bitcoin-hedge-against-global-disorder-analyst-sets-600-000-target/ This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

‘RICH DAD POOR

DAD’ AUTHOR:

BITCOIN IS ABOUT

TO ‘EXPLODE’

Robert Kiyosaki, the eccentric financial commentator who rose to global fame with his “Rich Dad Poor Dad” books, has predicted that the price of Bitcoin, the leading cryptocurrency, is about to “explode.”

The 77-year-old businessman and author is also perpetually bullish on precious metals (namely gold and silver).

Even though the investment community is still preoccupied with never-ending Bitcoin versus gold debates, Kiyosaki believes that the “cowards” who are pitting those two assets against each other will be “big losers” as soon as the U.S. Federal Reserve performs its much-anticipated dovish pivot.

Kiyosaki expects “real assets” to experience significant price appreciation due to the Fed’s rate cuts.

Instead of arguing with each other, Bitcoin and gold investors should be busy discussing whether they should buy Ferraris or Lamborghinis during the upcoming bull run. “You may soon be looking good driving a Ferrari or Lamborghini,” Kiyosaki added.

Bitcoin decoupling from gold

As reported by U.Today, Bitcoin recently decoupled from gold despite the fact that both of them are safe haven assets that are supposed to compete against each other. This can be explained by the risk-averse macro environment in the U.S.

While the price of the yellow metal recently reached a new all-time peak, Bitcoin is so far struggling to convincingly regain its mojo.

The top cryptocurrency has reclaimed the pivotal $60,000 level, but it is still far from its lifetime peak that was achieved in March.

Kiyosaki has predicted that the top cryptocurrency could reach $300,000 as soon as this year.

Source: https://www.tradingview.com/news/u_today:b2e27c858094b:0-rich-dad-poor-dad-author-bitcoin-is-about-to-explode/

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Undeterred Daily

Bitcoin Buying Spree

Hits 665 Days as It

Holds Over

$340 Million in BTC

El Salvador, the first country to embrace the flagship cryptocurrency Bitcoin as legal tender, is still accumulating 1 BTC per day, regardless of whether the price of the cryptocurrency is moving up or down.

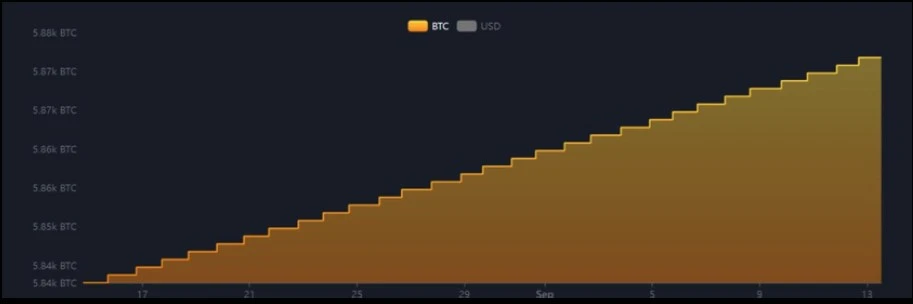

As first noted by on-chain analysis service Spot On Chain on the microblogging platform X (formerly known as Twitter), El Salvador has been stacking 1 BTC per day for the last 665 days to now hold 5,871 coins worth $341 million, with 3,046 BTC being known to have been bought at an average price of $43,888.

Bitcoin is at the time of writing trading near

the $58,200 mark after recovering from a selloff earlier this month that saw it plunge form over $64,000 to a low under $53,000.

The cryptocurrency underwent its halving event in April, which cut the Coinbase reward miners receive per block found in half.

El Salvador’s own Bitcoin website shows that the country has been slowly adding BTC to its stash.

El Salvador is a very compact country, covering approximately 21,041 square kilometers (8,124 square miles). This makes it the smallest country in mainland Central America, roughly comparable in size to the U.S. state of New Jersey.

Its developing economy is transitioning from a reliance on agriculture to a greater focus on manufacturing and services, with the U.S. dollar being its official currency after being adopted in 2001. In 2021, the country made Bitcoin legal tender to attract investment and modernize its financial system in a move led by President Nayib Bukele.

El Salvador, in December 2023, approved a law granting expedited citizenship to foreigners who contribute Bitcoin to government social and economic programs, in an initiative aiming to attract foreign investment and stimulate economic growth.

Source: https://www.tradingview.com/news/cryptoglobe:622c4941e094b:0-el-salvador-s-undeterred-daily-bitcoin-buying-spree-hits-665-days-as-it-holdsover-

340-million-in-btc/ This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

3-Year Cup-And-Handle Pattern

Promises To Send Bitcoin

Above $100,000

Crypto analyst Jelle has highlighted a bullish pattern that has been forming on the Bitcoin chart for the last three years. The analyst suggested that it could soon be time for the pattern to play out, with a price target of $100,000 and above in sight if it

does.

3-Year Cup And Handle Pattern Could Soon Play Out For Bitcoin

In an X (formerly Twitter) post, Jelle stated that it shouldn’t be long before the 3-year cup and handle pattern on Bitcoin’s chart starts playing out. The analyst suggested this could happen as soon as the fourth quarter of this year and noted that the pattern has a 6-figure range. The accompanying chart showed that Bitcoin could rise above $100,000 and reach as high as $140,000.

Indeed, the fourth quarter of the year is bullish for the flagship crypto, although it remains to be seen if it can rise above $100,000. Bernstein analysts have predicted that Bitcoin would at least reach $90,000 if Donald Trump wins the election. Standard Chartered has offered a more bullish prediction, stating that BTC will get to $150,000 by year-end if Trump wins.

However, irrespective of the election’s outcome, its aftermath is bullish for the flagship crypto since it would provide more certainty to the market. Historically, Bitcoin also enjoys positive monthly returns in the last quarter of every halving year. In 2016 and 2020, the flagship crypto enjoyed three consecutive months in the green between October and December.

The Fed rate cuts could begin at the next FOMC meeting next week, which will be held between September 17 and 18. This is

expected to boost investors’ confidence in investing in risk assets like Bitcoin.

Other Reasons BTC Could Rise Above $100,000

Crypto analysts have provided other reasons why Bitcoin could rise above $100,000 from a technical analysis perspective. Titan of Crypto highlighted a Bitcoin bull pennant that is currently forming on the monthly timeframe. He predicted this could send the flagship crypto to as high as $158,000 if it plays out.

Key Factors That

BTC Could Rise

Above $100,00

The crypto analyst had earlier revealed a Golden Cross that had formed on Bitcoin’s 2-month chart. He noted that this bullish pattern has always led to a massive rally for BTC, suggesting that this could happen again. The chart he shared showed that the flagship crypto could reach six figures if this rally were to occur.

Crypto analyst SalsaTekila has offered a more bullish prediction that Bitcoin could rise above $200,000 in this market cycle. He claimed this price level looks like a “target for chickens.” The analyst remarked that the market is structurally different this time as the spot market looks to dominate. He added that this is ultimately bullish as the available supply diminishes.

At the time of writing, Bitcoin is trading at around $59,900, up over 2% in the last 24 hours, according to data from CoinMarketCap.

Source: https://www.tradingview.com/news/newsbtc:542b1029d094b:0-3-year-cup-and-handle-pattern-promises-to-send-bitcoin-above-100-000/ This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.