One observer noted that despite the slip, Bitcoin is demonstrating resilience, yet it is anticipated that the corrective period may persist for some time before a resurgence in growth.

In the past 24 hours, Bitcoin and Ether experienced a 4% decline, while SOL and DOGE saw losses of 6% to 7%. This downward movement resulted in the highest volume of leveraged long liquidations in a week, as per data from CoinGlass.

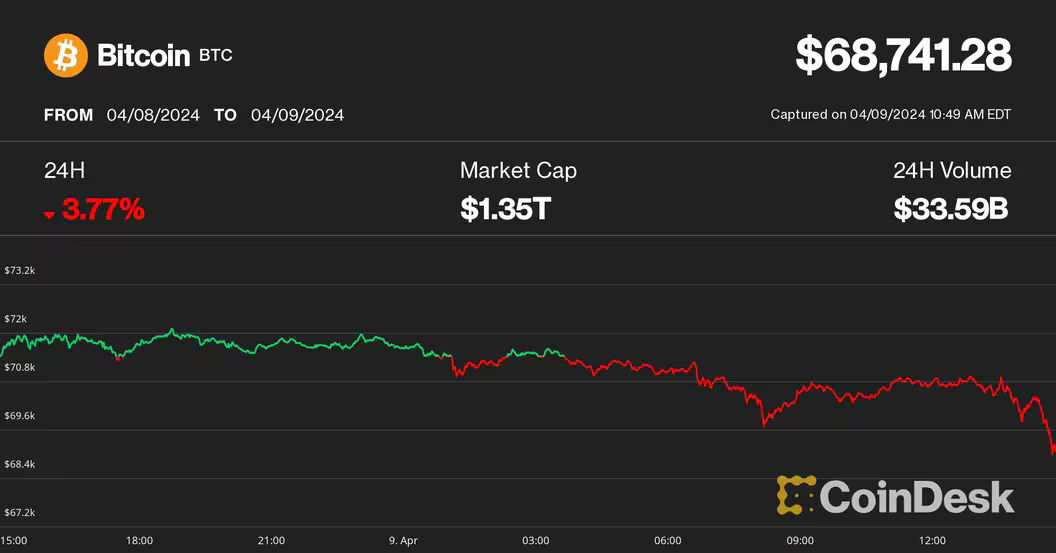

Bitcoin price on April 9 (CoinDesk)

Bitcoin price on April 9 (CoinDesk)

Bitcoin (BTC) buckled below $69,000 as cryptocurrencies slid Tuesday, paring optimism after Monday’s rally.

BTC slipped as low as $68,580 from above $71,000. The largest cryptocurrency by market cap was recently priced near $69,000, down about 4% over the past 24 hours, CoinDesk data shows.

The drop echoed through the crypto markets, with the broad-market CoinDesk 20 Index (CD20) losing 3.2% in the same period. Ether (ETH) fell below $3,500, almost 4% lower, and major altcoins solana (SOL) and dogecoin (DOGE) slid as much as 6% to 7%.

The declines led to almost $200 million worth of leveraged derivatives trading positions being liquidated across all digital assets as of 15:45 UTC, CoinGlass data shows. The overwhelming majority, some $175 million worth of positions, were longs betting on prices to rise. This was the largest daily leveraged long flush in a week, the data show, suggesting that leveraged traders were caught off-guard.

While bitcoin’s Monday breakout above $70,000 prompted some analysts to predict higher prices, some technical analysis indicated a different conclusion. Monday’s high price was below the record highs recorded in March, meaning that the subdued prices might continue for a while before targeting fresh highs, according to Joel Kruger, a market strategist at LMAX Group.

“Bitcoin continues to demonstrate remarkable resilience, finding support amidst a period of consolidation,” he said in an emailed note. “The daily chart hints at a potential lower top around $71,800, suggesting the possibility of corrective price action before a fresh attempt at record highs.”

Bitcoin (BTC) struggled to maintain its momentum above $69,000 as the broader cryptocurrency market faced a downturn on Tuesday, erasing some of the optimism following Monday’s rally.

BTC dipped to as low as $68,580 from its previous level above $71,000. The leading cryptocurrency, according to CoinDesk data, is currently hovering around $69,000, marking a decline of about 4% over the past 24 hours.

The downward trend extended across the crypto market, with the CoinDesk 20 Index (CD20) registering a 3.2% loss during the same period. Ether (ETH) also experienced a drop below $3,500, down nearly 4%, while major altcoins like Solana (SOL) and Dogecoin (DOGE) recorded declines of 6% to 7%.

The market downturn led to approximately $200 million worth of leveraged derivatives trading positions being liquidated across all digital assets by 15:45 UTC, as per CoinGlass data. Of this, the majority—about $175 million—were long positions anticipating price increases. This represents the largest daily liquidation of leveraged long positions in a week, indicating that leveraged traders were caught by surprise.

Despite Monday’s breakout above $70,000 prompting some analysts to forecast further gains, certain technical indicators suggest a different scenario. Monday’s peak fell short of the record highs reached in March, implying that subdued prices may persist before attempting to reach new highs, as noted by Joel Kruger, a market strategist at LMAX Group.

Kruger emphasized Bitcoin’s resilience amid a consolidation phase, stating, “The daily chart hints at a potential lower top around $71,800, suggesting the possibility of corrective price action before a fresh attempt at record highs.

Disclosure: The information provided is for educational and informational purposes only. It is not intended as investment advice, and any actions taken based on this information are at the reader’s sole discretion. The reader should conduct their research and consult with a qualified financial advisor before making any investment decisions. The accuracy, completeness, or reliability of the information is not guaranteed, and the author or provider of the information shall not be held liable for any errors, omissions, or inaccuracies in the content or for any actions taken in reliance thereon.