According to crypto analysts, Bitcoin is poised to enter price discovery if it surpasses the critical resistance at its all-time high of $69,000. Bitcoin (BTC), currently trading at $68,216, peaked at around $69,000 during the 2021 bull run. This level was retested on March 5, following the approval of spot Bitcoin exchange-traded funds (ETFs) in the United States earlier this year. Bitcoin has remained below this threshold for roughly 10 weeks despite multiple attempts.

BTC/USD daily chart. Source: TradingView

BTC/USD daily chart. Source: TradingView

Crypto analyst Daan Crypto Trades remarked that surpassing old all-time highs is “never an easy fight” and typically requires time. He pointed out that supply must “dry up” around the resistance zone and coins should shift from impatient to patient holders, which generally results in favorable outcomes.

“#Bitcoin Fighting the last resistance before full-on price discovery.”

BTC/USD weekly chart. Source: Daan Crypto Trades

BTC/USD weekly chart. Source: Daan Crypto Trades

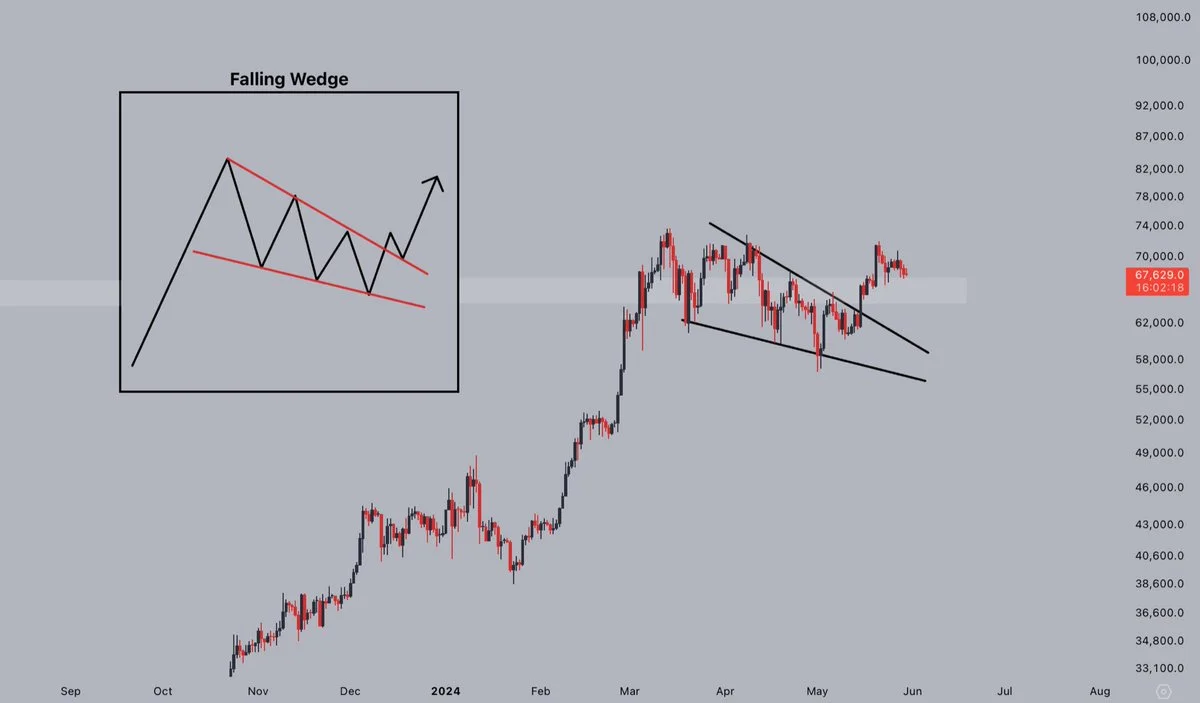

Other crypto analysts echo this optimistic view. “Bitcoin’s market structure remains firmly bullish!” proclaimed crypto analyst Jelle in a May 30 post on X, emphasizing that the price has been in “a steady uptrend for well over a year now, consolidating just below the current all-time highs.”

In a separate post on X, Jelle observed that BTC’s price was retesting a crucial support level after “breaking out from the falling wedge” on the daily time frame.

“Hold here, and new all-time highs should come soon enough,” Jelle added.

BTC/USD daily chart. Source: Jelle

BTC/USD daily chart. Source: Jelle

Pseudonymous crypto analyst CryptoCon characterized Bitcoin’s current low volatility around its previous highs as healthy price action.

“This period is only half as long as what we observed from August to October 2023, one of the least volatile times in Bitcoin’s history […] Such low-volatility phases are essential for establishing support before the next upward move,” they wrote in a May 29 post on X.

“The next green box is loading…”

BTC/USD daily chart. Source: CryptoCon

BTC/USD daily chart. Source: CryptoCon

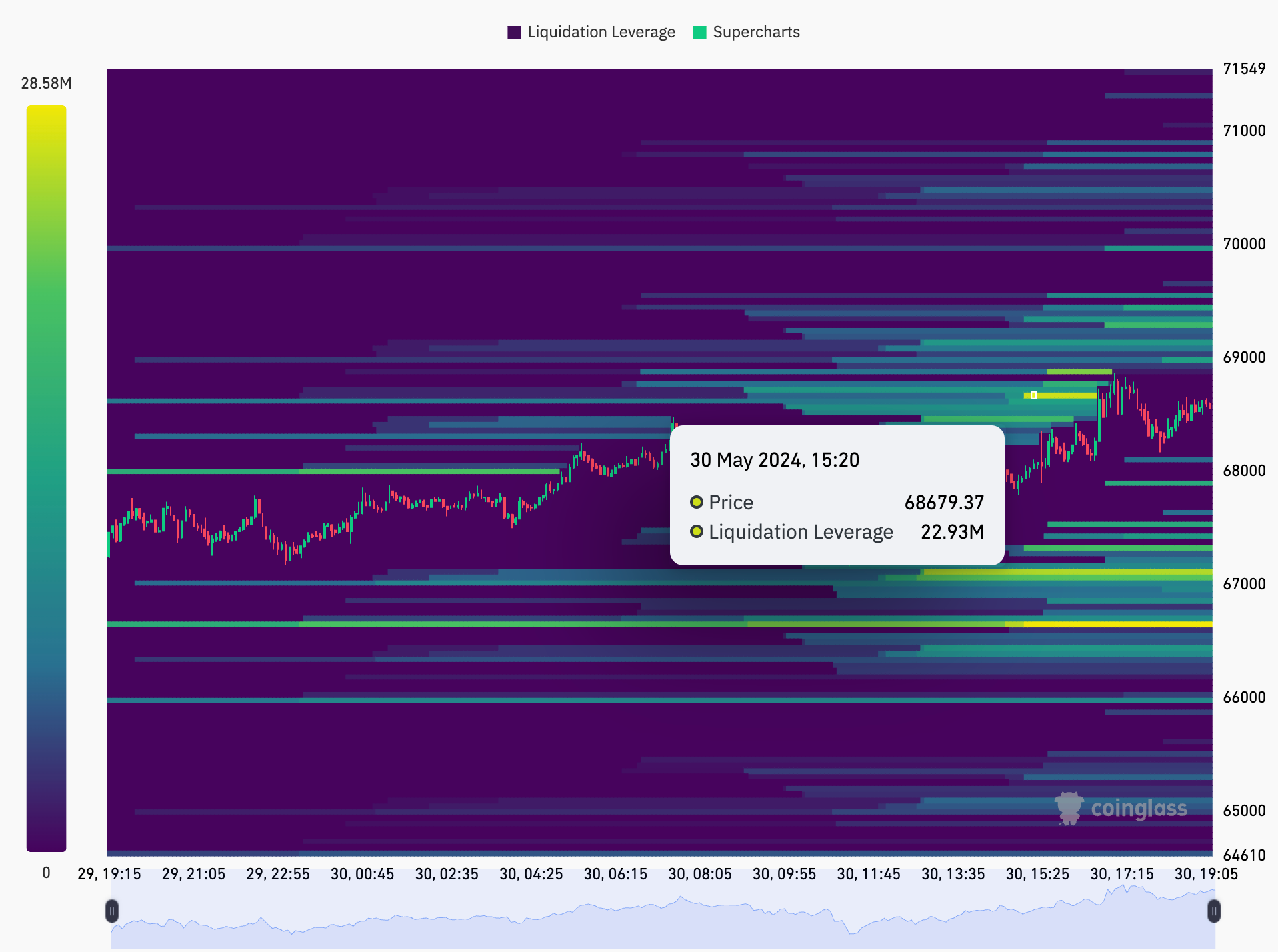

Daan Crypto Trades observed approximately “$100M in sell orders positioned around $69K,” contributing to the sell-side pressure at this level.

CoinGlass data shows that $68,700 is a significant area of bid liquidity just below this resistance.

Bitcoin liquidation heatmap. Source: CoinGlass

Bitcoin liquidation heatmap. Source: CoinGlass

As of May 30, BTC was trading at $68,485, reflecting a 1.5% increase over the past 24 hours.