Weekly Crypto Market Insights

(30 Sept – 6 Oct 2024)

The above chart is the Bitcoin (BTC) H1 chart on TradingView for the week of 30 Sept – 6 Oct 2024.

From the chart, the price of BTC opened at US$65,751.34 on 30 September 2024 and closed at US$62,720.01 on 6 October 2024. It marks an approximately 4.68% decrease in price. The price is below the EMA200 which marks a bearish trend for now.

The above chart is the Ethereum (ETH) H1 chart on TradingView for the week of 30 Sept – 6 Oct 2024.

From the chart, the price of ETH opened at US$2,666.38 on 30 September 2024 and closed at US$2,446.62 on 6 October 2024. It marks an approximately 8.09% decrease in price. The price is below the EMA200 which marks a bearish trend for now.

The above chart is the Solana (SOL) H1 chart on TradingView for the week of 30 Sept – 6 Oct 2024.

From the chart, the price of SOL opened at US$157.27 on 30 September 2024 and closed at US$146 on 6 October 2024. It marks an approximately 7.35% decrease in price. The price is below the EMA200 which marks a bearish trend for now.

The above chart is the TOTAL3 H1 chart on TradingView. It shows the total market capitalization of the top-125 cryptocurrencies, excluding BTC and ETH, for the week of 30 Sept – 6 Oct 2024. The purple line is a comparison with BTC market cap.

From the chart, the market capitalization of TOTAL3 opened at US$637.231B on 30 September 2024 and closed at US$600.739B on 6 October 2024. It marks an approximately 6.17% decrease in price. The market cap is below the EMA200 which marks a bearish trend for now.

The above chart is the OTHERS H1 chart on TradingView. It shows the total market capitalization of the top-125 cryptocurrencies, excluding BTC and the Top 10 cryptocurrencies, for the week of 30 Sept – 6 Oct 2024. The purple line is a comparison with BTC market cap.

From the chart, the market capitalization of OTHERS opened at US$232.07B on 30 September 2024 and closed at US$216.725B on 6 October 2024. It marks an approximately 7.26% decrease in price. The market cap is below the EMA200 which marks a bearish trend.

Fed Chair Powell Dampens 50bps Rate Cut Hopes

The Bitcoin (BTC) price is set to end Monday with losses of close to 3%. The market is set to end the month on a sour note thanks to not as dovish as hoped-for commentary from US Federal Reserve Chairman Jerome Powell and jitters about Japan’s hawkish incoming PM.

Powell’s speech indicated a preference towards cutting interest rates steadily at 25bps intervals going forward.

The Fed cut interest rates by 50bps earlier this month, the first cut since 2020, and indicated plans to significantly lower rates over the next year to keep the cooling

economy in balance.

But markets had started to build up hopes last week that the Fed might cut interest rates by 50bps again in November.

So Powell’s remarks seemed to come as a disappointment to the market. Bitcoin, which was last trading almost exactly in line with its 200DMA, was also weighed on Monday by news of the incoming Japanese PM.

Ishiba is thought to support policy normalization, though he has immediately thrown his support behind loose monetary policy.

It’s worth noting that the Japanese PM has no say in BoJ policy and may not even be PM in one month, given that he called for an election.

Bitcoin was probably looking for an excuse for a mini correction before the end of the month after a strong rally to as high as $ 66,000 last week.

Last, in the upper $63,700s, the Bitcoin price is now down just over 4% from its recent highs.

Will Bitcoin Pump in October?

Despite the month-end stumble, Bitcoin remains on course to end the month with 8% gains. That’s highly unusual for September, which is normally a bearish month for the Bitcoin price.

It sets a strong tone for October, which is normally Bitcoin’s strongest month of the year, hence the nickname “Uptober.”

According to bitcoinmonthlyreturn.com, the average September return is -4.4%, compared to an average return of 27% in October. However, some are concerned that pre-US election uncertainty may discourage the bulls from pursuing higher prices.

Whether a major rally must wait until November or come as soon as next month, risks are tilted to the upside for BTC. Fed/global central bank easing, the delayed arrival of post-Bitcoin halving tailwinds, and the alleviation of US election uncertainty will likely power BTC higher.

One wild card to that narrative is the US economy. Further weakening could trigger a return of recession fears, causing risk.

US ISM PMI activity data and the September jobs report will be released this week and will be closely scrutinized.

Strong data should support risk appetite and could kick off “Uptober” on a strong footing. A test of $70,000 could happen very soon.

Source: https://cryptonews.com/news/fed-chair-powell-dampens-50bps-rate-cut-hopes-heres-how-the-bitcoin-price-reacted/

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

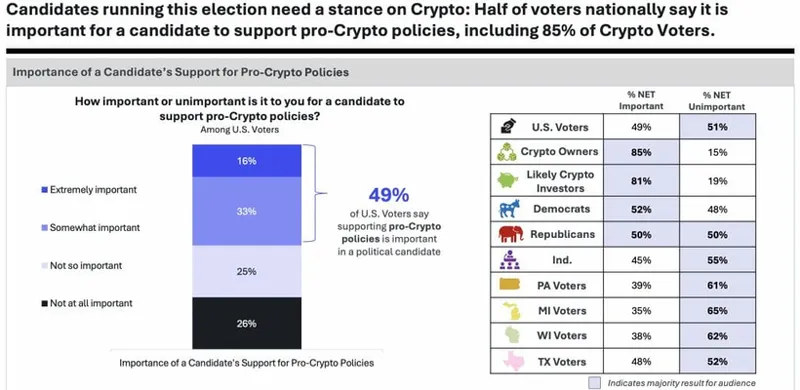

Half of US Voters Consider Crypto Important Ahead of Election

A recent study conducted by Consensys and HarrisX, published on October 2, shows that crypto-friendly policies may play a crucial role in shaping voting decisions for the upcoming 2024 US presidential election. With 92% of cryptocurrency owners planning to vote, candidates will need to address crypto issues to appeal to this significant US

voter demographic.

49% of US Voters Consider Cryptocurrency Important in the 2024 Election

The study reveals that 49% of US voters consider a candidate’s stance on cryptocurrency important when deciding their vote. This inclination toward pro-crypto candidates is particularly pronounced, with 27% of respondents more likely to support candidates who advocate for cryptocurrency policies.

Among cryptocurrency owners, 85% favor presidential candidates who support pro-crypto policies, and 92% are committed to voting in the 2024 election. US voters are 13% more likely to support pro-crypto candidates, a figure that rises to 58% among cryptocurrency owners.

The survey also delves into what voters want from crypto regulation. Key factors such as improved consumer protections and clearer regulatory frameworks would boost voter confidence in investing in cryptocurrencies. However, despite the growing interest in cryptocurrency, many US voters across party lines continue to view it as “too risky,” which remains a significant barrier to investment.

Crypto Voters Strongly Support Candidates with Pro-Crypto Policies

Another striking finding from the survey is the apparent gap in education about cryptocurrencies. Only 17% of voters report a strong understanding of cryptocurrency, and more than half admit to having little to no knowledge. Less than 10% were able to match crypto terms with their correct definitions in a knowledge test.

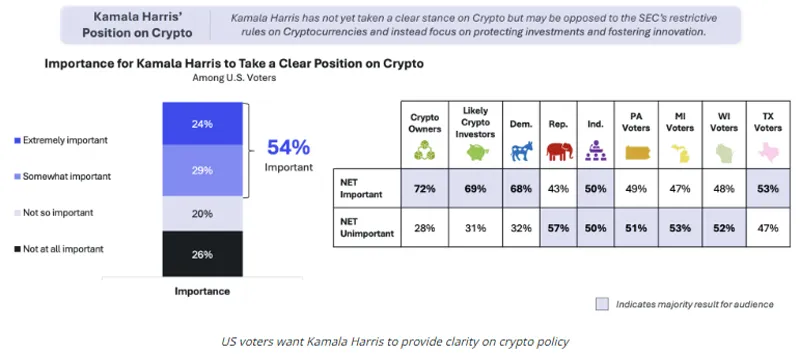

As US voters become more informed, their preferences will likely shape the political space. oters are nearly evenly split, with 35% favoring Republicans and 32% backing Democrats. Many voters have called for more direct communication from candidates, particularly Kamala Harris, with 54% of respondents stating it is important for her to clarify her views on cryptocurrency.

The survey also reveals interesting state-level trends. In Pennsylvania, Michigan, Wisconsin, and Texas, voters show a slight preference for Republican candidates on crypto policies. However, in most of these states—except Texas—Democratic candidates could gain more support by embracing pro-crypto policies.

For instance, 38% of voters in Pennsylvania trust Republicans on crypto policies, while 36% trust Democrats. With so much at stake, it is clear that cryptocurrency is becoming a key factor in how US voters trust and choose their candidates.

Source: https://cryptonews.com/news/49-of-us-voters-consider-crypto-important-consensys-reports/

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Ripple Partners with Mercado Bitcoin for Crypto Cross-Border Payments in Brazil

Ripple has launched its end-to-end payments solution in Brazil, partnering with Mercado Bitcoin to enhance cross-border transactions using blockchain technology. According to a recent press release, Mercado Bitcoin will use the Ripple Payments platform to streamline cross-border payments between Brazil and Portugal.

Cross-Border Payment Between Brazil and Portugal

RInitially, Mercado Bitcoin will use Ripple Payments for internal treasury operations within the two countries. This use case will allow the exchange to test the system’s effectiveness before expanding its application. The release stated that plans are in place to eventually offer Ripple’s solution for broader use, including supporting international payments for corporate and retail clients. The expansion would provide businesses a more efficient option for handling cross-border transfers.

Ripple’s Regional Focus in Latin America

Brazil’s increasing interest in digital payments and blockchain technology makes it a key market for Ripple, which opened its first office in the country in 2019. Since then, Ripple has focused on building infrastructure to support digital asset transactions within the region.

“The idea is to provide a simplified transfer through the expertise of Ripple, our international partner specializing in cross-border payments,” said Mercado Bitcoin Head of Banking Jordan Abud.

“The possibility of facilitating this type of operation, offering lower costs and making the platform even more complete shows our commitment to customers, while expanding the portfolio of products we offer today,” added Abud.

The statement clarified that the product is currently unavailable to the general public. The initial phase was focused solely on institutional operations between Mercado Bitcoin and its branch in Portugal.

Source: https://cryptonews.com/news/ripple-partners-with-mercado-bitcoin-for-crypto-cross-border-payments-in-brazil/

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

TON’s Transaction Volume Soars,

Outpacing Layer 1 Competitors

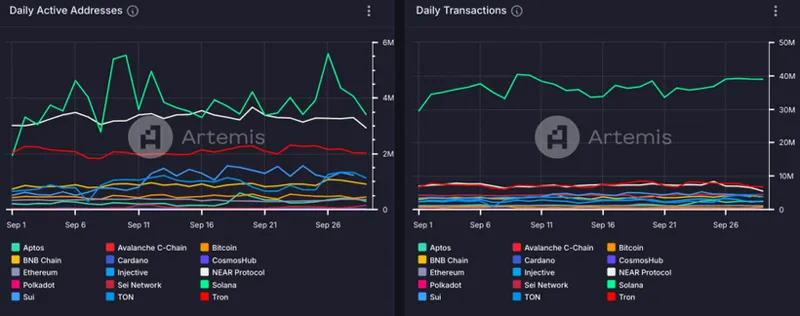

The Open Network (TON) has solidified its position as one of the leading Layer 1 solutions during the recent months. In September, TON captured over 50% of all Layer 1 transactions, outperforming competitors such as Ethereum (ETH) or Avalanche (AVAX), according to CryptoQuant data.

The success of TON can be attributed to several token launches. DOGS, one of the first major projects on the network, attracted a massive 28 million monthly active users (MAU). CatizenAI and Rocky Rabbit, both with 18 million MAU each, also gained significant attention. Watbird and Hamster Kombat further contributed to TON’s growth, with Watbird attracting 12 million MAU and Hamster Kombat reaching an impressive 110 million MAU.

Solana Maintains Lead

However, CryptoQuant has excluded Solana (SOL), BNB Chain (BNB) and NEAR Protocol (NEAR) from its overall analysis. Based on the Artemis data and the additional chains included in the analysis, Solana continues to lead all Layer 1 chains in terms of transaction count and daily active wallets. As of Sept. 30, Solana had processed over 1.1 billion transactions for the month and had gained 3.9 million daily active addresses.

In comparison, TON has performed well but has been overtaken by Solana in both categories. TON has reached 212.5 million transactions so far in September, securing second place in terms of transaction volume. However, in terms of daily active wallets, TON was overtaken by both Solana and NEAR Protocol, with 2.1 million daily active addresses (all data from Sept. 30).

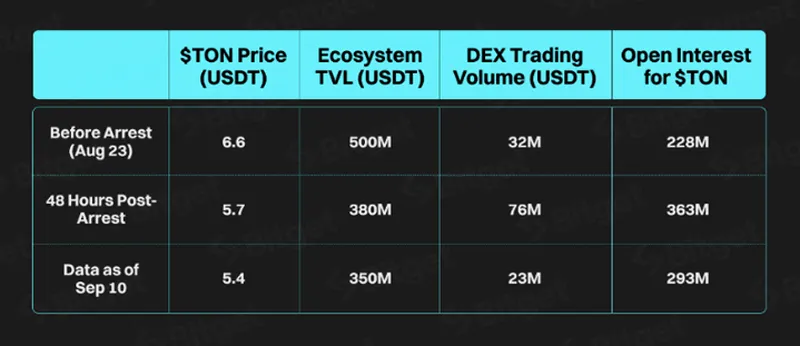

Bitget Predicts TON’s De-Telegramization

Bitget, a cryptocurrency exchange and major investor in the Open Network Foundation, outlined bullish predictions for the TON ecosystem in its latest September report.

One of the key predictions in the report is a potential “de-Telegramization” of the TON ecosystem. As Telegram faces increasing regulatory scrutiny, Bitget suggests that TON may need to distance itself from the messaging app to mitigate associated risks. While TON will likely continue to rely on Telegram‘s user base in the short term, the report forecasts a longterm trend towards greater independence.

“The news of the arrest [of Pavel Durov, CEO of Telegram, on Aug. 25] has had a significant impact on the TON ecosystem. As a result, the price of the TON token has dropped over 17.6% in the week following the arrest. Furthermore, the TVL on the TON chain has also seen a sharp decline, with a single-day drop exceeding 60%.”

As of Sept. 30, TON’s total value locked (TVL) is approximately $427 million, down 45% from its peak of $776 million in July 2024.

In terms of token performance, Bitget predicts that Toncoin, the native cryptocurrency of the TON blockchain, will outperform Bitcoin’s spot returns in a bullish market. The report also anticipates increased institutional interest in TON, with many institutions favoring over-the-counter (OTC) purchases.

Despite a significant drop following the arrest of Telegram CEO Pavel Durov in August, Toncoin has still managed to achieve a remarkable 149% return since the beginning of the year. The price has risen from $2.27 on January 1 to $5.82 at the time of writing.

Meanwhile, Bitcoin (BTC) has experienced a more modest 51% increase during the same period, rising from $43,835 on January 1, 2024, to $64,029 at the time of writing.

Source: https://cryptonews.com/news/tons-transaction-volume-soars-outpacing-layer-1-competitors-cryptoquant/

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Crypto Billionaire Changpeng

Zhao Promises More

Blockchain Investment After

US Custody Release

Former Binance CEO Changpeng Zhao has pledged to increase his investments in the blockchain sector after serving a four-month prison sentence in the US.

Over the weekend, Zhao also announced on X his plans to invest in artificial intelligence and biotech. He highlighted that as a long-term investor, he prioritizes making an impact over financial returns.

Changpeng Zhao Pledges More Time to Giggle Academy and Charity Work

Zhao also said that his educational initiative, Giggle Academy, will take up much of his time in the coming years. The project aims to provide free basic education globally for grades 1 to 12. Operating without a revenue model, it incorporates gamification, adaptive learning and blockchain technology, using “soul-bound tokens” to certify students’ achievements.

“I will also dedicate more time and funding to charity (and education). I have some rough ideas,” he said. Additionally, Zhao revealed he is currently writing a book, having completed two-thirds of it.

On April 30, 2024, Changpeng Zhao, also known as CZ, was imprisoned for four months for failing to implement a strong anti-money laundering system at Binance, violating the Bank Secrecy Act. This followed his November 2023 guilty plea, where he admitted to enabling transactions tied to criminal proceeds and sanctioned countries like Iran and Cuba.

Despite Lega Troubles and $50M Fine, CZ’s Net Worth Stands at $30.8B Post-Binance Penalty

As part of the plea deal, CZ agreed to step down as Binance’s CEO and pay a $50m fine. Meanwhile, Binance was fined $4.3b, marking one of the largest corporate penalties in US history for such violations.

Zhao was granted an early release from prison on Friday, ahead of his scheduled release, due to a rule in US Code Title 18 that avoids freeing inmates on weekends.

Despite facing legal challenges, Zhao’s net worth is about $30.8b, according to the Bloomberg Billionaires Index. This financial standing is primarily due to his substantial ownership in Binance.

Source: https://cryptonews.com/news/changpeng-zhao-binance-former-ceo-promises-blockchain-investment-custody/

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.