Weekly Crypto Market Insights

(21 – 27 Oct 2024)

The above chart is the Bitcoin (BTC) H1 chart on TradingView for the week of 21 – 27 Oct 2024.

From the chart, the price of BTC opened at US$69,031.00 on 21 October 2024 and closed at US$68,021.70 on 27 October 2024. It marks an approximately 1.46% decrease in price. The price is above the EMA200 which marks a bullish trend for now.

The above chart is the Ethereum (ETH) H1 chart on TradingView for the week of 21 – 27 Oct 2024.

From the chart, the price of ETH opened at US$2,746.91 on 21 October 2024 and closed at US$2,507.80 on 27 October 2024. It marks an approximately 8.71% decrease in price. The price is below the EMA200 which marks a bearish trend for now.

The above chart is the Solana (SOL) H1 chart on TradingView for the week of 21 – 27 Oct 2024.

From the chart, the price of SOL opened at US$167.40 on 21 October 2024 and closed at US$176.63 on 27 October 2024. It marks an approximately 5.51% increase in price. The price is above the EMA200 which marks a bullish trend for now.

The above chart is the TOTAL3 H1 chart on TradingView. It shows the total market capitalization of the top-125 cryptocurrencies, excluding BTC and ETH, for the week of 21 – 27 Oct 2024.

From the chart, the market capitalization of TOTAL3 opened at US$638.7B on 21 October 2024 and closed at US$618.056B on 27 October 2024. It marks an approximately 3.23% decrease in price. The market cap is above the EMA200 which marks a bullish trend for now.

The above chart is the OTHERS H1 chart on TradingView. It shows the total market capitalization of the top-125 cryptocurrencies, excluding BTC and the Top 10 cryptocurrencies, for the week of 21 – 27 Oct 2024.

From the chart, the market capitalization of OTHERS opened at US$232.839B on 21 October 2024 and closed at US$212.479B on 27 October 2024. It marks an approximately 8.74% decrease in price. The market cap is above the EMA200 which marks a bullish trend.

Bitcoin hits $73.6K as fundamentals suggest new all-time highs are programmed

Bitcoin price rallies within $200 of a new all-time high as several fundamentals point to the crypto bull marking picking up pace. Bitcoin price sprinted toward its all-time high at $73,800, and this move differs from recent rallies as several fundamentals suggest that the bull market is shifting into a higher gear. Here are six important pieces of data that signal Bitcoin is ready to hit new highs.

Bitcoin officially exits a seven-month-long downtrend

Bitcoin’s strong range break and sustained multiday close above the previous trading range inspired traders to open new positions with the intent of chasing higher targets in the $85,000–$160,000 range, a point well illustrated by veteran trader Peter Brandt.

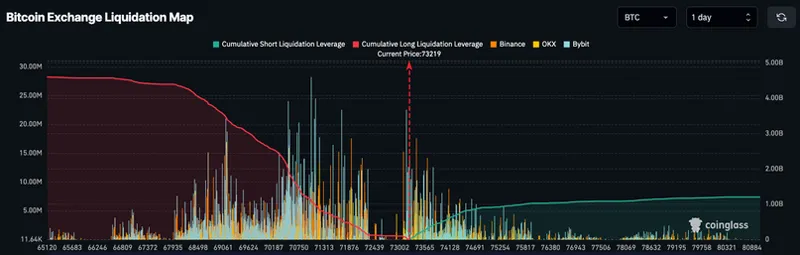

Bitcoin price broke through sell walls, liquidating most short traders

The longstanding wall of asks (the red rectangle in the candlestick chart) at $65,000 to $71,000 was cleared as Bitcoin stormed through $68,000 to $70,000, liquidating short traders and sending bears to their caves with empty pockets.

BTC/USDT chart showing sell walls and liquidation (bottom). Source: TRDR

Bitcoin exchange liquidation map. Source: CoinGlass

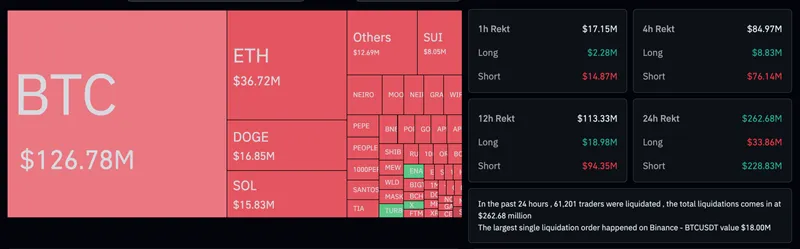

Crypto market 24-hour liquidations. Source: CoinGlass

Bitcoin dominance hits 60%

Bitcoin dominance, a dynamic ratio that denotes the market share of BTC in the total crypto market, moved to 60% on Oct. 29 for the first time since March 2021.

Some traders view the Bitcoin dominance metric and the Crypto Fear & Greed Index as a gauge of investor sentiment. According to CoinGecko, “There can be an impending BTC bull run when Bitcoin’s dominance and price assume an upward trend.”

Open interest rises to a new all-time high

On the run-up to the all-time high, Bitcoin open interest hit a new all-time high at $43.6 billion. This highlights market participants’ interest in BTC, and the ramp-up as the price hits new all-time highs can be interpreted as a positive investor sentiment indicator.

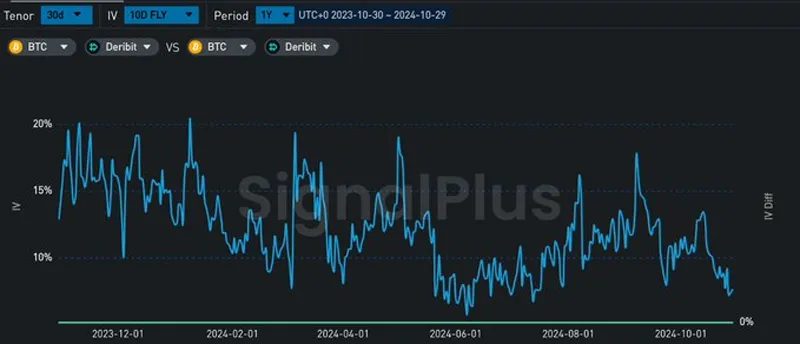

Contango, a juicy basis trade, and CME futures hitting new all-time highs

For the past two days, the Bitcoin market has been in contango, with futures prices leading the spot price; and on Oct. 29, Bitcoin hit a new all-time high at $74,485 in the CME futures.

Regarding the popularity of the basis trade in the futures market, HighStrike’s head of crypto options and derivatives analyst, JJ, told Cointelegraph:

“Essentially, what happened is you had tons of people cash and carry by

longing the IBIT/spot ETFs and shorting the CME futures, but very few, if any, people were directionally long CME futures. You can see this in how the CME basis dropped from 16% in February (when many were directionally long into the all-time high breakout) to just 8.75% now.”

JJ elaborated by explaining:

“What’s happening now is you have hedges closing in preparation for price discovery and those funds with no BTC exposure using the CME to hedge their non-exposure by going speculatively long into the election. The net result is CME basis poised to breakout higher than 10% into the end of the year.”

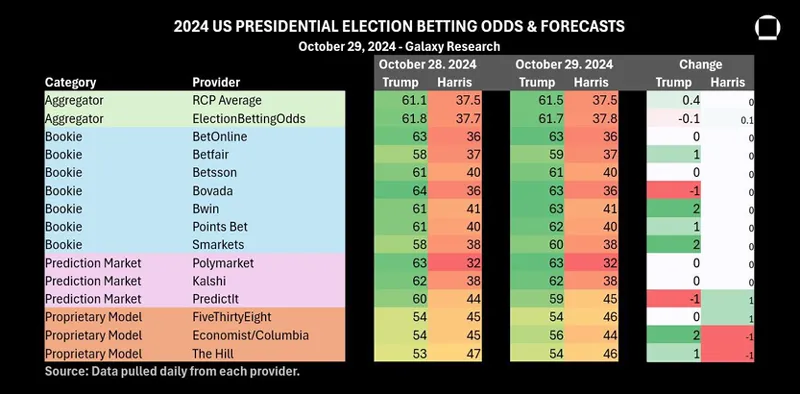

Traders bet on a Trump election victory and a crypto-friendly presidency

Bitcoin futures markets reflect a rapacious appetite for calls in the options market, a potential gamma squeeze and traders positioning for what they believe will be a Donald Trump election victory, followed by a crypto-friendly

administration.

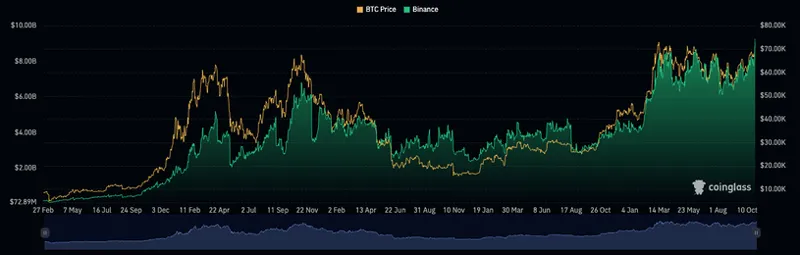

Spot Bitcoin ETF inflows soar

Inflows to the spot Bitcoin exchange-traded funds (ETFs) have soared over the past two weeks, with more than $3.8 billion entering the instruments during this time. The trend continued on Oct. 28, with Farside Investors data showing the ETFs taking in $479.4 million. To date, the total assets under management in the ETFs sit at $68.5 billion, and professional traders anticipate this figure to rise as options launch on the ETFs in the near future.

Source: https://cointelegraph.com/news/bitcoin-hits-73-6-k-as-fundamentals-suggest-new-all-time-highs-are-programmed. This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

CryptoQuant CEO Predicts Bitcoin Could Be Used as a Mainstream Currency by 2030

Ki Young Ju, CEO of on-chain data firm CryptoQuant, hinted in a Thursday X post that Bitcoin (BTC) may become a global currency by 2030, with Satoshi Nakamoto’s dream of a decentralized, peer-to-peer payment system potentially materializing even sooner.

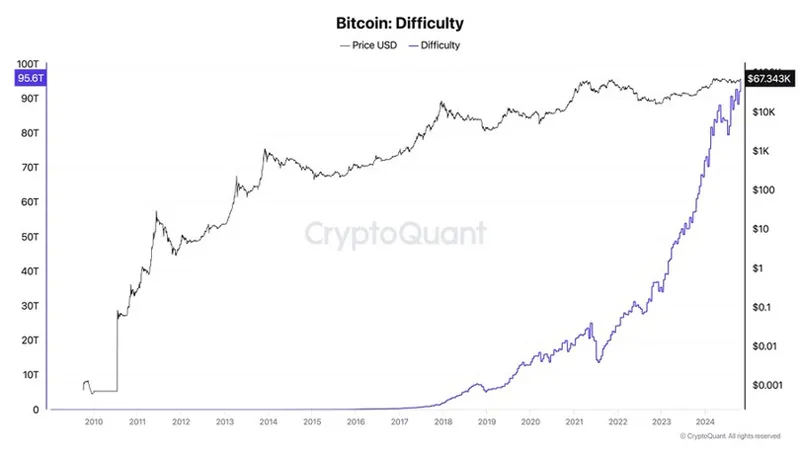

The Evolution of Bitcoin Mining and CryptoQuant’s Predictions for Global Currency Adoption by 2030

In a detailed Thursday X post, Ju described how Bitcoin could evolve from a speculative asset to a low-volatility currency by 2030.

This outlook stems from major changes in Bitcoin mining since its early days. Back in 2009, solo miners could easily mine 50 BTC using just a personal computer.

However, the mining landscape has drastically changed, with difficulty surging by 378% over the last three years.

Today, large-scale mining operations, often backed by institutional investors, dominate the sector.

As institutional players assume control, the barriers to entry in mining have risen, contributing to a more stable Bitcoin ecosystem. Ju suggested that this increased stability could lead to a reduction in Bitcoin’s price volatility. While such a development might make Bitcoin less attractive to day traders, it could enhance its appeal as a practical currency for everyday transactions.

As the ecosystem matures, these developments tie directly into the upcoming halving event, a pivotal moment in Bitcoin’s evolution. Ju predicts that after the next halving, expected around April 2028, Bitcoin will enter a new phase.

Historically, Bitcoin has seen substantial price increases following halving events, but Ju believes that by 2028, institutional adoption will reach a critical mass, accelerating Bitcoin’s global acceptance as a currency.

The increasing presence of major fintech companies, such as Stripe’s recent entry into the stablecoin infrastructure space, could also accelerate Bitcoin’s transformation into a widely used currency.

Overcoming Barriers to Bitcoin Adoption and CryptoQuant’s Insights on Current Market Trends

Historically, Bitcoin’s volatility has hindered its use for transactions, with businesses and consumers hesitant to engage with an asset that fluctuates significantly in value.

However, Ju believes that this volatility is gradually decreasing as the Bitcoin ecosystem continues to mature.

He remarked, “As volatility decreases, Bitcoin’s role as a currency becomes increasingly inevitable,” adding that this trend could accelerate with institutional backing.

This stabilization may stem from advancements in protocol, the development of Layer 2 (L2) networks, or the use of Wrapped Bitcoin (WBTC), which integrates BTC into various ecosystems without the complexities of L2 infrastructure.

Nevertheless, Ju stressed that institutional support will be crucial for Bitcoin L2s to remain competitive.

Bitcoin recently retraced after briefly touching $69,000 for the first time since June 2023, trading at $67,667 as of Thursday, showing a 1.66% change in the last 24 hours.

As Bitcoin approaches its previous all-time high, retail investors are cautiously reentering the market, although transfer activity remains low, according to data from CryptoQuant.

This more stable and maturing Bitcoin market could soon see the cryptocurrency making strides toward mainstream adoption, as predicted by CryptoQuant’s Ki Young Ju.

Source: https://cryptonews.com/news/cryptoquant-ceo-predicts-bitcoin-as-global-currency-by-2030/

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

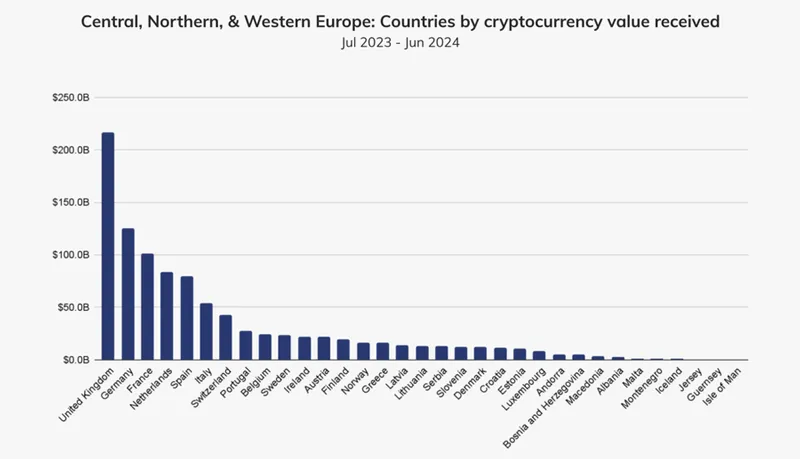

Europe Emerges as Second-Largest Crypto Economy With Nearly $1 Trillion On-Chain Value

The UK emerged as the dominant force in CNWE’s crypto landscapee, attracting $217 billion in crypto value and driving innovation in merchant services and stablecoins.

Central, Northern, and Western Europe (CNWE) is emerging as a global powerhouse in the cryptocurrency market, ranking second only to North America.

A new report by Chainalysis reveals a vibrant crypto economy in the region, with $987.25 billion flowing in on-chain value between July 2023 and June 2024, representing 21.7% of global transaction volume.

The United Kingdom (UK) stands out as the undisputed leader in CNWE’s crypto space, attracting a hefty $217 billion in crypto value during the period. The UK is also a key driver of innovation, particularly in areas like merchant services and stablecoins.

Stablecoins Outpace Bitcoin and Drive CNWE Crypto Growth

Stablecoins, cryptocurrencies pegged to traditional assets like the euro or US dollar, have become the undisputed king in CNWE, growing 2.5 times faster than North America for transfers less than $1 million. They constitute nearly half of all crypto inflows, valued at $422.3 billion, showcasing a significant rise in both retail and professional use.

In the past year, average monthly stablecoin transfers below $1 million in CNWE ranged between $10 billion and $15 billion. Interestingly, stablecoins have far surpassed Bitcoin (BTC) for fiat currency trade, with the euro accounting for a whopping 24% of global stablecoin purchases.

The European Union is actively shaping the future of crypto in CNWE with the implementation of its Markets in Crypto-Assets Regulation (MiCA), as per the report. While the impact on stablecoins is already underway, the full effect on crypto-asset service providers (CASPs) is yet to be seen, with regulations for this sector coming into effect in December 2024.

More Than Just Stablecoins: CNWE’s Growing Crypto Landscape

Despite the dominance of stablecoins, CNWE’s crypto landscape offers more. For transactions below $1 million, Bitcoin saw a significant 75% growth, the highest of all asset types in the region. Overall, Bitcoin accounted for roughly one-fifth of CNWE’s total crypto value received.

While still in its infancy, the real-world assets (RWA) tokenization is starting to take hold in CNWE. Experts see this as a potential game changer in the traditional securities market. “Across Europe, we see tokenization projects for RWAs gaining traction, particularly in sectors such as real estate, intellectual property and collectibles such as art, cars or wine,” said Philipp Bohrn, VP, Public and Regulatory Affairs at Bitpanda, a cryptocurrency exchange based in Austria.

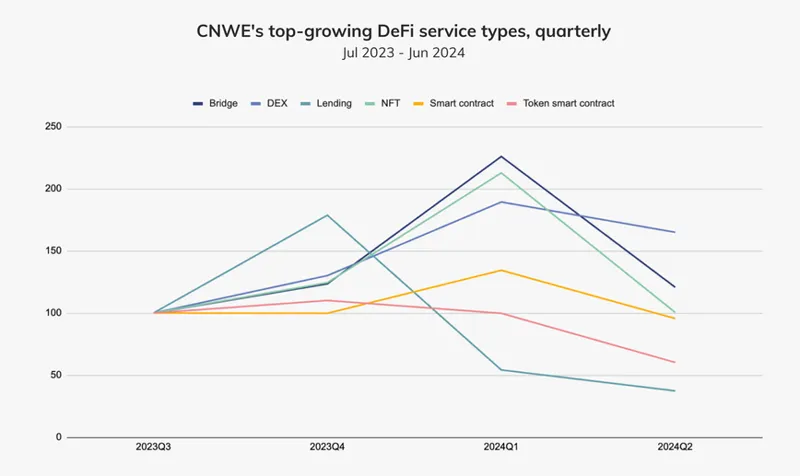

CNWE’s decentralized finance (DeFi) activity grew faster than the global average, ranking fourth in the world. The region outperformed North America, Eastern Asia, and MENA in year-over-year growth, accounting for

$270.5 billion of all crypto received in the region. Decentralized exchanges (DEXs) were the primary catalyst for DeFi growth in CNWE, outperforming other DeFi services.

Source: https://cryptonews.com/news/europe-emerges-as-second-largest-crypto-economy-with-nearly-1-trillion-on-chain-value-chainalysis/ This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Bitcoin Could Potentially Surge to $92,000 Under Trump: Bitwise

Bitwise’s head of alpha strategies, Jeff Park, has predicted that Bitcoin could soar to $92,000 if Donald Trump wins the 2024 U.S. presidential election.

In an October 22 post on X, Park explained that by analyzing Bitcoin’s price movement against Trump’s odds on the decentralized betting platform Polymarket, and applying merger arbitrage-style probability calculations,

he sees a strong likelihood of a post-election surge.

“I project a Trump victory could push BTC to ~$92,000,” Park wrote, adding to the growing list of analysts forecasting that a Trump win could significantly boost the crypto market.

U.S. Election Draws Interest from Crypto Community

The 2024 U.S. presidential election is drawing an unprecedented level of interest from the crypto community, as Donald Trump has made pro-crypto policies a key part of his campaign.

He has promised to make the U.S. the “crypto capital of the world” and vowed to remove SEC Chair Gary Gensler on his first day in office, aiming to create a more favorable regulatory environment for digital assets.

Erik Finman, a Bitcoin millionaire, also shares Park’s optimism.

Finman said that a Trump presidency could see Bitcoin rally as high as $100,000, crediting Trump’s policies for potentially igniting the crypto market and driving widespread growth.

Despite the bullish predictions from some quarters, not everyone is convinced that a Trump presidency would result in long-term gains for Bitcoin.

Billionaire investor Mark Cuban, who supports Kamala Harris, expressed skepticism.

Cuban claimed that while a Trump victory might lead to an initial “pump” in crypto markets, the rally could be short-lived due to inflationary pressures from Trump’s proposed economic policies, such as import tariffs. According to 538 polling data, Harris leads Trump by a narrow margin of 1.8% nationally.

However, on betting markets like Polymarket, Trump holds a significant lead of 18.8%, reflecting growing confidence in his electoral chances among crypto enthusiasts.

Trump-Backed PAC Raises $7.5 Million in Crypto Donations

A political action committee (PAC) supporting former President Donald Trump has secured approximately $7.5 million in cryptocurrency donations.

As reported, the Trump 47 joint fundraising committee reported contributions in Bitcoin, Ether, and XRP, along with stablecoins like Tether and USDC.

In May, Trump became the first major presidential candidate to accept digital token donations, signaling his new stance.

According to a report from nonprofit watchdog group Public Citizen, nearly half of the corporate money flowing into the current election cycle originates from the crypto sector.

Major industry players such as Coinbase, Ripple, and venture capital firm Andreessen Horowitz have been significant contributors.

The total amount raised by the industry this election season is approximately 13 times what was raised during the previous presidential cycle.

Meanwhile, crypto owners are more inclined to support former President Donald Trump, while those without digital assets lean towards Vice President Kamala Harris, according to a survey conducted by Fairleigh Dickinson University’s (FDU) Poll.

The survey, led by Dan Cassino, professor of government and politics and executive director of the FDU Poll, found that among these, 50% support Trump.

In contrast, only 38% of crypto holders back Harris.

Source: https://cryptonews.com/news/bitcoin-could-potentially-surge-to-92k-under-trump/

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Tesla Billionaire Elon Musk Declares ‘Financial Emergency’ As $35.7 Trillion ‘Debt Bomb’ Primes A Bitcoin Price Boom To Rival Gold

Tesla billionaire Elon Musk, who surprised traders with a shock bitcoin endorsement this week, has repeatedly warned in recent weeks that the U.S. is teetering on the brink of “bankruptcy.”

The bitcoin price has surged this year as fears over the spiraling $35.7 trillion debt pile pushes the price of gold to an all-time high—with the Federal Reserve caught in a “nightmare” scenario.

Now, Musk, who is working overtime to get “crypto president” Donald Trump back into the White House, has called the U.S. government’s $1 trillion per year interest payments a “financial emergency,” as inflation fears push another legendary investor to buy bitcoin and gold.

“Just the interest payments on the debt are 23% of all federal tax revenue,” Musk said during a Trump campaign rally, later calling the situation a “financial emergency” on X. “The interest payments now exceed the Defense Department budget, which is $1 trillion a year. That’s a lot of money.”

The bitcoin price has returned to just below its all-time high of $70,000 per bitcoin this year, rocketing higher along with the gold price, as investors bet higher interest rates combined with a huge increase in deficits will create a feedback loop, forcing governments to print more money.

Tesla continues to hold around 10,000 bitcoin—sometimes called digital gold—worth almost $800 million on its balance sheet, last week sparking fears it could be about to cash out when it suddenly moved its bitcoin to new wallets.

U.S. national debt has skyrocketed in recent years, crossing the $34 trillion mark at the beginning of 2024, largely due to Covid and lockdown stimulus measures that sent inflation spiraling out of control and forced the Federal Reserve to hike interest rates at a historical clip.

Earlier this year, Bank of America analysts warned the U.S. debt load is about to ramp up to add $1 trillion every 100 days—potentially fueling a bitcoin price surge—and could reach $36 trillion by the end of 2024. This week, legendary billionaire investor Paul Tudor Jones warned “all roads lead to inflation,” telling CNBC that he’s “long gold” and “long bitcoin” as a result.

“Under Trump, the deficit goes up by $500 billion per year; under [vice president Kamala] Harris’ plan, it goes up by an additional $600 billion per year. I have a feeling all those are just pipe dreams,” said Tudor Jones, who earlier this year warned of a “debt bomb” in the U.S. due to “fiscal recklessness.” In 2020, Tudor Jones helped kick off the Covid-era bitcoin and crypto bull run when he came out as one of Wall Street’s first bitcoin-backers, calling it the “fastest horse to beat inflation.”

Source: https://www.forbes.com/sites/digital-assets/2024/10/27/tesla-billionaire-elon-musk-declares-financial-emergency-as-357-trillion-debt-bomb-primes-a-bitcoinprice-

boom-to-rival-gold/ This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.