Transaction fees will serve a vital function in sustaining Bitcoin miners following the halving, as the reward for mining a block is scheduled to decrease from 6.25 BTC to 3.125 BTC.

Bitcoin transaction fees have exceeded those of Ethereum for three consecutive days, as miners and traders brace themselves for the impending Bitcoin halving and the introduction of Runes on Bitcoin, albeit to a lesser extent.

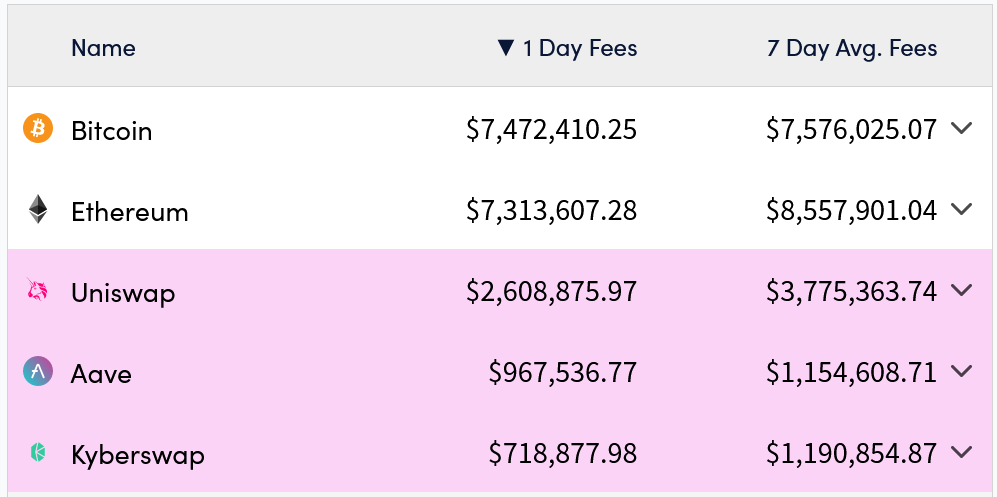

Data from Crypto Fees reveals that on April 17, bitcoin miners earned $7.47 million in fees, surpassing the $7.31 million paid to Ethereum miners by about $160,000. Similarly, on April 15 and 16, bitcoin miners earned $9.98 million and $5.91 million, respectively, outpacing Ethereum miners by $3.5 million and $1.1 million on those respective days.

However, Ethereum maintains a slight lead on a 7-day average fee basis, with fees totaling $8.55 million compared to Bitcoin’s $7.57 million.

Largest fees by blockchains and decentralized finance projects. Source: Crypto Fees

Largest fees by blockchains and decentralized finance projects. Source: Crypto Fees

Bitcoin transaction fees are determined by the size or data volume of the transaction and the demand for block space at the time of the transaction request.

The increase in Bitcoin (BTC) fees is occurring at a critical juncture for Bitcoin miners, as the upcoming Bitcoin halving event on April 20 will reduce the mining subsidy from 6.25 BTC ($398,000) to 3.125 BTC ($199,000).

At present, approximately 900 Bitcoins are mined per day, translating to about $57.2 million at current prices.

Based on the $7.47 million fee count on April 17, transaction fees constituted 11.5% of the total block rewards in the Bitcoin mining industry.

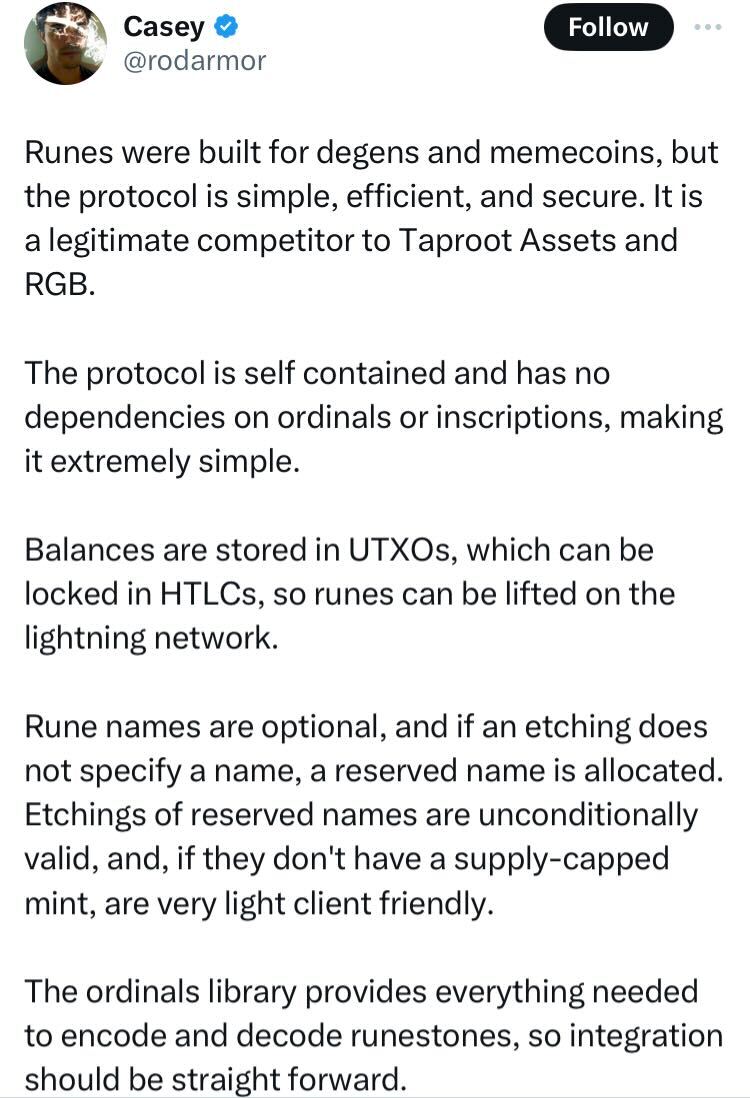

Runes, designed to simplify the creation of fungible tokens on Bitcoin, will enter into competition with Ordinals, catering to memecoin enthusiasts and other community-driven audiences.

Casey Rodarmor, the creator of Runes and also the mind behind Ordinals, asserts that Runes, being fully UTXO-based, should not congest the Bitcoin network to the same degree as Ordinals.

Source: Casey Rodamor

Source: Casey Rodamor

The recent increase in Bitcoin fees could be attributed, in part, to a decrease in BRC-20 token prices in recent days as some traders divert their focus to Runes.

Ordinals (ORDI) and Sats (SATS), the two leading BRC-20 tokens in terms of market capitalization, have experienced declines of 38% and 43%, respectively, over the past week, as reported by CoinMarketCap.