The recent achievement comes shortly after BlackRock introduced its inaugural tokenized asset fund, BUIDL, joining 16 other tokenized government securities funds launched last week.

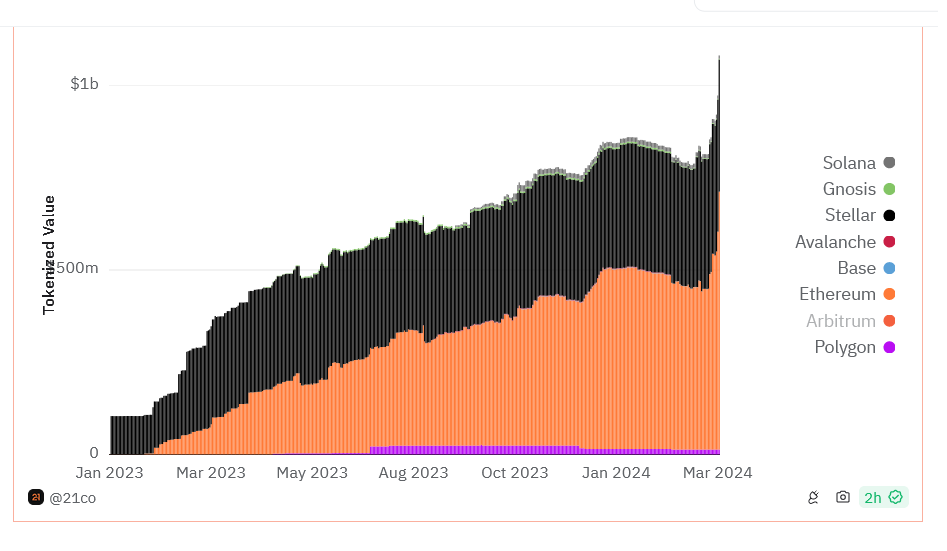

More than $1 billion worth of United States Treasurys have been tokenized on various blockchains including Ethereum, Polygon, Solana, and others, with assistance from the recent launch of the BlackRock USD Institutional Digital Liquidity Fund.

BlackRock introduced its product, named “BUIDL,” on the Ethereum blockchain on March 20, which now holds a market cap of $244.8 million. Notably, four transactions totaling $95 million contributed to the fund over the week, propelling it to become the second-largest tokenized government securities fund.

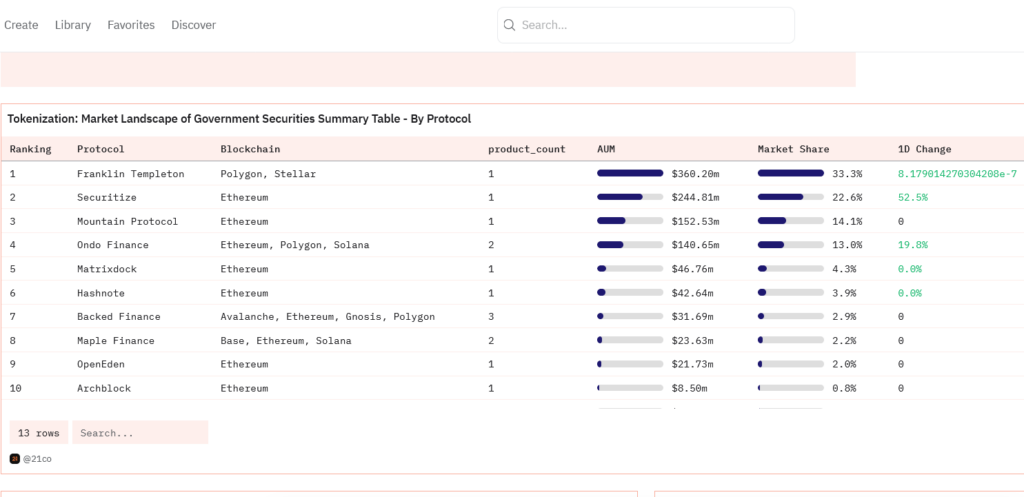

Currently, BUIDL is second only to Franklin Templeton’s Franklin OnChain U.S. Government Money Fund (FOBXX), established 11 months ago, with $360.2 million invested in U.S. Treasurys. Data compiled by the parent firm of 21Shares on a Dune Analytics dashboard indicates this ranking.

According to the dashboard, the total value of tokenized U.S. Treasurys across 17 products has now surpassed $1.08 billion.

Source: Dune Analytics

Real-world asset tokenization firm Ondo Finance recently deposited $79.3 million into BlackRock’s fund, facilitating instant settlements for its U.S. Treasury-backed token, OUSG. The total deposit across four transactions amounted to $95 million, as per Etherscan data.

With this deposit, Ondo Finance now holds a 38% share in BUIDL, stated Tom Wan, a research strategist at 21.co, in a post on March 27.

BUIDL, pegged at a 1:1 ratio with the United States dollar, offers daily accrued dividends directly to investors each month. Launched on Ethereum via the Securitize protocol, it is described as more attractive than stablecoin yields in the current high-interest rate environment, according to 21.co’s Dune dashboard.

BlackRock CEO Larry Fink recently highlighted blockchain tokenization as a catalyst for enhancing capital markets’ efficiency. Boston Consulting Group predicts this market could reach $16 trillion by 2030, encompassing various assets beyond U.S. Treasurys, including stocks and real estate.

Ethereum leads in real-world asset (RWA) tokenization, accounting for $700 million. Franklin Templeton’s FOBXX is tokenized on Stellar and Polygon, which hold the second and third-largest market shares at $358 million and $13 million, respectively.

Source: Dune Analytics

WisdomTree, a prominent asset management firm, is also engaging in the tokenization of real-world assets (RWAs). Additionally, blockchain-native firms such as Ondo Finance, Backed Finance, Matrixdock, Maple Finance, and Swarm are active participants in this space.