Explore effective ways to modify your trading approaches to accommodate the Bitcoin halving and ETF dynamics, ensuring readiness for changes in the cryptocurrency market.

Executive Summary

- With Bitcoin’s halving drawing near, the considerable purchasing influence of ETFs is poised to overshadow the traditional supply constraints typically associated with halving. This development underscores the importance for traders to reconcile the historical effects of halvings with the contemporary impact of ETFs on Bitcoin’s supply and pricing dynamics.

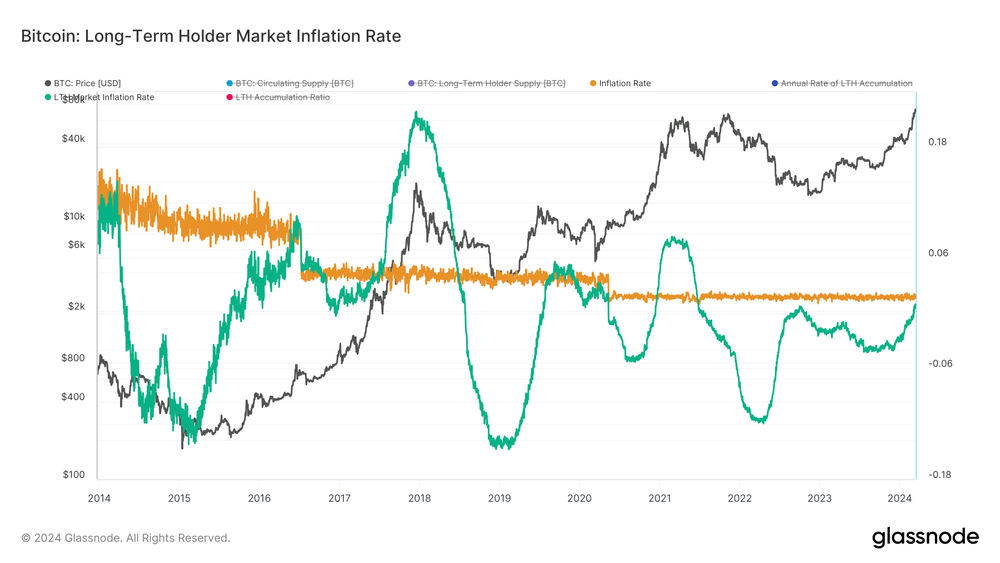

- As we approach a critical phase in the market cycle, the supply dynamics of Bitcoin are increasingly influenced by the actions of long-term holders (LTHs). Given their potential to significantly affect market liquidity and sentiment through selling or holding decisions, traders must closely monitor the Long-Term Holder Market Inflation Rate. Doing so enables them to anticipate market shifts and adapt their strategies accordingly.

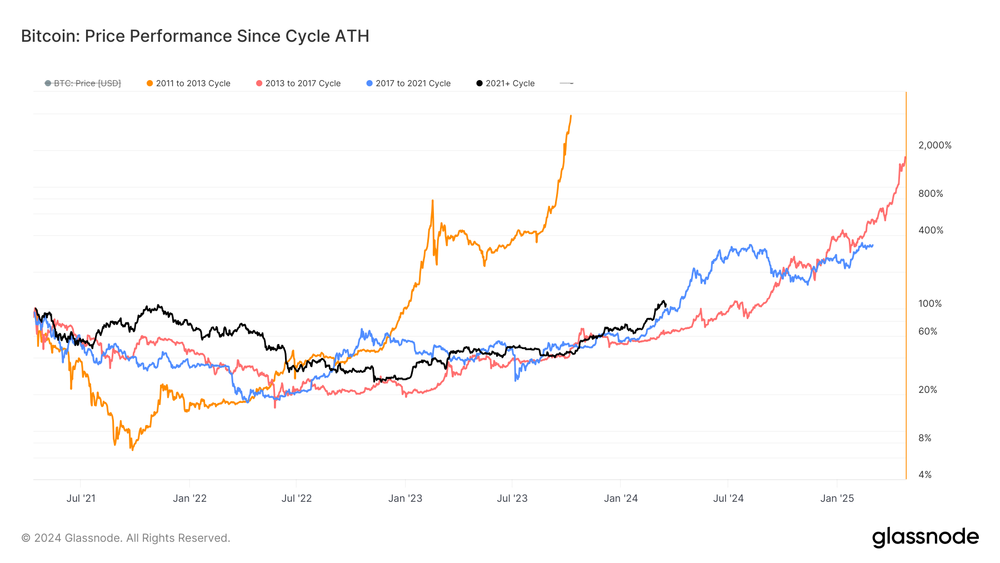

- Although reaching an all-time high (ATH) before the halving presents a new scenario, the cycle’s progression reflects patterns observed in the past when aligned with the ATH from April 2021. While ETFs have stabilized during corrections, a potential decline in ETF demand could exacerbate market fluctuations. This underscores the importance of strategic vigilance in trading approaches.

As the Bitcoin halving approaches, directional traders meticulously analyze its potential impact on market trends and adjust their strategies accordingly, considering its historical significance as a bullish catalyst.

However, the current market conditions introduce new challenges. This Bitcoin cycle has charted unprecedented territory, with the largest digital asset experiencing a remarkable surge and reaching an all-time high before halving for the first time.

This deviation from historical patterns raises pivotal questions for traders: Will the halving trigger another upward trend, or are different market dynamics shaping the cycle’s trajectory?

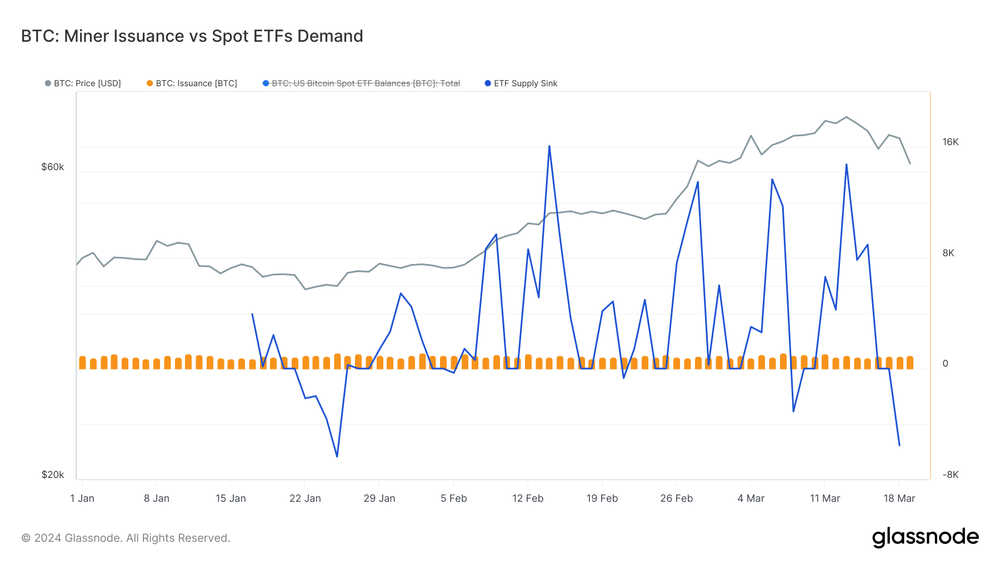

Comparing BTC miner issuance and ETF flows

Comparing BTC miner issuance and ETF flowsIn this report, we will examine the upcoming halving from a trading strategy standpoint, probing whether we’re entering uncharted territory and identifying the factors driving potential market shifts. Our insights aim to assist directional traders in navigating the distinctive landscape of the Bitcoin market.

Bitcoin Halving and ETF Impact on Supply Dynamics

Traditionally, Bitcoin halving events have been seen as catalysts for bull markets due to their reduction in new coin issuance. However, the current market landscape deviates from historical patterns as ETF demand surpasses new coin creation.

ETFs are now outpacing miners in withdrawing Bitcoin from circulation, significantly altering supply dynamics. Despite halving reducing daily supply from miners by half, ETFs’ substantial acquisitions may negate its scarcity effects.

ETFs preemptively tighten Bitcoin supply, potentially overshadowing halving’s impact in the short to medium term. This introduces market complexities, including potential price shifts from ETF outflows.

Long-Term Holder Influence on Supply

Beyond halving and ETFs, long-term holders (LTHs) play a significant role in Bitcoin’s supply dynamics. LTHs’ decisions affect market supply and demand, with Glassnode’s Long-Term Holder Market Inflation Rate tracking their accumulation or distribution patterns.

Current data suggests we’re in an early stage of an LTH distribution cycle, with about 30% completed. Monitoring this metric can inform trading strategies, particularly in identifying potential market tops or bottoms.

Halving: A Sell-the-News Event?

Although Bitcoin halvings are often seen as bullish, they can trigger immediate market volatility due to psychological factors. Sometimes, they’re perceived as sell-the-news events, with sentiment building up before the halving, only to result in significant price corrections afterward.

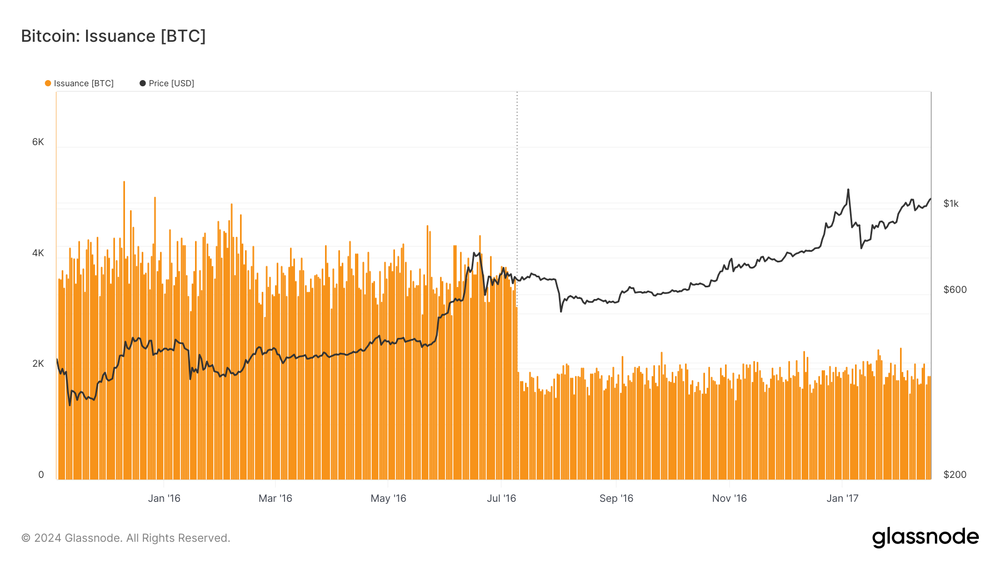

In 2016, for instance, there was a sharp sell-off, with prices dropping from around $760 to $540, a 30% correction, coinciding with the halving. This illustrates how market participants often react to the event itself rather than its long-term implications, causing immediate volatility.

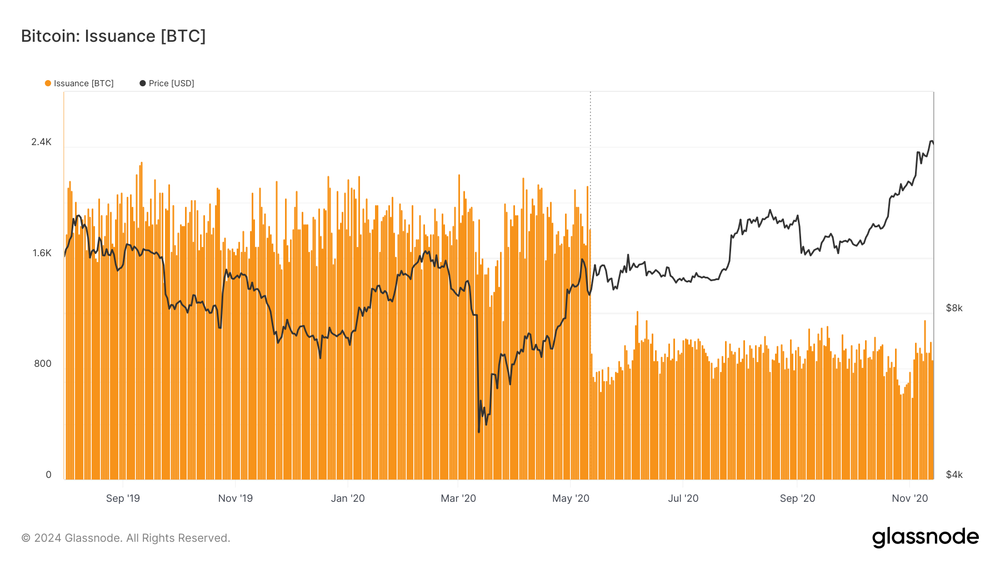

The 2020 halving was more complex. While it didn’t lead to the same sharp sell-off as in 2016, miners faced challenges due to price recovery before the halving and a reduction in issuance afterward. This nuanced response highlights how market reactions to halving can vary based on broader economic conditions and sentiment.

Approaching the next halving, market indicators suggest a significant correction may occur. This correction, aligning with historical trends, could serve as a reset, clearing short-term speculative interest and paving the way for the next growth cycle.

This anticipation is influenced by various factors, notably the impact of ETFs on the market. While ETF buying has bolstered Bitcoin’s price, it’s widely believed that these inflows won’t continue indefinitely. If ETF demand slows or reverses before the halving, it could intensify market effects. The combination of reduced ETF demand and traditional halving psychology may lead to heightened volatility, prompting traders to adjust their positions accordingly.

In summary, the halving’s immediate market impact will be influenced by psychological factors and institutional dynamics, particularly ETF activity. Traders should brace for potential volatility around the halving, with ETF activity serving as a vital short-term market sentiment indicator.

This Cycle’s Unique Traits

Bitcoin cycles traditionally start 12 to 18 months post the previous bull market peak, with a new all-time high achieved several months after the halving. While many view the halving as a catalyst for the next bull run due to supply constraints, this cycle’s halving effect is likely reduced by institutional demand from Bitcoin ETFs.

The influx of capital from ETFs has propelled BTC beyond its previous cycle’s ATH pre-halving. Some speculate this may shorten the current cycle compared to previous ones. Despite breaking the ATH pre-halving, it doesn’t necessarily indicate deviation from historical norms.

At Glassnode, we argue that the previous cycle’s bull market peak occurred in April 2021, despite Bitcoin’s higher price in November 2021. This assessment is supported by technical and on-chain indicators displaying bear market values post the April high, suggesting the cycle’s progression.

Considering April 2021 as the previous bull market peak, the current cycle aligns with historical patterns, suggesting the bull market might continue despite surpassing the previous ATH before the halving.

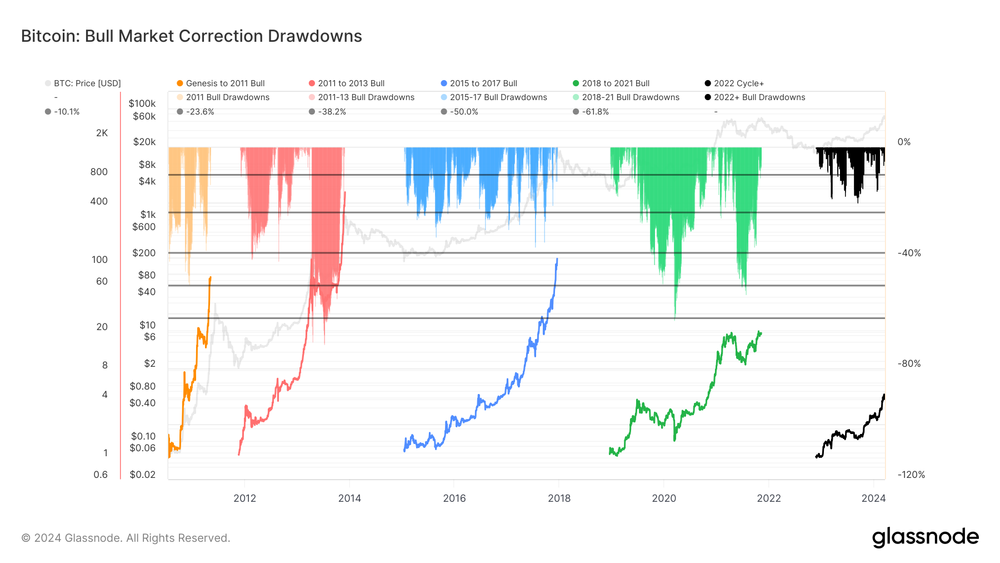

To refine trading strategies by comparing the current cycle with historical trends, monitoring the Bull Market Correction Drawdowns metric is advisable. This indicator tracks the depth and frequency of price retracements during the ongoing bull market.

This cycle has seen fewer severe corrections compared to past bull markets, typically experiencing drawdowns of 30-40%. Monitoring these drawdowns provides insight into market sentiment and potential turning points. With ETF inflows influencing the market, changes in this trend of milder corrections could signal shifts in investor behavior, prompting timely strategy adjustments.

Effect on Directional Trading Approaches

ETFs play a crucial role in shaping the Bitcoin market, especially as the halving approaches. Yet, it’s equally important to consider the impact of long-term holders (LTHs) on supply dynamics. The interaction between the halving’s supply reduction and ETF demand creates a complex dynamic affecting market responses.

For traders refining their strategies, monitoring LTH behavior is vital. LTHs’ decisions to hold or sell can indicate sentiment shifts and liquidity changes. As ETFs already affect supply-demand balance, LTH actions could be pivotal post-halving.

Successful trading in this cycle requires a comprehensive approach. Traders must track ETF activity for demand signals and monitor LTH sentiment for supply dynamics. Adapting strategies accordingly is key to navigating Bitcoin’s market cycle.

Disclaimer: This report is for informational and educational purposes only and does not constitute investment advice. Any decisions made based on the information presented here are at your discretion, and you are solely responsible for your investment choices.