Summary

- The Bitcoin Halving decreases miner rewards, influencing the supply and demand equilibrium. The upcoming Bitcoin Halving is anticipated in April 2024.

- Halving typically triggers market fluctuations and heightened speculation in the crypto sphere.

- Miners must adjust to the diminished profitability, possibly restructuring the mining sector.

- The occurrence stimulates technological advancements and fosters community growth within the blockchain ecosystem.

- The Halving underscores Bitcoin’s attractiveness as an enduring investment asset, potentially serving as a hedge against inflation.

What Does the Bitcoin Halving Entail?

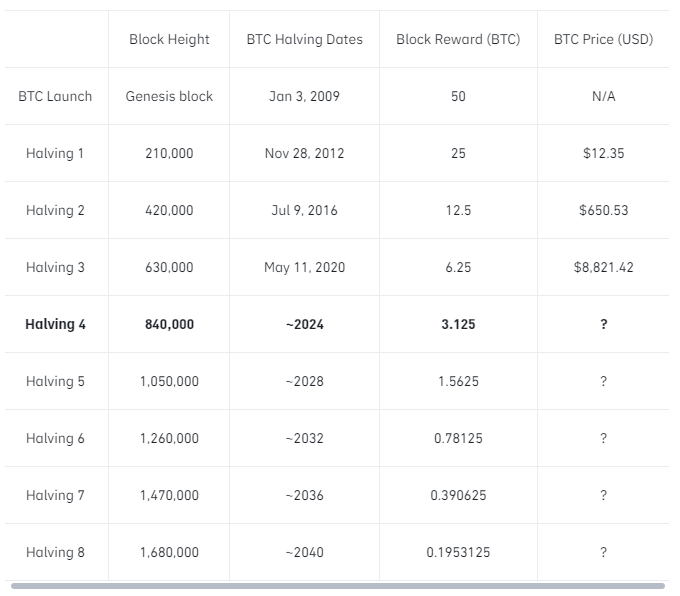

The Bitcoin Halving, also dubbed the “Halvening,” is a programmed event embedded within the Bitcoin protocol, occurring once every 210,000 blocks, roughly every four years. It entails a reduction in the rewards granted to miners for validating transactions on the blockchain. This mechanism is engineered to regulate the issuance of new bitcoins and uphold their scarcity, thereby ensuring a finite supply of BTC. Essentially, the halving slashes the BTC rewards bestowed upon miners by half.

Outlined in the original Bitcoin whitepaper authored by the pseudonymous Satoshi Nakamoto in 2008, was the concept of a fixed supply of 21 million bitcoins. This predetermined supply mechanism was introduced to curb inflation and emulate the scarcity of precious metals such as gold. By moderating the pace at which new bitcoins are minted, the protocol aims to establish a deflationary currency with the potential for long-term value preservation or appreciation.

Hence, the Halving assumes a critical role in regulating the influx of new bitcoins into circulation, gradually tapering the production of fresh coins over time. At the inception of Bitcoin in 2009, miners received a reward of 50 BTC for each successfully mined block.

The inaugural Halving event occurred in 2012, reducing the block reward to 25 BTC. Subsequent Halvings in 2016 and 2020 further diminished the reward to 12.5 and 6.25 bitcoins, respectively. The forthcoming Bitcoin Halving is slated to decrease the block reward to 3.125 BTC and is anticipated to transpire in April 2024, coinciding with the attainment of block height 840,000.

What Occurs with Your Bitcoin Post-Halving?

Following a Bitcoin halving event, your current Bitcoin holdings remain unaffected. The halving process does not directly alter the quantity of bitcoins you possess. Nonetheless, it can indirectly influence the price of Bitcoin and various facets of the cryptocurrency ecosystem. This is precisely why investors, traders, and cryptocurrency enthusiasts closely monitor this event. Here are several reasons elucidating the significance of the Bitcoin Halving and why individuals should take note:

1. Supply and Demand Dynamics

The Bitcoin Halving reduces the pace of new Bitcoin creation, tightening the supply side. Consequently, this affects the equilibrium between supply and demand, potentially leading to fluctuations in Bitcoin’s market value. According to basic economic principles, a decrease in supply while demand remains constant or increases tends to drive up the asset’s value. This anticipation of heightened scarcity often triggers increased investor interest and speculation in Bitcoin.

2. Market Volatility

Historically, the Bitcoin Halving has been associated with increased volatility in the cryptocurrency market. Speculators and investors closely monitor market dynamics before and after the event, attempting to forecast its impact on Bitcoin’s price. This anticipation frequently fuels price fluctuations and heightened trading activity.

3. Impact on Miners

With the halving of the reward for mining new blocks, Bitcoin mining profitability is directly affected. This reduction in rewards presents challenges for miners, particularly those operating with higher energy costs and less efficient hardware. Miners must evaluate the viability of their operations post-halving and adapt their strategies accordingly. Consequently, the mining landscape may change, potentially leading to the displacement of smaller or less efficient miners while larger, more resourceful operations persist.

4. Technological and Community Development

The Bitcoin Halving serves as a significant milestone that stimulates discussions and debates within the blockchain community. It encourages developers and stakeholders to explore innovative solutions to address the evolving dynamics of the Bitcoin ecosystem. This drive for technological advancement often results in the creation of new tools, protocols, and initiatives aimed at enhancing the scalability, efficiency, and security of the Bitcoin network, thereby fostering its long-term sustainability and growth.

5. Long-term Investment Implications

For long-term investors, the Bitcoin Halving underscores the asset’s deflationary nature and potential as a store value. The predictable scarcity introduced by the halving mechanism positions Bitcoin as a hedge against inflation and economic instability, appealing to individuals and institutions seeking to diversify their investment portfolios. The halving reinforces Bitcoin’s narrative as digital gold, bolstering its allure as a long-term investment asset with the potential for significant appreciation over time.

Bitcoin Halving Countdown Timer

The upcoming Bitcoin Halving is anticipated to take place in April 2024, when the block height reaches 840,000. To facilitate tracking, you can monitor the halving countdown timer on the Binance Bitcoin Halving page.

Conclusion

The Bitcoin Halving transcends mere technical adjustment; it stands as a foundational element of the cryptocurrency ecosystem, molding the narrative and course of Bitcoin’s journey ahead. With each Halving event, conversations surrounding Bitcoin’s intrinsic value, its significance in the global financial arena, and its capacity as a catalyst for change in digital finance are amplified.