The Australian Securities Exchange has approved the VanEck Bitcoin ETF to begin trading on June 20.

Australia’s largest stock exchange, the Australian Securities Exchange (ASX), has approved its first spot Bitcoin exchange-traded fund (ETF), which will begin trading on June 20.

According to a VanEck press release shared with Cointelegraph, investment firm VanEck will issue the spot Bitcoin ETF, named the VanEck Bitcoin ETF (VBTC). This approval follows the firm’s recent success in launching spot Bitcoin ETFs, including the VanEck Bitcoin Trust (HODL) in the United States on January 11.

Arian Neiron, Chief Executive Officer for VanEck in the Asia-Pacific region, emphasized the growing demand for Bitcoin exposure in Australia through “a regulated, transparent and familiar investment vehicle.”

“We recognize Bitcoin is an emerging asset class that many advisers and investors want to access,” Neiron stated. “VBTC also makes Bitcoin more accessible by managing all the back-end complexity. Understanding the technical aspects of acquiring, storing, and securing digital assets is no longer necessary,” he added.

While this is the first spot Bitcoin ETF approved by the ASX, Australia has seen the launch of two other Bitcoin ETFs in the past two years.

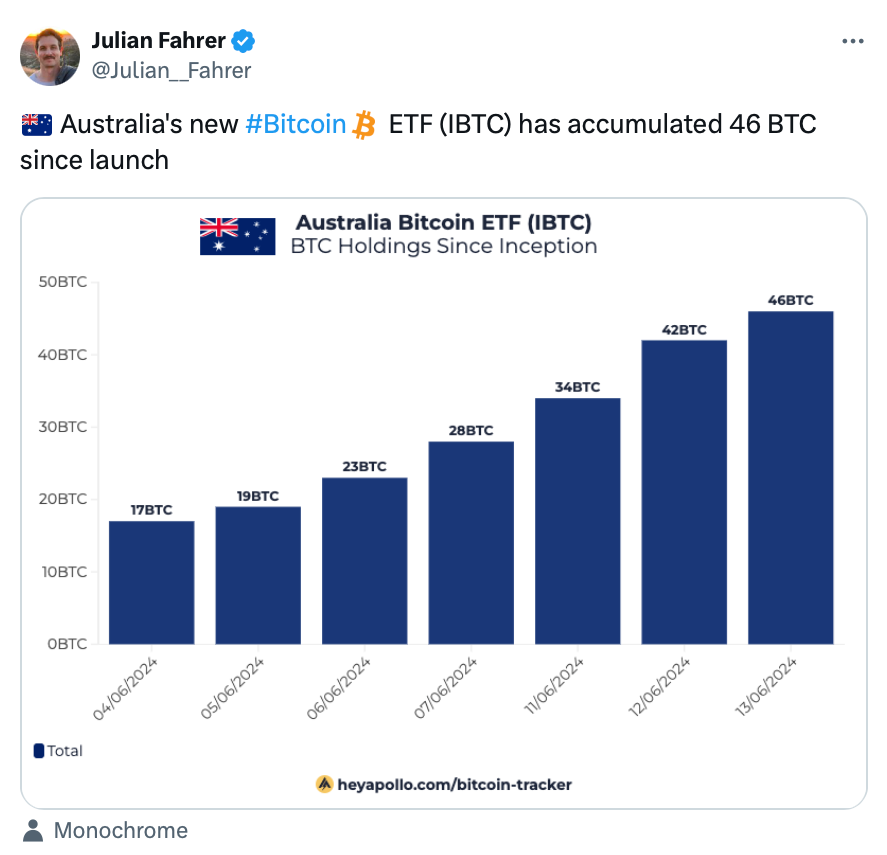

Recently, the Monochrome Bitcoin ETF (IBTC) was approved and began trading on Australia’s second-largest stock exchange, the Cboe Australia exchange.

The Monochrome Bitcoin ETF commenced trading when the markets opened on the Cboe Australia exchange on June 4.

Source: Julian Fahrer

Source: Julian Fahrer

Monochrome stated that IBTC’s holdings are stored offline in a device not connected to the internet, utilizing a crypto custody solution that adheres to “Australian institutional custody regulatory standards.”

In April 2022, the Global X 21 Shares Bitcoin ETF (EBTC) became the first Bitcoin ETF to debut in Australia.