Observers note that liquidity appears to have bypassed several stages, flowing directly from Bitcoin into meme-coins amidst an unusual bull market.

According to crypto industry analysts, the current Bitcoin halving cycle is being dubbed as the “most peculiar” bull market to date, marked by an early peak in Bitcoin’s price and a significant surge in memecoins.

On April 1, Zach Rynes, also known as “ChainLinkGod,” expressed his thoughts on this unusual trend to his 171,000 followers on X, stating, “This bull market has been peculiar.”

Traditionally, during bull markets, funds typically flow into Bitcoin first, followed by Ether and other major cryptocurrencies before trickling down to smaller coins. However, this cycle has deviated from the norm, with capital moving directly from Bitcoin to memecoins, a pattern noted by Rynes as “a bit unusual.”

Source: Zach Rynes

On April 1, the total market capitalization of memecoins surged to $70 billion, largely fueled by the rapid rise of newly introduced tokens such as Solana-based Dogwifhat (WIF) and Book of Meme (BOME), alongside established memecoins like Pepe and Bonk.

Furthermore, the Coinbase layer-2 network Base has emerged as a hub for memecoin speculation, with tokens like DEGEN witnessing an astonishing 2,800% surge in value over the past month. DEGEN, an informal token distributed to the community on the decentralized social network Farcaster, has gained significant traction within the Base ecosystem.

Rynes further commented that market fundamentals currently hold minimal significance:

“There’s some retail money that’s entered, but nowhere near the levels we’ve seen before; we’re in an attention economy based on specific narratives, not real fundamentals.”

On April 1, Ethereum educator Anthony Sassano echoed similar sentiments, stating that after approximately a decade in the crypto space, “I can confidently assert that this is, without a doubt, the most unusual bull market the crypto sphere has experienced.” He further mentioned that retail participation is not significant until the entire market experiences a collective upsurge.

“Not these isolated sector-specific pumps that are very obviously pushed by crypto natives and just involve a hot ball of money rotating around.”

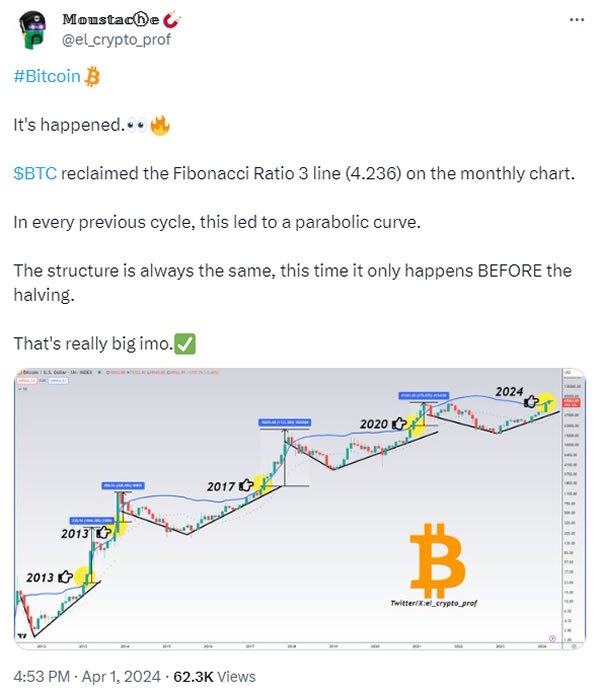

Adding to the peculiarities of this market cycle is the scenario where Bitcoin achieved an all-time high before the halving. In past cycles, Bitcoin’s all-time high typically occurred in the year following the halving event.

Bitcoin soared to $73,734 on March 14, with the halving set to occur in just 18 days on April 20. Analysts have speculated that the retracement before the halving has already concluded.

On April 1, technical analyst Moustache emphasized that BTC had reestablished a crucial Fibonacci ratio level observed in previous cycles, albeit this time occurring before the halving.

Source: Moustache