Weekly Crypto Market Insights

(2-8 September 2024)

The above chart is the Bitcoin (BTC) H1 chart on TradingView for the week of 2-8 September 2024.

From the chart, the price of BTC opened at US$58,217 on 2 September 2024 and closed at US$53,687. It marks an approximately 7.71% decrease in price. The price is below the EMA200 which marks a bearish trend for now, and the Fear & Greed Index is Fear.

The above chart is the Ethereum (ETH) H1 chart on TradingView for the week of 2-8 September 2024.

From the chart, the price of ETH opened at US$2,480.83 on 2 September 2024 and closed at US$2,245.74 on 8 September 2024. It marks an approximately 9.29% decrease in price. The price is below the EMA200 which marks a bearish trend for now.

The above chart is the Solana (SOL) H1 chart on TradingView for the week of 2-8 September 2024.

From the chart, the price of SOL opened at US$134.29 on 2 September 2024 and closed at US$126.74 on 8 September 2024. It marks an approximately 4.97% decrease in price. The price is below the EMA200 which marks a bearish trend for now.

From the chart, the market capitalization of TOTAL3 opened at US$555.173B on 2 September 2024 and closed at US$535.637B on 8 September 2024. It marks an approximately 3.23% decrease in price. The market cap is below the EMA200 which marks a bearish trend for now. The trend of TOTAL3 moves in tandem with BTC.

From the chart, the market capitalization of OTHERS opened at US$187.338B on 2 September 2024 and closed at US$178.626B on 8 September 2024. It marks an approximately 4.40% decrease in price. The market cap is above the EMA200 which marks a good reversal from a bearish trend to a bullish trend.

Analyst’s Notes

Our team of analysts wishes to highlight 2 important findings from 2-8 September 2024 for the weekly crypto market insights.

Falling Wedge Chart Pattern Formed – Potential Bullish Breakout

First, our analysts believe that a falling wedge chart pattern has formed on the BTC D1 chart, and this is a potential sign of a bullish breakout in the near future. This is in tandem with the upcoming interest cut that will most probably happen on 18 September 2024.

Our prediction is that price will hover within the area of the wedge and a breakout upwards should happen, causing a continuation of a bullish uptrend.

🔼 Bitcoin (BTC) D1 Chart showing a falling wedge chart pattern.

Altcoins Recovery Stronger Than Expected

Our analysts have noted that the Top 125 cryptocurrencies, less the Top 10 (the strong altcoins that made up the C100 portfolio), have increased in terms of adoption rate and volume. It will also translate to a faster and stronger recovery as compared to BTC, ETH and SOL. This is a strong testament and proof that diversifying into a portfolio of the Top 100 Altcoins is a great investment strategy.

🔼 OTHERS.D H1 Chart showing a a bullish trend above EMA200.

Bitcoin analyst sees ‘biggest bull cycle’ with $45K now BTC price floor

Bitcoin is due some “final corrections” before spending the next two years on a bull run, bold new analysis predicts. In his latest X content, trader, analyst and entrepreneur Michaël van de Poppe eyed $53,000 as the next BTC price dip target.

BTC price forecast: “Clearly breaking back upwards” at $53,000

Few Bitcoin market observers are willing to go on record to call the end of six months of BTC price consolidation.

For Van de Poppe, however, the end of one of the most frustrating episodes in Bitcoin history should be imminent.

“Liquidity was taken & #Bitcoin is back up to $54.8K,” he wrote about short-timeframe moves on BTC on Sept. 7.

“Expect a max of $55.5K on this run and then we could be revisiting $53K before clearly breaking back upwards. Final corrections & then 2 years bull.”

Recovery Roadmap and Market Sentiment

The day prior, another post included a chart with a potential roadmap for the recovery, barring any surprise “events” throwing it off course.

Bitcoin has failed to convince traders that lower lows will not surface — even a month after it hit a six-month bottom below $50,000. Despite favorable macro-economic conditions around the corner, crypto market doom and gloom persists.

Van de Poppe acknowledges the risks, arguing that equities are “running up on weakness.”

“The equity markets are fragile in terms of liquidity, and people are very eager to put their money away towards these assets due to fear of inflation. That’s going to reverse really soon,” he forecast on Sept. 8.

Bitcoin vs. S&P 500 echoes 2019

For Bitcoin, however, there is a silver lining — a major “crash” is likely off the table.

Instead, BTC is copying behavior from 2019 when compared to the S&P 500, with the implication that it is just at the start, not the end, of a long-term bull market.

“We can also see that there’s been a significant correction taking place on the markets, which is likely coming to an end, just like the correction in 2019 landed at $6K, we’re likely landing at $45-50K on Bitcoin,” Van de Poppe concluded.

“From that perspective, with the upcoming rate cuts from the FED the weakening economy, and the global liquidity being increased in China, it seems almost inevitable that we’re actually at the edge of the biggest bull cycle ever.”

Sept. 18 will see the United States Federal Reserve meet to decide on interest rate changes, with markets long pricing in 100% odds of a rate cut.

This should ultimately benefit crypto and risk assets, as lower rates encourage liquidity to enter the markets.

Source: https://www.tradingview.com/news/cointelegraph:bcced29bd094b:0-bitcoin-analyst-sees-biggest-bull-cycle-with-45k-now-btc-price-floor/. This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Bitcoin’s Structure Looks Similar to 2019, Top Expert Claims

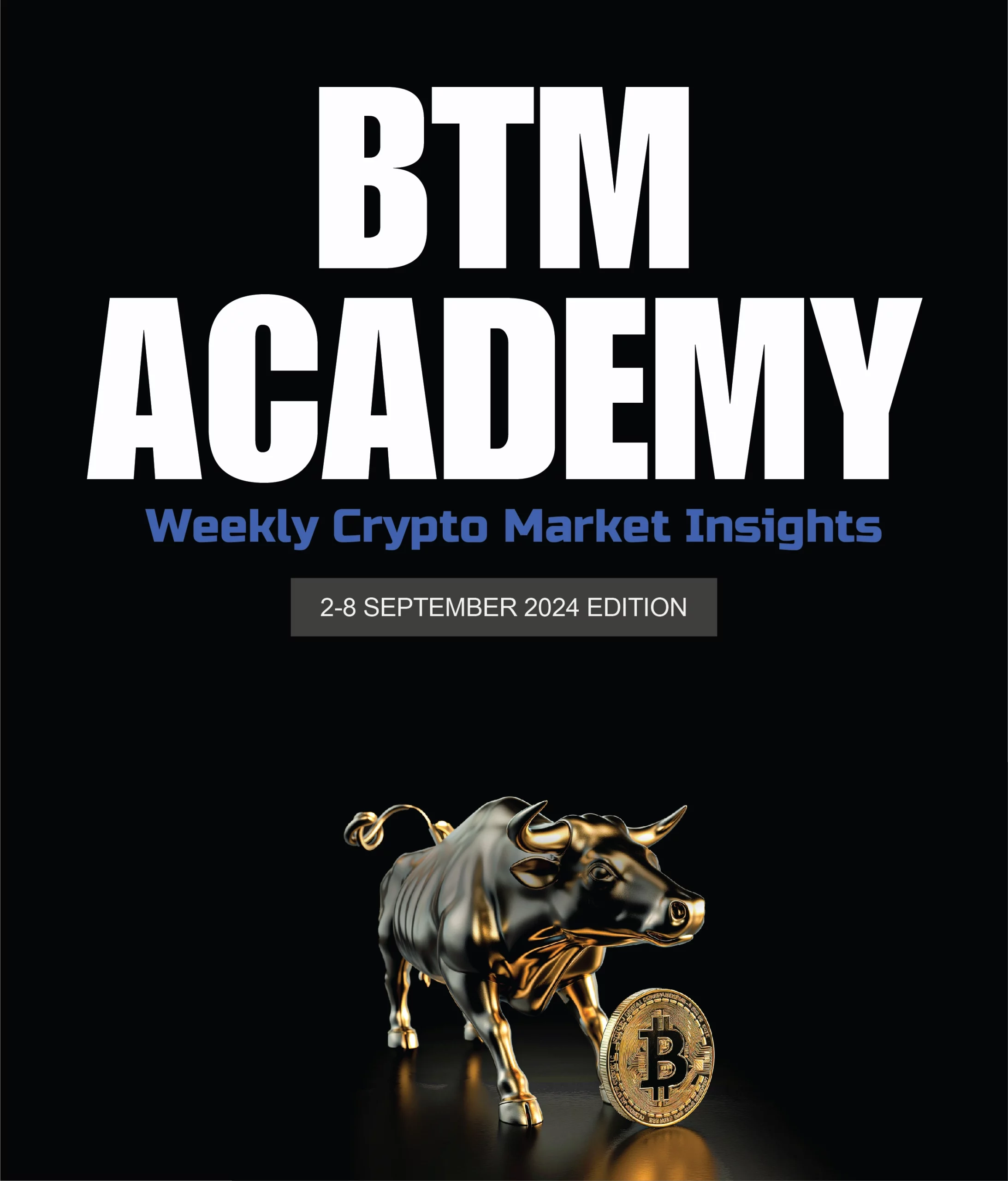

Julien Bittel, head of macro research at Global Macro Investor (GMI), has stated that Bitcoin’s structure looks similar to the one from 2019.

Back then, the leading cryptocurrency by market cap was stuck in “a consolidation range.”

This year’s Bitcoin price structure is starting to look eerily similar to 2019. Take a close look at the chart – it’s almost a perfect fractal of what we saw back then.

Bitcoin has been stuck in a consolidation phase, and interestingly, just like in 2019, this consolidation — Julien Bittel, CFA (@BittelJulien) September 7, 2024 So far, this consolidation phase has lasted exactly 175 days.

“We’re now approaching that critical juncture where things could start moving in a big way,” he added.

Important week

Bittel has added that the next week could be extremely important for the leading cryptocurrency.

It remains to be seen whether the leading cryptocurrency is going to follow the 2019 script in 2024.

“All eyes on how Bitcoin reacts as we hit this potential inflection point – does it follow the 2019 script, or do we see a deviation this time around?” Bittel wrote.

If this fractal manages to hold, the leading cryptocurrency could experience “some serious upside momentum” in the near future.

BITCOIN’S MOST RECENT CRASH

On Sept. 6, the price of the leading cryptocurrency collapsed all the way to $52,546, the lowest level since early August.

The crash came after the most recent U.S. jobs report that failed to provide definite clues about the size of the upcoming rate cut. Despite experiencing a slight increase immediately after the data was published, the cryptocurrency then ended up plunging together with tech stocks.

At press time, the leading cryptocurrency is changing hands at $54,584 on the Bitstamp exchange after paring some losses.

As reported by U.Today, legendary trader Peter Brandt recently issued a bearish Bitcoin warning, claiming that prolonged corrections could cause significant emotional damage.

Source: https://www.tradingview.com/news/u_today:4de7500b4094b:0-bitcoin-s-structure-looks-similar-to-2019-top-expert-claims/

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Celebrates

3 Years

of Bitcoin Adoption,

Eyes Broader Access

Three years ago today, El Salvador made history as the first nation to adopt Bitcoin as legal tender.

This move has sparked a phase of growth and development for the country, as it has become a model for crypto adoption and has drawn attention from global stakeholders.

At press time, the leading cryptocurrency is changing hands at $54,584 on the Bitstamp exchange after paring some losses.

As reported by U.Today, legendary trader Peter Brandt recently issued a bearish Bitcoin warning, claiming that prolonged corrections could cause significant emotional damage.

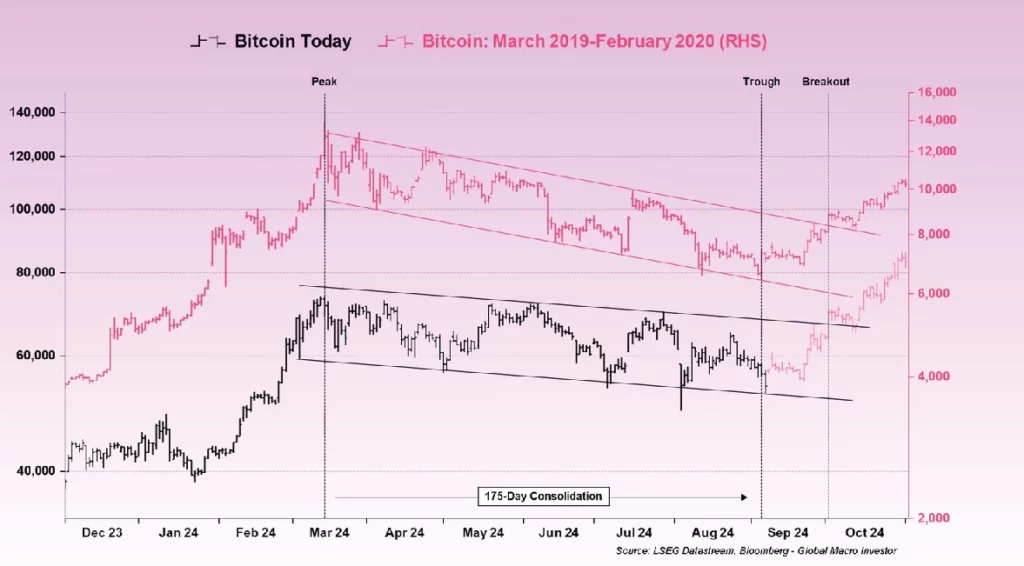

Bitcoin’s Role in El Salvador Grows With $31 Million in Unrealized Gains

In honor of this milestone, Max Keiser, senior Bitcoin adviser to President Nayib Bukele, shared the administration’s vision for expanding Bitcoin access.

“Our plan is to provide every Salvadoran with a Bitcoin cold storage solution. So that even $0.50 of regular savings into Bitcoin creates education, retirement, and inheritance funds,” he explained.

Keiser’s statement highlights the Bitcoinfriendly approach chosen by President Bukele’s government. Though international bodies like the IMF initially criticized the move, they have since acknowledged that Bitcoin’s adoption has not harmed the country’s economy.

Instead, Bitcoin has benefited El Salvador. Its national Bitcoin wallet holds 5,865 BTC, generating over $31 million in unrealized gains. While the profit may seem small, the real impact has been increased global recognition and investment in the country.

For context, a port in El Salvador’s proposed Bitcoin City was one of the two that Turkish company Yilport Holdings would upgrade with a record $1.6 billion investment. Further, Bukele’s administration’s strong stance on freedom of speech and individual liberty has also gained attention.

President Bukele stressed this in a recent post, describing El Salvador as a new safe haven for freedom of speech and expression.

“As the world spirals into chaos and government crackdowns intensify, we will stand as the new beacon of hope for the future,” Bukele stated.

Despite the progress, Bukele acknowledged that Bitcoin adoption has not reached the expected levels. He attributes this to its voluntary use in the country but remains optimistic about the longterm financial benefits for early adopters.

Meanwhile, political opponents have called the Bitcoin initiative a failure, claiming “nobody” uses it. In response, the government is ramping up efforts to promote Bitcoin awareness, focusing on education. Recently, a Bitcoin training program was launched for 80,000 public servants.

Source: https://www.tradingview.com/news/beincrypto:d65cc721a094b:0-el-salvador-celebrates-3-years-of-bitcoin-adoption-eyes-broader-access/. This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Bitcoin’s Structure Looks Similar to 2019, Top Expert Claims

In a significant development, Federal Reserve Governor Christopher Waller has backed a potential interest rate cut at the upcoming September meeting. As it seems, the markets remain in a holding pattern, with investors anxiously awaiting the potential impact on digital assets.

According to CNBC, Fed Governor Christopher Waller on Friday backed an interest rate cut at the central bank’s upcoming policy meeting in less than two weeks. Waller echoed Fed Chair Jerome Powell’s statement from late August that the “time has come” for monetary policy adjustment, however, he did not specify the pace and magnitude of the cuts.

Fed Governor Waller backs interest rate cut at September meeting — CNBC (@CNBC) September 6, 2024

Crypto market awaits reaction

So far yet, the cryptocurrency market has had little reaction to Waller’s comments. Cryptocurrencies witnessed mixed price action in early Saturday trade, with Bitcoin falling 3% in the last 24 hours to $54,360. Several cryptocurrencies also fell, with Ethereum, Dogecoin and Pepe reporting losses of more than 4% each. A few assets such as Algorand, BONK and Optimism traded in the green with gains up to 4%.

Stocks earlier fell as the markets appeared to take a “wait and see” stance, with investors weighing the larger implications of the top Fed official’s remarks. Bitcoin and other major cryptocurrencies have been closely following global stocks in recent weeks.

A looser monetary policy is frequently considered beneficial for speculative assets. This is because lower interest rates may encourage investors to seek better returns in riskier assets such as cryptocurrencies, potentially driving up prices.

Source: https://www.tradingview.com/news/u_today:056c0f7c1094b:0-key-fed-statement-rocks-markets-crypto-awaits-reaction/

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Bitcoin Fear And

Greed Index Falls To

Extreme Fear

as BTC Dips Below $54,000

On Friday, the cryptocurrency market’s Fear and Greed Index plummeted to “extreme fear,” reflecting growing anxiety among investors as the Bitcoin price dipped to a weekly low of $53,700.

This downturn marks a continuation of a broader sell-off that has plagued the market, particularly since Bitcoin struggled to maintain momentum above the critical $60,000 threshold.

Bitcoin Targets $53,000 Amid Bearish Sentiment

The steep decline in Bitcoin’s value can be traced back to August’s significant crash, attributed to challenging macroeconomic conditions that resulted in increased liquidity exiting risk assets, including cryptocurrencies.

Furthermore, September has historically been a bearish month for Bitcoin, with an average negative return of 6%. As of now, just six days into the month, Bitcoin has already recorded an 8% decline, a trend that market expert Benjamin Cowen suggests could align with typical September behavior if the month concludes at this rate.

However, further price retracements could occur if key support levels fail to hold. Analyst Justin Bennett pointed out that Bitcoin appears to be heading towards a target of $53,000 after a failed attempt to retest its all-time high of $69,000, which was achieved at the end of August.

Bennett indicated that while the situation remains fluid, there is potential for a brief relief rally in the $52,000 to $53,000 range before a deeper correction could lead the price down to $48,000.

Another analyst, Michael van de Poppe, has also weighed in on the current market dynamics, stating that the market may have overreached by taking liquidity from above.

Van de Poppe anticipates that Bitcoin will likely test the $53,000 level before any upward movement occurs. For Bitcoin to regain its footing, van de Poppe emphasizes the necessity of reclaiming the $56,000 mark following the recent dip.

Key Factors That

Could Catalyze

BTC’s Price Recovery

Despite this bearish sentiment dominating the market, BTC investor Lark Davis remains optimistic about the future, suggesting that the next six months could be pivotal for Bitcoin and the broader market, regardless of recent price corrections.

One of Davis’ key points is the upcoming fourth quarter, which has historically been a bullish period for BTC, especially in Halving years. In addition, he highlights the rising M2 money supply, which could lead to more capital being injected into the market, further fueling a potential rally.

Davis also discusses the possibility of rate cuts by the US Federal Reserve, which analysts suggest could act as a significant catalyst for BTC’s price. Should the Fed implement cuts of 25 basis points, it could create a more favorable environment for the entire crypto market.

Another critical factor Davis points to is the upcoming US election, which is just 60 days away. As reported by NewsBTC, a potential return of former President Donald Trump could positively impact the crypto market.

Trump has indicated plans to put BTC at the forefront of his economic agenda, including loosening regulations and fostering a more supportive environment for cryptocurrencies. This shift could instill greater confidence among investors and potentially boost BTC prices significantly.

However, it remains to be seen what the next few days will bring for the Bitcoin price as the bearish sentiment in the market is palpable, but with October holding potential gains as has historically happened in past years. When writing, the largest cryptocurrency on the market was trading at $54,100.

Source: https://www.tradingview.com/news/newsbtc:875311a04094b:0-bitcoin-fear-and-greed-index-falls-to-extreme-fear-as-btc-dips-below-54-000/. This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.