Weekly Crypto Market Insights

(16-22 September 2024)

The above chart is the Bitcoin (BTC) H1 chart on TradingView for the week of 16-22 September 2024.

From the chart, the price of BTC opened at US$60,335.41 on 16 September 2024 and closed at US$62,652.12 on 22 September 2024. It marks an approximately 4.87% increase in price. The price is above the EMA200 which marks a bullish trend for now.

The above chart is the Ethereum (ETH) H1 chart on TradingView for the week of 16-22 September 2024.

From the chart, the price of ETH opened at US$2,408.72 on 16 September 2024 and closed at US$2,570.51 on 22 September 2024. It marks an approximately 6.69% increase in price. The price is above the EMA200 which marks a bullish trend for now.

The above chart is the Solana (SOL) H1 chart on TradingView for the week of 16-22 September 2024.

From the chart, the price of SOL opened at US$135.77 on 16 September 2024 and closed at US$143.13 on 22 September 2024. It marks an approximately 6.31% increase in price. The price is above the EMA200 which marks a bullish trend for now.

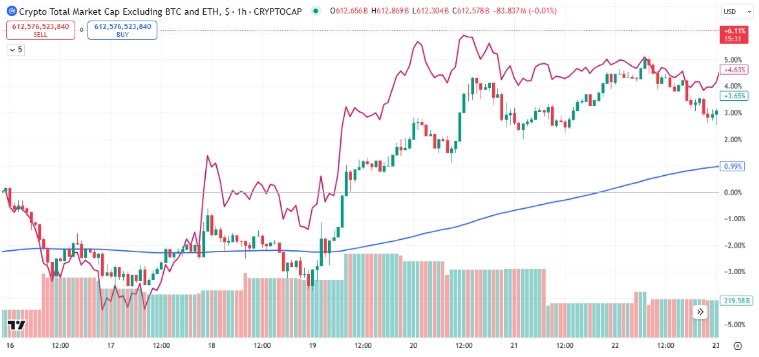

The above chart is the TOTAL3 H1 chart on TradingView. It shows the total market capitalization of the top-125 cryptocurrencies, excluding BTC and ETH, for the week of 16-22 September 2024. The purple line is a comparison with BTC market cap.

From the chart, the market capitalization of TOTAL3 opened at US$578.205B on 16 September 2024 and closed at US$694.347B on 22 September 2024. It marks an approximately 3.13% increase in price. The market cap is above the EMA200 which marks a bullish trend for now.

The above chart is the OTHERS H1 chart on TradingView. It shows the total market capitalization of the top-125 cryptocurrencies, excluding BTC and the Top 10 cryptocurrencies, for the week of 16-22 September 2024. The purple line is a comparison with BTC market cap.

From the chart, the market capitalization of OTHERS opened at US$199.107B on 16 September 2024 and closed at US$208.134B on 22 September 2024. It marks an approximately 4.90% increase in price. The market cap is above the EMA200 which shows a bullish trend.

Analyst’s Notes

Our team of analysts wishes to highlight an important findings from 16-22 September 2024 for the weekly crypto market insights.

Bullish Breakout from Trendline

The price of BTC has broken out from the trendline, which is very bullish. Our analysts believe that a retracement will happen to retest the trendline. And after that the price will test the resistance zone around US$68,000.

Crypto and commodities poised for massive rally, says market analyst

The U.S. Federal Reserve has decided to cut rates by 50 basis points.

This is the first rate cut initiated by the world’s most important central bank in

four years.

The price of Bitcoin, the leading cryptocurrency, is currently sitting at $60,900 on the Bitstamp exchange

after surging sharply higher.

The Fed kept market observers guessing about the size of its much-awaited rate cut until the very last moment.

While the Fed’s moves tend to be more or less predictable, there was a lot of uncertainty surrounding its most recent decision.

More than $55 million had been staked on the Fed rate cut on the popular crypto-based prediction market PolyMarket.

As reported by U.Today, the odds of a 50-basis point rate cut surged sharply higher on PolyMarket earlier this week, surpassing 50%. However, on Wednesday, the odds of a super-sized move declined substantially.

Now, US futures are pricing in a 64% chance of a 25-basis point rate cut being implemented in November.

The Fed went on a prolonged rate hike cycle back in 2022 in order to tame out-of-control inflation. This hawkish cycle lasted until July 2023.

It is worth noting that the European Central Bank (ECB) has already cut rates multiple times this year due to declining eurozone inflation. Some economists claim that the Fed was actually too slow to start cutting rates.

While speculation about the Fed’s rate cut has dominated headlines over the past few weeks, JPMorgan CEO Jamie Dimon recently downplayed the significance of the Fed’s move. He claimed that the central bank’s decision would not matter much, urging investors to pay attention to “a real economy.”

Source: https://www.tradingview.com/news/u_today:de9557740094b:0-bitcoin-surges-as-fed-opts-for-massive-rate-cut/ This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Vitalik Buterin Outlines Ethereum’s Next Decade at Token2049 Singapore

Buterin acknowledged past challenges in crypto but noted Ethereum’s progress in lowering fees, reducing confirmation times and improving user experience.

Ethereum co-founder Vitalik Buterin delivered a keynote speech on Wednesday at TOKEN2049 in Singapore, outlining

his vision for the cryptocurrency’s future. Buterin was optimistic about Ethereum’s progress and its potential to achieve mainstream adoption in the coming decade.

He also acknowledged that the crypto space has had its limitations in the past. He pointed out that high transaction fees and poor user experiences had slowed widespread adoption.

However, Buterin highlighted the significant strides Ethereum has made in overcoming these challenges. Transaction fees have dropped significantly. Confirmation times have been drastically reduced. The user experience of on-chain applications has also greatly improved.

Vitalik Buterin Criticizes Traditional Security Models, Suggests Multi-Signature Wallets

Buterin proposed multi-signature smart wallets as a more secure and convenient solution.

Further, Buterin pointed out the advancements in account abstraction, security tools and privacy protocols as further evidence of Ethereum’s growth. He underscored the importance of meeting mainstream adoption while preserving the core values of open-source and decentralization.

One of the key areas Buterin focused on was the security of user funds. He criticized the traditional options of either extreme

self-sovereignty or reliance on trusted third parties, both of which have inherent flaws.

By requiring multiple private keys to authorize transactions, multi-signature wallets can provide enhanced protection for user funds while still maintaining a high degree of privacy.

Buterin also discussed the ongoing technical improvements on the Ethereum mainnet, such as increased decentralization,

reduced confirmation times, and improved scalability. He expressed his belief that these advancements will play a crucial role in

Ethereum’s future success.

TOKEN2049 Lights Up Singapore

The premier crypto event kickstarted today with keynote speeches from the likes of Arthur Hayes, Vitalik Buterin, Olaf Carlson-Wee, and the co-founder and CEO of Bitgo Mike Belshe. With over 800 side events taking place alongside the TOKEN2049, the attendees have filled up the streets of Singapore celebrating Web3.

Source: https://cryptonews.com/news/vitalik-buterin-ethereum-vision-next-decade-token2049/

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

FINTECH GIANT REVOLUT PLANNING TO LAUNCH ITS OWN STABLECOIN

Revolut is reportedly planning to launch its own stablecoin, marking a major expansion of its crypto offerings amid growing competition in the stablecoin market.

Revolut is preparing to launch its own stablecoin, positioning itself to compete with major players in the space, as revealed by a Coindesk report on September 18.

The London-based company is further expanding into the crypto market, joining firms like PayPal, Ripple, and BitGo.

Revolut Eyes Stablecoin Market Expansion

Revolut’s upcoming stablecoin will enter a rapidly growing sector that has attracted considerable interest from fintech and blockchain companies

The stablecoin market is currently dominated by Tether’s USDT, which has a market cap of approximately $119 billion, and Circle’s USDC, which holds about a third of that size.

Revolut’s entry into this market follows PayPal’s stablecoin launch last year and recent announcements from Ripple and BitGo regarding their own token plans.

The profitability of stablecoins, driven by real-world asset backing and interest payments, has made them an appealing venture for companies.

Tether, for example, posted a $5.2 billion profit in the first half of 2024. Revolut’s launch seeks to tap into this market by offering security and compliance for its users.

Revolut has been steadily building its presence in the digital asset space.

These moves further highlight its growing influence in the cryptocurrency space and its continued focus on expanding crypto services.

Regulatory Timing and New Ventures from Former Executives

Revolut’s stablecoin initiative comes as regulatory frameworks, particularly in Europe, are becoming clearer.

The upcoming Markets in Crypto Assets (MiCA) regulations are expected to provide better guidance on managing crypto tokens, which could help legitimize Revolut’s efforts in the space.

With a valuation of $45 billion and a UK banking license secured in July, Revolut is set to scale its operations globally.

Meanwhile, three former Revolut executives have launched Neverless, a commission-free crypto trading app with a passive investment option.

The startup has already raised $6.7 million in pre-seed funding, marking one of Europe’s largest rounds in that category.

Neverless has registered as a Virtual Asset Service Provider (VASP) in several European countries, signaling further

competition in the fintech space.

Source: https://cryptonews.com/news/fintech-giant-revolut-planning-to-launch-its-own-stablecoin/

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Bhutan Surpasses

El Salvador as a Major Bitcoin Holder

in South Asia

Bhutan holds 13,029 Bitcoin, valued at approximately $758 million. Bhutan has emerged as a major Bitcoin holder, surpassing El Salvador in terms of cryptocurrency holdings, according to data from Arkham

Intelligence.

On September 16, the on-chain analytics platform revealed that Bhutan holds 13,029 Bitcoin, valued at approximately $758 million.

This makes Bhutan the largest Bitcoin holder in South Asia, surpassing El Salvador, which holds 5,875 BTC worth $331 million.

As first noted by on-chain analysis service Spot On Chain on the microblogging platform X (formerly known as Twitter), El Salvador has been stacking 1 BTC per day for the last 665 days to now hold 5,871 coins worth $341 million, with 3,046 BTC being known to have been bought at an average price of $43,888.

Bhutan Mines Bitcoin Using Hydroelectric Power

The Bitcoin holdings are reportedly linked to the Kingdom of Bhutan’s investment arm, Druk Holdings and Investments (DHI), which has been mining Bitcoin using the country’s abundant hydroelectric power.

Arkham Intelligence was able to confirm the activity through a combination of on-chain data and satellite imagery, pinpointing mining operations at the site of Bhutan’s former Education City project.

In addition to Bitcoin, Druk Holdings also holds 656 ETH, valued at around $1.5 million, along with smaller amounts of BNB and Polygon, further diversifying its crypto portfolio.

The scale of Bhutan’s Bitcoin holdings is significant when compared to the country’s economy.

Bhutan’s gross domestic product (GDP) is expected to reach $3 billion by the end of 2024, meaning the Bitcoin stash represents roughly a quarter of its GDP.

Bitcoin mining in Bhutan begann in April 2019, when the cryptocurrency was priced at around $5,000.

EMore recently, in May 2023, DHI partnered with Bitdeer to expand its carbon-neutral mining operations, with plans to boost the country’s mining capacity to 600 megawatts by mid-2025.

In comparison, El Salvador began purchasing Bitcoin in September 2021 when prices were much higher, at around $51,700.

The Central American nation has since focused on mining Bitcoin using geothermal energy from volcanoes but trails Bhutan in overall holdings.

As first noted by on-chain analysis service Spot On Chain on the microblogging platform X (formerly known as Twitter), El Salvador has been stacking 1 BTC per day for the last 665 days to now hold 5,871 coins worth $341 million, with 3,046 BTC being known to have been bought at an average price of $43,888.

Failed Government Project Becomes Largest BTC Mining Facility

The project aimed to establish an international center for education and knowledge but was abandoned due to scandals and mismanagement.

The Bitcoin mine on this site is concealed behind mountainous terrain but is betrayed by transformers and power lines. Historical satellite imagery reveals that its construction began in December 2021. The country’s government, including the Ministry of Finance, has remained tight-lipped about its cryptocurrency activities.

DHI, which also oversees Bhutan’s flagship airline, hydroelectric power plants, and a cheese factory, has not provided detailed information on revenues or investment in bitcoin mining. Bhutan’s interest in Bitcoin mining arose as a response to the economic challenges caused by the COVID-19 pandemic. Bhutanese officials began engaging with bitcoin miners and suppliers in 2020.

The country experienced a significant surge in power usage by the industry in 2022, along with a substantial increase in imports of chips used for Bitcoin mining. While the identified state-owned mines represent a significant development, they may not be Bhutan’s largest.

The country has also partnered with Singaporean Bitcoin mining giant Bitdeer for a 600 MW facility in the town of Gedu.

The largest and most significant mining facility in Bhutan is positioned on the site of a failed $1 billion government project called “Education City,” Forbes reported last year.

Source: https://cryptonews.com/news/bhutan-surpasses-el-salvador-as-a-major-bitcoin-holder-in-south-asia-arkham/

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

FBI Confirms: Binance Founder CZ to Be Released Next Week

According to the Federal Bureau of Prisons’ website, Binance founder Changpeng Zhao (CZ) is confirmed for release on September 29, 2024.

CZ’s release marks a significant turning point for Binance and the cryptocurrency world, with many people expressing their anticipation of him on social media.

In a highly anticipated development, the Federal Bureau of Prisons has confirmed that Binance founder Changpeng Zhao, commonly known as CZ, is scheduled for release on September 29, 2024.

This confirmation was verified through the Bureau’s Inmate Locator tool, which lists Zhao’s identification number as 88087-510 with the corresponding release date.

Binance’s CZ Coming Back Before The End Of September: Bullish Outlook?

This news has ignited a flurry of reactions from the crypto community, many of whom see CZ’s return as a critical moment for Binance and the digital asset space at large.

Zhao’s release is expected to have profound implications for Binance’s operations. Under his leadership, Binance became the largest cryptocurrency exchange in the world by trading volume, dominating the industry.

His return could signal a strategic shift for the platform as it grapples with growing regulatory scrutiny and competition from decentralized exchanges.

Market analysts have already begun discussing the potential ripple effects of his release. Many believe that Zhao’s return could reinvigorate confidence in Binance, potentially leading to an uptick in trading volumes and renewed focus on Binance’s core business initiatives.

However, others remain cautious, noting that the regulatory landscape has significantly changed since CZ’s legal troubles began.

The Charges

Leading to

Zhao’s Arrest

Zhao’s legal troubles began in late 2023 when U.S. authorities launched a sweeping investigation into Binance’s operations.

CZ was arrested under allegations of violating several U.S. financial laws, including charges related to money laundering, operating an unlicensed money transfer service, and facilitating illegal transactions through Binance’s platform.

The U.S. Securities and Exchange Commission (SEC) and the Department of Justice (DOJ) led the case against Zhao and Binance, accusing them of facilitating illicit activity on their platform.

The charges revolved around Binance’s failure to comply with U.S. anti-money laundering (AML) regulations.

U.S. officials alleged that Binance allowed individuals to trade without proper Know Your Customer (KYC) procedures, thereby enabling bad actors to use the platform for money laundering and other financial crimes.

Additionally, CZ was accused of willfully circumventing regulatory frameworks, which allowed Binance to operate as an unlicensed entity in certain jurisdictions. Binance was also accused of facilitating transactions related to illegal activities such as ransomware attacks, darknet market sales, terrorist financing, and being used to launder billions of dollars in illicit funds.

Since CZ’s arrest, the DOJ’s case against him and Binance has led to an increased scrutiny of other major exchanges. During the court proceedings, Zhao maintained his innocence, asserting that Binance had always taken compliance seriously and that the company was working closely with regulators to address the concerns.

However, the weight of the charges led to his detention and four months prison sentence as the investigation into Binance’s practices unfolded.

With his upcoming release, questions remain about Zhao’s future role at Binance and how the exchange plans to navigate its current and forthcoming regulatory challenges.

Although CZ’s leadership was instrumental in building Binance into a global powerhouse, the state of crypto he returns to may look vastly different from the way he left it, as stricter regulations and increased oversight now define a large part of the space.

Source: https://cryptonews.com/news/fbi-confirms-binance-founder-cz-to-be-released-next-week/

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.