BlackRock’s CEO, Larry Fink, expresses satisfaction with the significant retail interest in the company’s spot Bitcoin ETF, stating that he has been pleasantly surprised by the demand.

BlackRock CEO Larry Fink has expressed his positive sentiment regarding his firm’s spot Bitcoin (BTC) exchange-traded fund (ETF), noting that he has been pleasantly surprised by its performance. He reaffirmed his bullish outlook on Bitcoin’s long-term viability.

“In a March 27 interview with Fox Business, Fink stated, ‘IBIT is the fastest-growing ETF in the history of ETFs. Nothing has gained assets as fast as IBIT in the history of ETFs.’ He further expressed surprise at the strong performance of the iShares Bitcoin Trust (IBIT) during its initial 11 trading weeks.

According to data from Farside Investors, IBIT garnered $13.5 billion in inflows during the first 11 weeks, reaching a daily high of $849 million on March 12. On average, IBIT has seen inflows of slightly over $260 million per trading day.

“We’re creating now a market that has more liquidity, more transparency and I’m pleasantly surprised. I would never have predicted before we filed it that we were going to see this type of retail demand,” Fink said.

When questioned if IBIT’s performance exceeded his expectations, Fink acknowledged that it indeed surpassed his projections. He further emphasized his optimistic outlook on Bitcoin’s long-term sustainability by stating, “I’m highly optimistic about Bitcoin’s long-term prospects.”

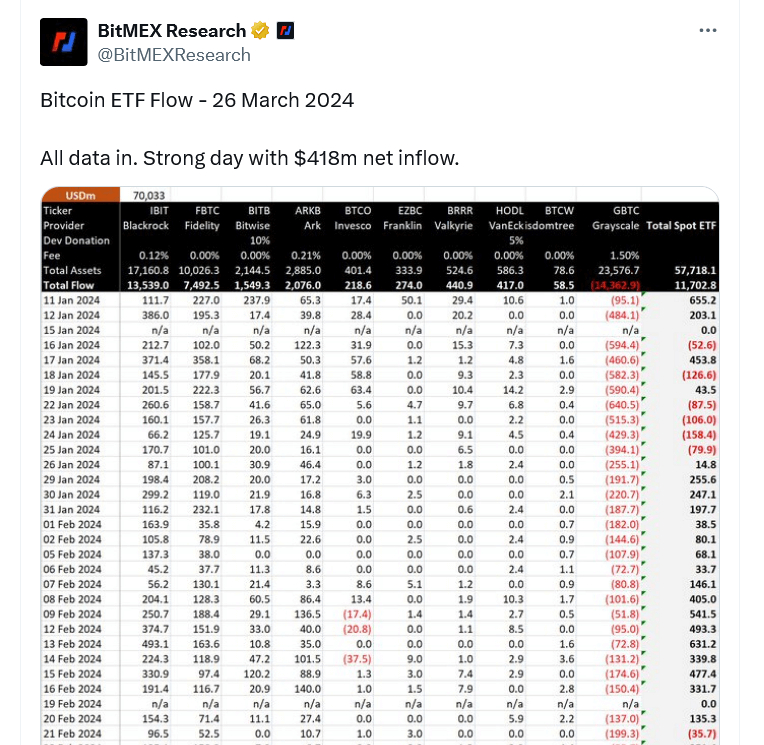

IBIT, as reported by BitMEX Research, currently possesses $17.1 billion worth of Bitcoin. Remarkably, it achieved the $10 billion mark in just two months, a feat that took the initial gold ETF two years to accomplish.

Among the presently authorized ETFs, IBIT ranks second in terms of Bitcoin holdings, trailing only behind the Grayscale Bitcoin Trust, which holds $23.6 billion in BTC. However, Grayscale’s Bitcoin reserves have been dwindling, decreasing from the 620,000 BTC it previously held before transitioning to a spot Bitcoin ETF.

Excluding Grayscale, the nine Bitcoin ETF issuers collectively manage more than $34.1 billion in Bitcoin. Notably, IBIT, the Fidelity Wise Origin Bitcoin Fund (FBTC), and ARK 21Shares Bitcoin ETF (ARKB) are leading the inflows.

However, industry experts anticipate that some spot Bitcoin ETF issuers might eventually terminate operations due to inadequate profitability.

Hector McNeil, co-CEO and founder of white-label ETF provider HANetf, recently stated to Cointelegraph, “Most of the current ETFs launched will never break even as costs will only be feasible with billions of assets under management, which they won’t achieve.”

To compete with major players, several ETF issuers have reduced their fees. Nevertheless, these smaller issuers face significant challenges in this competitive landscape, as highlighted by Bloomberg ETF analyst Henry Jim.

“If they match fees, they won’t have enough revenue to survive, and if they don’t lower fees, they won’t be able to gather enough critical mass assets to survive.”

On March 27, Hashdex, an asset management firm, received approval for its spot Bitcoin ETF, becoming the 11th and most recent participant in the competitive US spot Bitcoin ETF market.