Is Solana truly fulfilling its reputation as the ‘Ethereum-killer’? Plus, one trader suffered a loss of over $1 million due to a hard fork.

Welcome to Finance Redefined, your weekly digest of essential decentralized finance (DeFi) insights — a newsletter designed to deliver the most significant developments from the previous week.

In the realm of DeFi, Solana sustained its upward trajectory, poised to surpass Ethereum in transaction fees within the coming week. Meanwhile, the Financial Conduct Authority (FCA) in the United Kingdom is striving to amalgamate the best elements of traditional finance (TradFi) with regulations pertinent to DeFi, shaping a holistic crypto framework.

A trader faced a staggering loss exceeding a million dollars in crypto assets due to the 0L Network hard fork.

Among the top 100 DeFi tokens by market capitalization, the past week we have witnessed a varied performance, with several tokens experiencing double-digit growth while others saw declines on the weekly charts.

The Report suggests Solana might surpass Ethereum in transaction fees within a week

The Solana network appears to be closing in on surpassing Ethereum in transaction fees, marking a potentially significant milestone in Solana’s quest to be labeled as the ‘Ethereum killer.’ Additionally, on May 7, Solana’s total economic value of $2.8 million came close to Ethereum’s $3.1 million.

According to Dan Smith, senior research analyst at Blockworks, Solana could overtake Ethereum’s transaction fees as early as this week. However, Solana’s daily transaction fees still lag behind Ethereum’s. Data from DefiLlama shows that Ethereum generated over $2.75 million in fees in the 24 hours leading up to May 8, whereas Solana’s fees amounted to $1.49 million.

An executive asserts that FCA crypto regulators will adopt the most effective practices from both traditional finance (TradFi) and decentralized finance (DeFi)

When it comes to overseeing cryptocurrencies such as Bitcoin (BTC), financial authorities in the U.K. are striving to leverage the strengths of both traditional finance (TradFi) and decentralized finance (DeFi), as indicated by an executive at the FCA.

The cryptocurrency community and regulatory bodies have been deliberating the optimal approach to regulating the crypto market, grappling with concerns of over-regulation or inadequate oversight. According to Matthew Long, the director of payments and digital assets at the FCA, the most effective regulatory strategy involves integrating various methodologies and evaluating their efficacy.

Trader suffers a loss exceeding seven figures following the 0L Network hard fork

Reportedly, a trader suffered a loss exceeding $1 million in cryptocurrency following the 0L Network hard fork. Identified only by the pseudonym NN, the trader attributed the loss to an unapproved hard fork within the community.

NN disclosed having acquired 147 million Libra tokens in February 2023, valued at approximately $1.47 million at the time, before involvement in the protocol for marketing purposes. Since May 3, Libra’s value has plummeted by over 58%, trading above $0.001 as of 12:35 pm UTC, according to CoinGecko data.

The inaugural Bitcoin-backed synthetic dollar is set to debut with a 25% yield

Hermetica has introduced the inaugural Bitcoin-backed synthetic United States dollar, marking a significant advancement in Bitcoin-native DeFi.

Scheduled for launch in June, the new synthetic dollar, USDh, promises users potential yields of up to 25%, as per Hermetica’s announcement provided to Cointelegraph. This innovative currency will empower Bitcoin holders to both retain and generate yield on their U.S. dollar holdings without reliance on the traditional banking system or involvement in non-Bitcoin-related assets, as stated by Jakob Schillinger, the founder and CEO of Hermetica Labs.

Overview of the DeFi Market

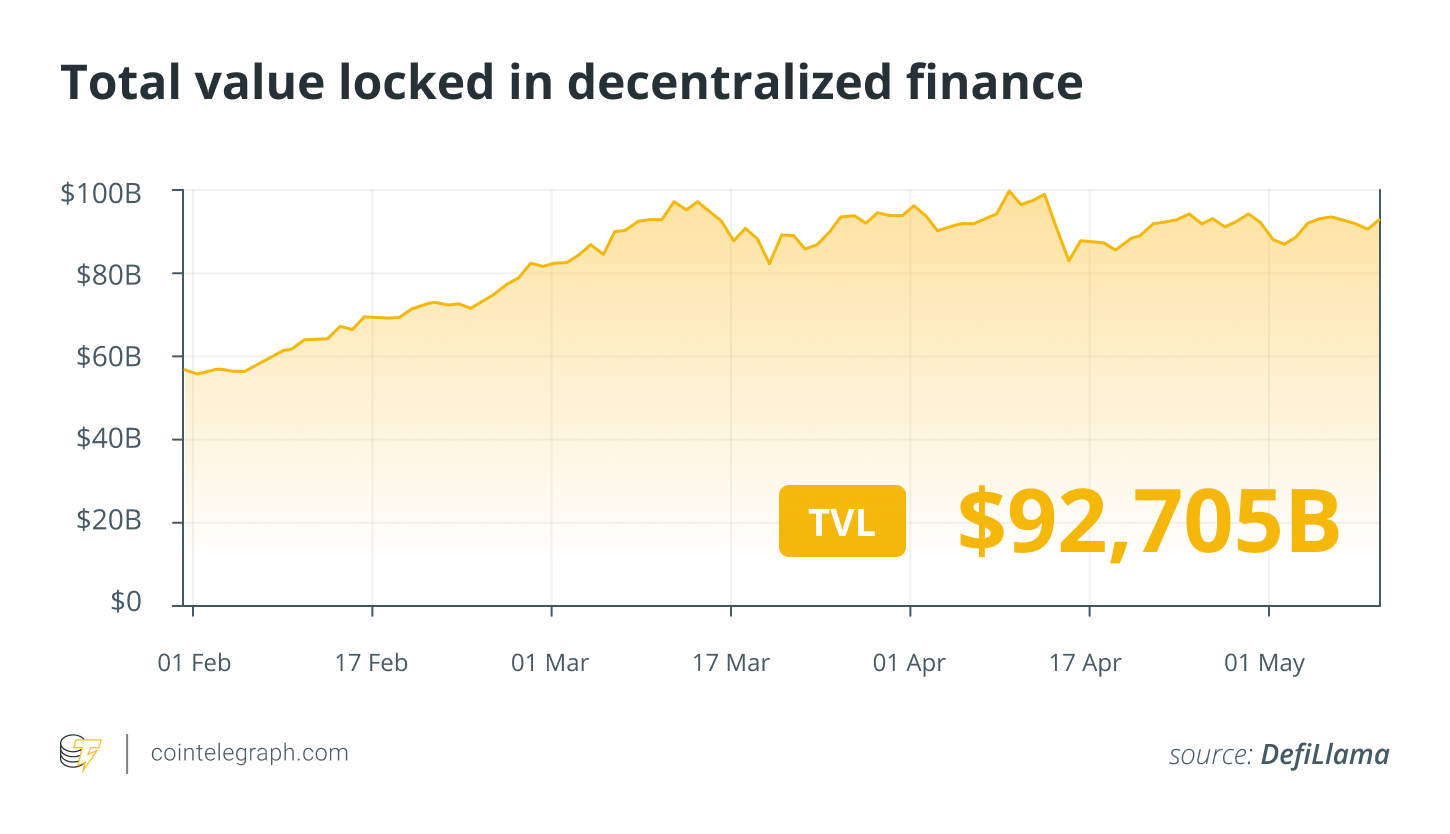

Information sourced from Cointelegraph Markets Pro and TradingView indicates that the top 100 DeFi tokens experienced a bearish week, as the majority traded in the red on the weekly charts. However, the total value locked in DeFi protocols surged above $90 billion.

Thank you for following our recap of the most influential DeFi updates this week. Stay tuned for more stories, insights, and educational content about this rapidly evolving sector next Friday.