Despite the growing difficulty and cost of mining, Riot saw a surge in net income, driven by a remarkable 131% year-on-year rise in the price of Bitcoin.

Bitcoin (BTC) prices dropped to $57,736 as mining firm Riot Platforms disclosed a groundbreaking $211.8 million net income for Q1 2024 — marking a company record and a staggering 1,000% surge compared to the previous year. Despite this, the firm fell short of analyst revenue projections.

Released on May 1, Riot’s first quarter results reveal a 55.4% year-on-year spike in mining revenue, totaling $74.6 million, primarily fueled by a 131% surge in Bitcoin’s price.

However, the company’s total revenue reached $79.3 million, falling short of research firm Zacks’ estimates by 14%.

Riot attributed the slower rise in net income and mining revenue to reduced Bitcoin production and heightened mining costs, stemming from an uptick in Bitcoin’s network difficulty and hash rate.

Riot’s unaudited financial statement for Q1 2024. Source: Riot Platforms

Riot’s unaudited financial statement for Q1 2024. Source: Riot Platforms

During Q1, Riot extracted 1,364 BTC, marking a 36% decline from the same period in 2023. The average cost to mine 1 BTC stood at $23,000, reflecting a 144% increase compared to last year, primarily influenced by an 89% surge in the global network hash rate, as stated by Riot.

Last month, Riot unveiled plans for a new facility in Corsicana, Texas, which CEO Jason Les anticipates will emerge as the world’s largest dedicated Bitcoin mining facility upon completion.

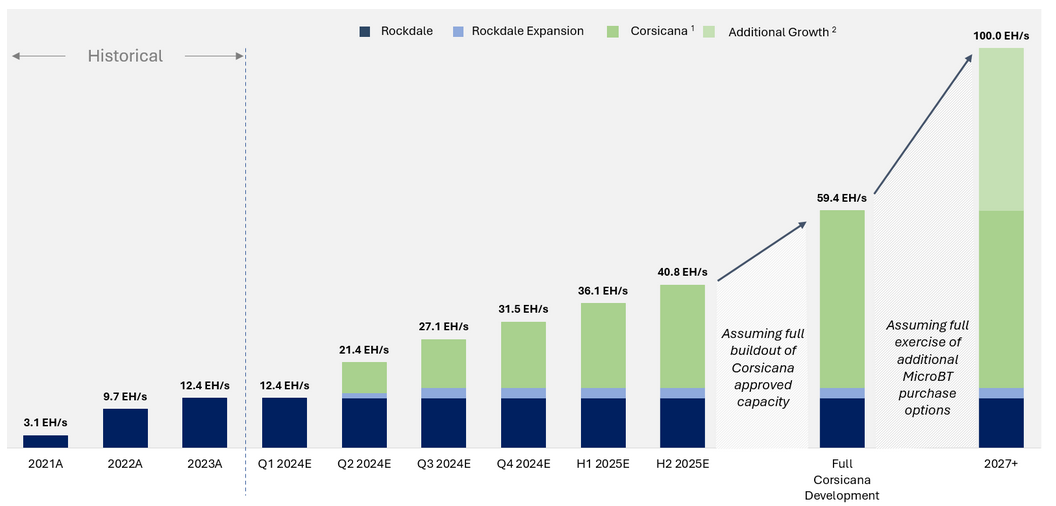

The mining company asserted its progress in scaling its hash rate capacity from 12.4 exahashes per second (EH/s) to 31 EH/s by year-end. It foresees a further boost to 41 EH/s upon the full deployment of its Corsicana facility in 2025. Additionally, Riot sets an ambitious long-term target to achieve a hash rate of 100 EH/s by 2027 or shortly thereafter.

Change in Riot’s hash rate bi-annually by facility. Source: Riot Platforms

Change in Riot’s hash rate bi-annually by facility. Source: Riot Platforms

Presently, Riot holds the third-largest hash rate among mining companies, trailing only competitors Marathon Digital and Core Scientific, with 24.7 EH/s and 16.9 EH/s respectively, as reported by Hashrate Index.

On May 1, Riot’s stock price experienced a 2.87% decline, reaching $9.82. However, post-market trading showed a 1.1% increase, according to Google Finance.

Bitcoin miners are adapting to the reduced mining rewards following the April 20 halving event, which saw rewards decrease from 6.25 BTC to 3.125 BTC. The latter is presently valued at approximately $180,600.